Topic

News about the global financial industry with a focus on developments in Hong Kong and China.

- The People’s Bank of China has come out in favour of trading bonds on the secondary market, indicating a more vigorous monetary policy is on the cards

- Move would suggest a greater willingness to adopt more radical methods to support economic growth, in contrast with earlier conservative stances

Charles Li, former head of the Hong Kong stock exchange, wants to bring its model of financing for a cut of daily revenue to Southeast Asia as early as the fourth quarter.

Reports suggest US has discussed sanctions on some Chinese banks over their trade with Russia, but analysts say moves to remove China from the Swift interbank financial system could create a ‘huge problem’ for global trade.

Carlson Tong Ka-shing, a veteran accountant and former head of the city’s market regulator, will work with CEO Bonnie Chan, as the exchange grapples with low market turnover and a decline in new listings.

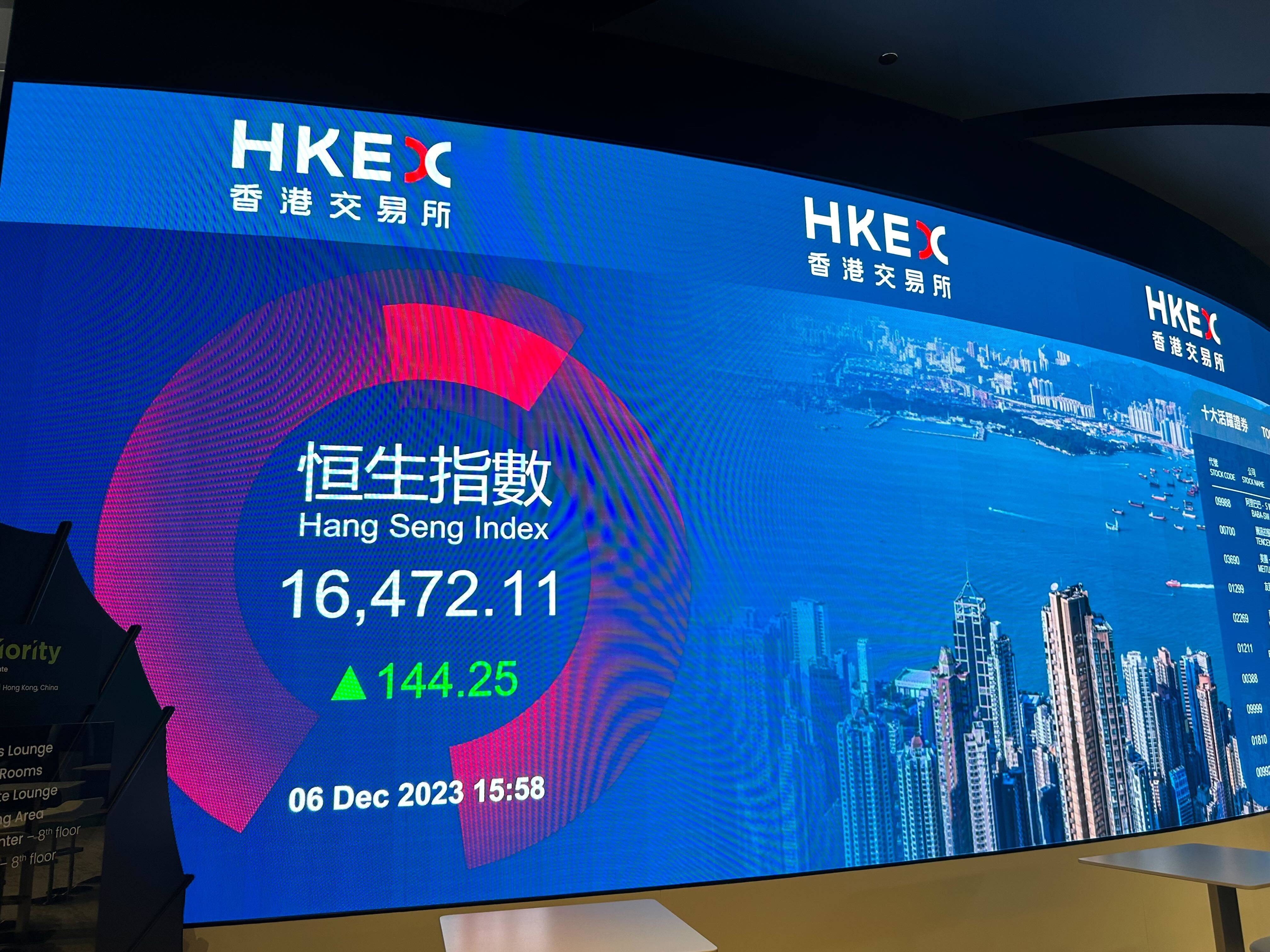

Net profit for the January-to-March period came in at HK$2.97 billion (US$380 million), or HK$2.35 per share, beating a consensus estimate of a 14 per cent decline and improving on the fourth quarter of 2023 by 14 per cent.

Readers discuss the need to train Hong Kong’s workforce as the digital economy gathers steam, the importance of applied science education, and a change in the qualification required to teach English at local schools.

Tesla launch of ‘new models’ by early 2025 in an advanced timeline would use its current platforms and production lines

China could face a third wave of corporate bond defaults, induced by high financing costs, slow economic growth and tighter government policies, S&P analysts said. Local government financing vehicles may be the weakest link.

ESG reporting and the Greater Bay Area offer opportunities for young accountants, and the IPO market is set to recover, new HKICPA president Roy Leung says.

Hong Kong offers plenty of wealth management and stock market opportunities despite headwinds and uncertain economic outlook in China, according to speakers at the Apec Business Advisory Council summit.

Hong Kong’s SMEs are more optimistic than their peers in mainland China, Singapore and Australia when it comes to growing their businesses this year, thanks to government support and an increase in online sales, a survey shows.

Role of fund managers will be strengthened as cost of rule violations increases ‘substantially’, a lawyer says, while Goldman Sachs predicts higher ‘quality premium for large-cap stable growers’.

Many Chinese firms are expected to shift their fundraising plans to Hong Kong following measures by the mainland’s market regulator to support initial public offerings in the city, analysts say.

The Hong Kong Monetary Authority’s SME information platform is part of its ongoing efforts to help SMEs affected by the shift in consumer and tourist spending patterns.

The city state’s incoming PM inherits a currency that has risen 40 per cent against its major trading partners over the past two decades, while the economy has doubled in size and total assets under management have climbed more than eight-fold.

Beijing’s prudent monetary moves and an emphasis on restructuring local government debt have sparked debate over how long it will take policymakers to ‘walk it off’.

BNP Paribas marks its re-entry into China’s market with hires, at a time when Morgan Stanley, Goldman Sachs and JPMorgan have all made rounds of job cuts in Hong Kong and China

Hong Kong stocks extended gains amid expectations the latest measures announced by Chinese authorities will broaden the investor base

Hong Kong’s representatives to the Asia-Pacific Economic Cooperation business advisory council plan to use the platform to showcase the city as more than just a finance hub.

China Securities Regulatory Commission on Friday announce five measures to further enhance connectivity between mainland and Hong Kong capital markets.

China’s capital market regulators have announced a package of measures to boost liquidity, attract international investors and enhance competitiveness between the mainland and Hong Kong.

Germany’s Allianz Global Investors looks forward to tapping mainland China’s ‘vast potential and steady growth’ after getting the green light to operate an onshore fund management company there, says regional head.

It is only a matter of time before the currently depressed market stages a rebound, according to Fred Hu of private-equity firm Primavera Capital.

A new operating model enabling Hongkongers to use the services of multiple credit reference agencies for the first time will start on April 26, the Hong Kong Association of Banks and two other industry groups announced.

Asia official with Washington-based agency points to the PBOC’s policy moves, as well as China’s infrastructure spending, as economic bellwethers in the face of headwinds.

Scam operators seemingly thumb their noses at the regulator, which recently launched a campaign warning the public about financial frauds.