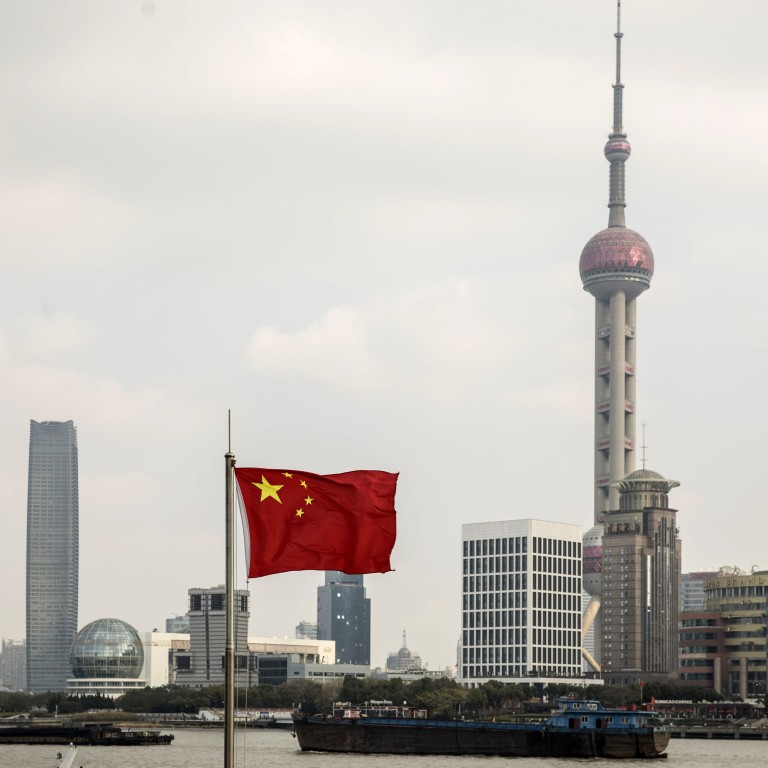

China’s venture capital market plummets amid trade war, tech start-up valuation concerns

- The value of investments tumbled 77 per cent year on year to US$9.4 billion in the second quarter

- The number of deals in the country roughly halved to 692

Venture capital deals in China plummeted in the second quarter, as investors pulled back amid unpredictable trade talks and growing concerns about start-up valuations. The value of investments in the country tumbled 77 per cent to US$9.4 billion in the second quarter from a year earlier, while the number of deals roughly halved to 692, according to market research firm Preqin.

The second quarter of last year marked the peak for China venture deals with a total of US$41.3 billion invested.

China’s tech investments continue to slide, dragging down global activity in venture capital sector

By comparison, the largest venture deal in the second quarter of this year was a US$1 billion investment in JD Health, the health care affiliate of e-commerce services provider JD.com.

China has never been through a widespread bust like the United States did after the dot-com boom, in part because the country’s venture capital market is so new.

Years of steady growth in hi-tech investments resulted in predictable – and enormous – profits.

Whether the current downturn becomes a painful crash depends in large part on how venture capital firms, entrepreneurs and regulators in China navigate terrain they have never seen before.

Shakeout looms for China’s electric car market, as 80 per cent of start-ups predicted to go under

“We’re seeing real stress in the system for the first time,” said Gary Rieschel, a founding partner at Qiming Venture Partners who has worked in China and the US. “We have never seen a downturn in the China market. For 20 years, it’s been pretty much up and to the right.”

Venture capital deals tripled that year to more than US$17 billion and proceeded to rise every year through 2018, when the total topped US$105 billion, which was almost as much as in the US.

Along the way, firms like Qiming, Sequoia China, Tiger Global Management and SoftBank Group Corp fostered some of the most valuable start-ups in the world.

‘Distorted’ private tech market valuations to see correction in next six to nine months, says Alibaba’s Joe Tsai

ByteDance, the force behind short-video app TikTok and other addictive services, sports a valuation of US$75 billion, the highest anywhere according to CB Insights. Didi, the ride-hailing service that ousted Uber Technologies from China, was last valued at US$56 billion, the second highest.

But the rise of China’s technology industry put it squarely in the crossfire of the trade war. The Trump administration has accused China of stealing intellectual property and unfairly subsidising companies in strategic fields, including semiconductors, artificial intelligence and autonomous driving.

The trade war gives investors one more reason for caution. Valuations had already grown vertiginous. High-profile start-ups such as smartphone-maker Xiaomi Corp and on-demand delivery services giant Meituan Dianping saw their stocks tumble after they went public, reinforcing the impression that private-market valuations had got out of hand.

We’re seeing real stress in the system for the first time

“You’re really reaching the end of the shared economy – this idea of let’s give away services for free and make up for it in volume,” Qiming Venture Partners’ Rieschel said. “Some companies – Didi is the classic case – are just not showing any ability to become profitable.”

A Didi representative did not respond to a message and email seeking comment.

Valuations have not declined yet in China though. The country’s start-ups have resisted so-called down rounds, when they raise money at lower valuations than an earlier round.

Chinese start-ups join rush to launch IPOs on Shanghai exchange’s new tech board

“China entrepreneurs, more than any on the planet, will do unnatural things to avoid a down round,” Rieschel said.

Meanwhile, venture capital firms are pivoting to alternative business models, like enterprise software. Such start-ups are not only less capital intensive, they are at a stage of development where they require less money.

“It won’t cost you that much to sit on your hands for a few months,” Rieschel said.