China’s AI start-ups are closing more funding deals, yet they’re still attracting less money than the US

- AI start-ups in China are closing a larger share of funding deals worldwide, but their share of the amount raised has been declining since 2017

- Their US counterparts still strike the most deals, although their share of the number of deals has been dropping

Chinese artificial intelligence (AI) start-ups have been securing a greater share of funding deals in the industry in recent years, but the total value of these investments has actually been dropping amid a cooling venture capital landscape and political uncertainty about the ongoing tech and trade war with the US.

Last year, Chinese AI start-ups closed 13 per cent of global funding deals, up from 4 per cent in 2014. In comparison, their US counterparts still had the greatest share of deals worldwide but their share has been declining in the last five years, from 71 per cent in 2014 to 39 per cent in 2019, according to a report by tech-market intelligence firm CB Insights published on Wednesday.

However, the amount raised by Chinese start-ups accounted for only 11 per cent of total funds raised by AI start-ups worldwide in 2019, down from 21 per cent the previous year. Meanwhile, AI start-ups in the US accounted for 64 per cent last year, a slight increase from 60 per cent the previous year.

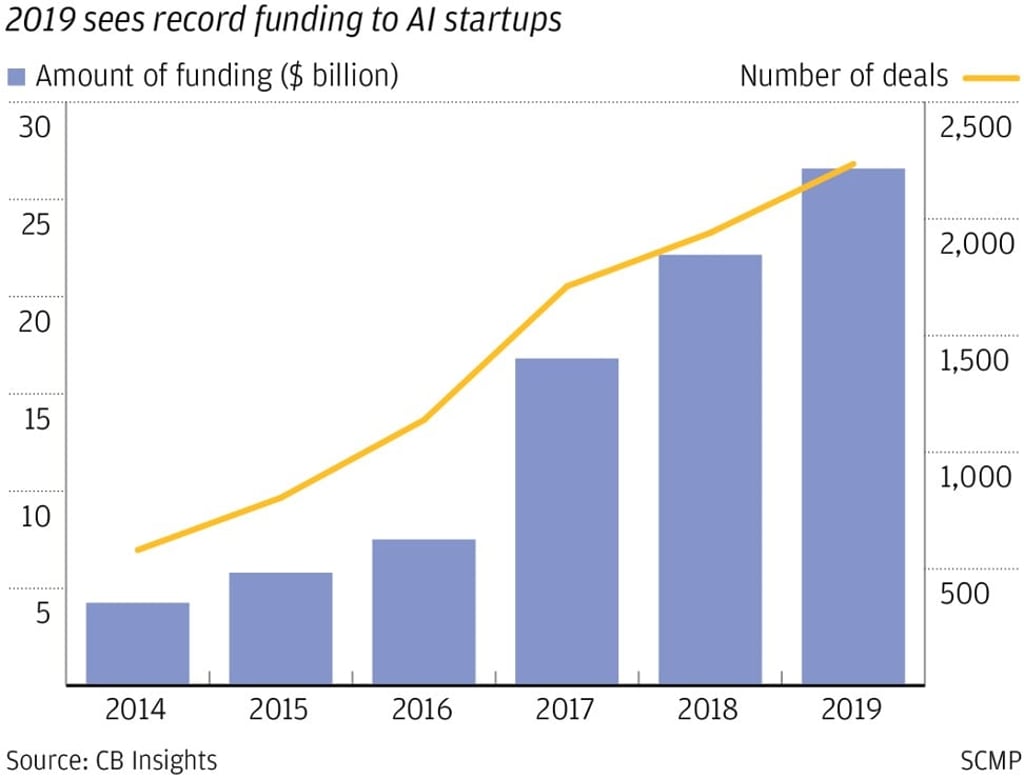

The global AI sector had a record year in 2019, with US$26.6 billion being poured into the sector across 2,235 deals, up from US$22.1 billion across 1,940 deals the year before, according to CB Insights.

This means that Chinese AI start-ups raised slightly more than US$2.9 billion in 2019, compared to about US$4.7 billion the year before, while US AI start-ups raised US$17 billion last year, compared to roughly US$13.3 billion the year before.