Tech war: China’s legacy chipmakers surge after Beijing targets US analogue ICs

Leading the rally was Beijing-based SG Micro whose shares on Shenzhen’s ChiNext board surge by the maximum 20 per cent limit on Monday

Shares of China’s domestic legacy chipmakers, including SG Micro and 3Peak, surged on Monday after Beijing’s weekend announcement of an anti-dumping investigation into imported US semiconductors.

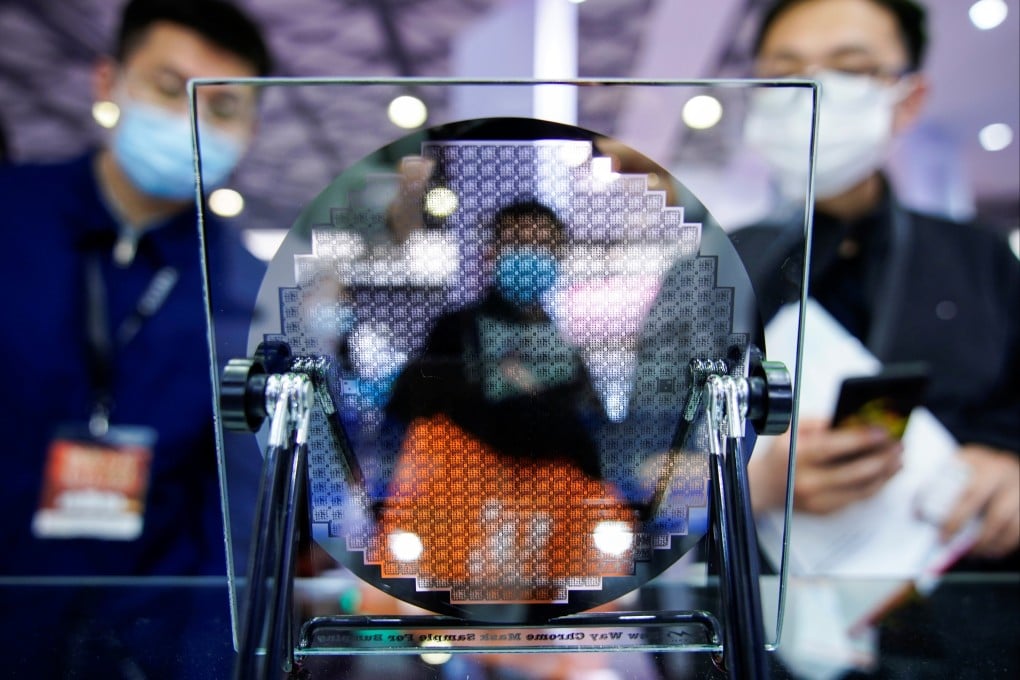

The government’s probe into imported “analogue integrated-circuit (IC) chips” – widely used in home appliances, machinery and electric vehicles – marked the first-ever anti-dumping probe into imported IC products as the country makes steady progress in developing domestic alternatives for these products.

Leading the rally was SG Micro, a Beijing-headquartered analogue IC maker, whose shares on Shenzhen’s ChiNext board surged by the maximum 20 per cent limit on Monday to close at 87.42 yuan (US$12.26).

The company has a broad chip portfolio spanning industrial, consumer electronics, communications and automotive applications, with power management chips as its largest product line. It announced plans last month to seek a Hong Kong listing.

Shares of 3Peak, which specialises in analogue signal chain and power management chips, rose 9.7 per cent to 163.2 yuan at closing, while while Novosense Microelectronics gained 10.79 per cent.

Other gainers included Finemade Microelectronics, Shanghai Belling, Chipown Microelectronics and Southchip Semiconductor.