Topic

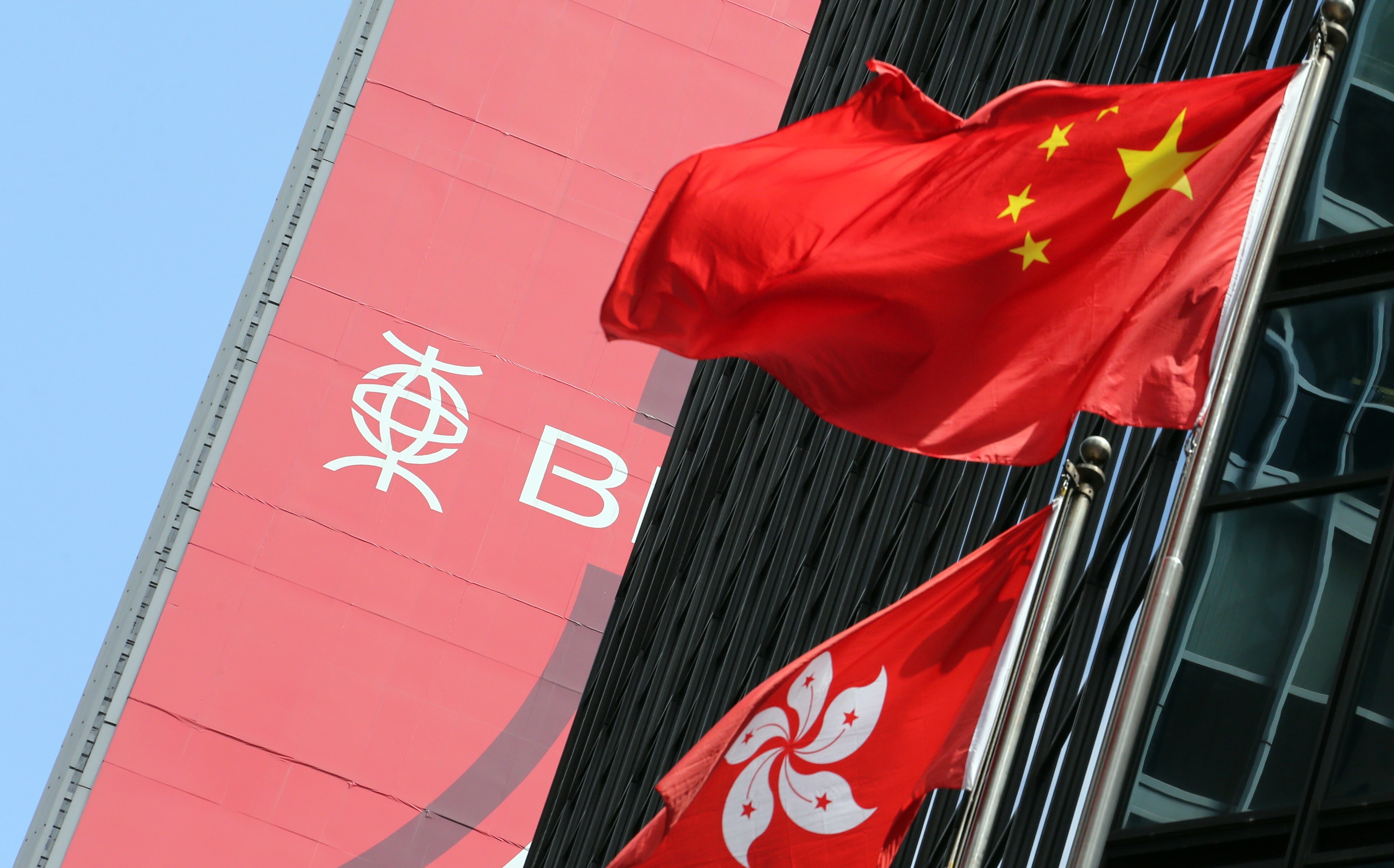

Founded in 1918, Bank of East Asia is the largest independent local bank and third largest bank in Hong Kong. It was co-founded in 1918 by Li Koon-chun, grandfather of David Li Kwok-po, who has been its chief executive since 1981.

With the Fed expected to start cutting rates before the end of the year, margins for lenders will narrow, potentially exposing threats in other areas. Hong Kong’s banks have made provisions and shored up balance sheets to ward off China property risk

- HSBC, Hang Seng Bank, and BOCHK are keeping their prime lending rates unchanged at 5.875 per cent, paying 0.875 per cent per annum for deposits

- Standard Chartered Bank also said it would keep its prime lending unchanged at 6.125 per cent

Hong Kong’s largest family-owned lender said its non-performing loans in mainland China dropped by 0.47 percentage points to 2.68 per cent at the end of 2023 compared with the first half, as its overall exposure to troubled Chinese property developers shrank.

Qianhai’s tax incentives are among measures that have attracted major Hong Kong banks to invest in grade-A office buildings, and to develop a wide range of banking, securities and insurance businesses in the area.

Hong Kong banks have launched marketing campaigns to kick off the Year of the Dragon. The giveaways include fireworks dinners, lucky draws and air tickets to lock in new clients and entertain wealthy customers.

The 18-storey BEA Tower, built at a cost of US$196 million, houses the bank’s Qianhai branch, innovation centre and data lab. The 105-year-old lender is targeting wealth management and fintech in the bay area.

Like its competitors, Bank of East Asia is betting on Hong Kong’s expanded role in the Greater Bay Area to tap the growing affluence and China’s potential for wealth management.

China’s worsening property crisis saw bad loans rise at Bank of East Asia and China Construction Bank, which tarnished otherwise decent first-half earnings.

Higher interest rates are expected to help drive profit gains at big Hong Kong lenders, including HSBC and Standard Chartered, in second quarter as US Federal Reserve prepares to hikes rates further.

Chinese tycoon Chen Hongtian is in discussions with lenders to retrieve assets worth HK$10 billion (US$1.27 billion) after a ‘short-term liquidity issue’ forced him to miss mortgage payments.

Bank of East Asia plans to set up its first branch in Hainan province, as officials in China’s largest free-trade hub court foreign investment in the financial sector.

Chen Hongtian’s company, Cheung Kei Group, cites defaults on ‘several big-ticket accounts receivable’ and ‘abnormal obstacles’ for loss of control over assets including house on The Peak.

Chen was the talk of the town in Hong Kong for purchasing the house on The Peak for a record price of HK$2.1 billion in 2016.

The de facto central bank’s new platform is designed to help small and medium-sized enterprises get cheaper loans by sharing their operational data with banks.

The banking giants could face weaker results as market uncertainty hit global deal making and China’s economic slowdown could prompt additional provisions for their onshore commercial property portfolios, according to analysts.

Ping An’s push to break up HSBC has failed to spur gains in bank’s Hong Kong share price, which is lagging the benchmark Hang Seng Index.

SFC has reminded member firms to review and update business continuity plans amid potential for disruption.

The provisions at HSBC, Hang Seng Bank, Standard Chartered and Bank of East Asia, revealed during results announcements over the past two weeks, hint at the impact the developers’ credit crunch has had on lenders.

Twelve Hong Kong banks, including note-issuing lenders HSBC, Standard Chartered and Bank of China (Hong Kong), will suspend all banking services on Saturdays starting this week and the next until further notice.

Banks, insurance firms, wealth management firms and stockbrokers have been spared from the city’s draconian social-distancing and shutdown rules, but financial firms said they are not taking any chances.

The lai see – cash wrapped in vibrantly coloured packets, typically red – is a tradition that harks back millennia, usually given by elders to young or unmarried visitors.

About 9 per cent of bank workers in Hong Kong are likely to lose their jobs because of branch closures, but those with skills in wealth management, green finance and digital banking are likely to be in demand, HKMA deputy CEO Arthur Yuen says.

Bank of East Asia said it would pay an interim dividend of 35 HK cents a share as its first-half results benefited from an improving economic outlook.

Wealth Management Connect is the banking sector’s ‘next big driving force’ for fee-based income, says Bank of China Hong Kong executive Arnold Chow.

Hong Kong’s biggest publicly traded life insurer will buy a 24.99 per cent stake in China Post Life Insurance as it expands its presence in the mainland.

The Bank of East Asia is looking to extract commission income from cross-selling AIA life policies to its banking clients after divesting its insurance assets. Cross-border wealth management and insurance schemes could be the next big thing, co-CEO Adrian Li says.

AIA and Bank of East Asia struck a 15-year partnership to distribute life, savings products to lender’s retail customers in the Greater Bay Area as part of agreement to sell BEA Life.

Bank of East Asia’s annual profit rose to HK$3.61 billion in 2020 after the Hong Kong lender reported its worst results in a decade in 2019.

HSBC said it would pay a dividend of 15 US cents a share after the bank’s UK regulator expressed comfort with lender resuming investor payouts.