Topic

The business of climate change forms a core part of SCMP’s climate change coverage. Key topics covered include the policy drivers, financing and business case for the commercialisation of low carbon energy technology and solutions – ranging from green hydrogen to wind, solar and nuclear energy – and carbon removal technologies such as afforestation and carbon capture, utilisation and storage. Sustainable consumption of products that reduce the carbon footprint of supply chains are also featured regularly, spanning topics such as upcycling and recycling of textiles, food wastes and packaging materials.

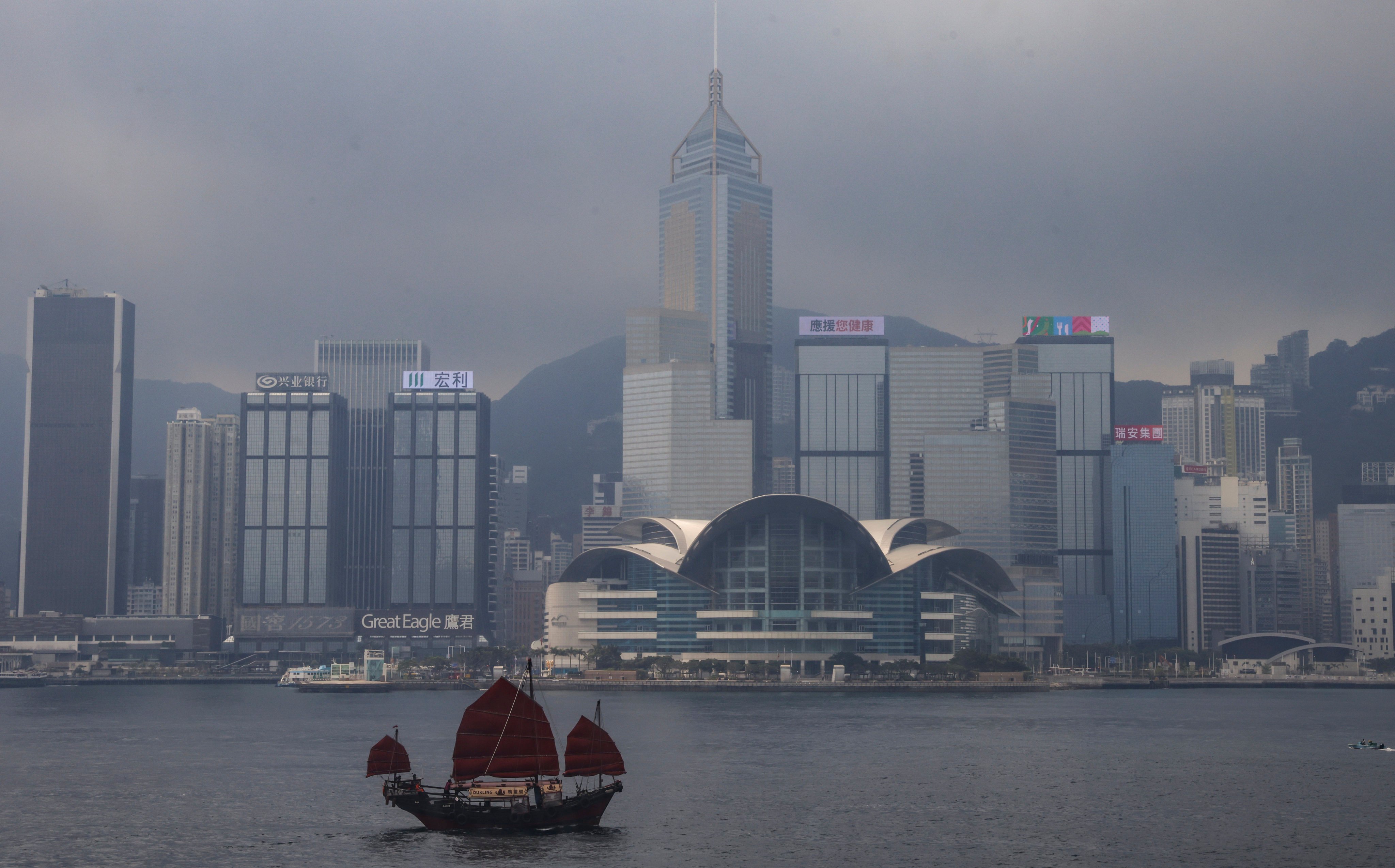

City’s businesses will be required to meet international standards on sustainability, but this will require funding from both the public and private sectors.

- Domestic demand for oil will rise only 1 per cent year on year in 2024 after growing 11 per cent in 2023, state-owned oil and gas producer says

- Oil consumption will continue to grow in other sectors such as petrochemicals, but will peak before 2030, executive says

‘Private firms are obviously looking at the torch that is potentially coming for themselves,’ when it comes to declaring emissions goals, says Net Zero Tracker project leader

Hong Kong has the potential to become an international innovation hub for hydrogen technologies, says Towngas’s Don Cheng.

Hong Kong can do more to help finance the transition of high-emitting sectors and heavy-polluting industries to more sustainable business activities as a hub for the region, Financial Secretary Paul Chan says.

The ISSB, a sustainability-reporting standard-setting body, will vote this week to add biodiversity-related disclosures to its work plan, paving the way for such standards to become the global baseline.

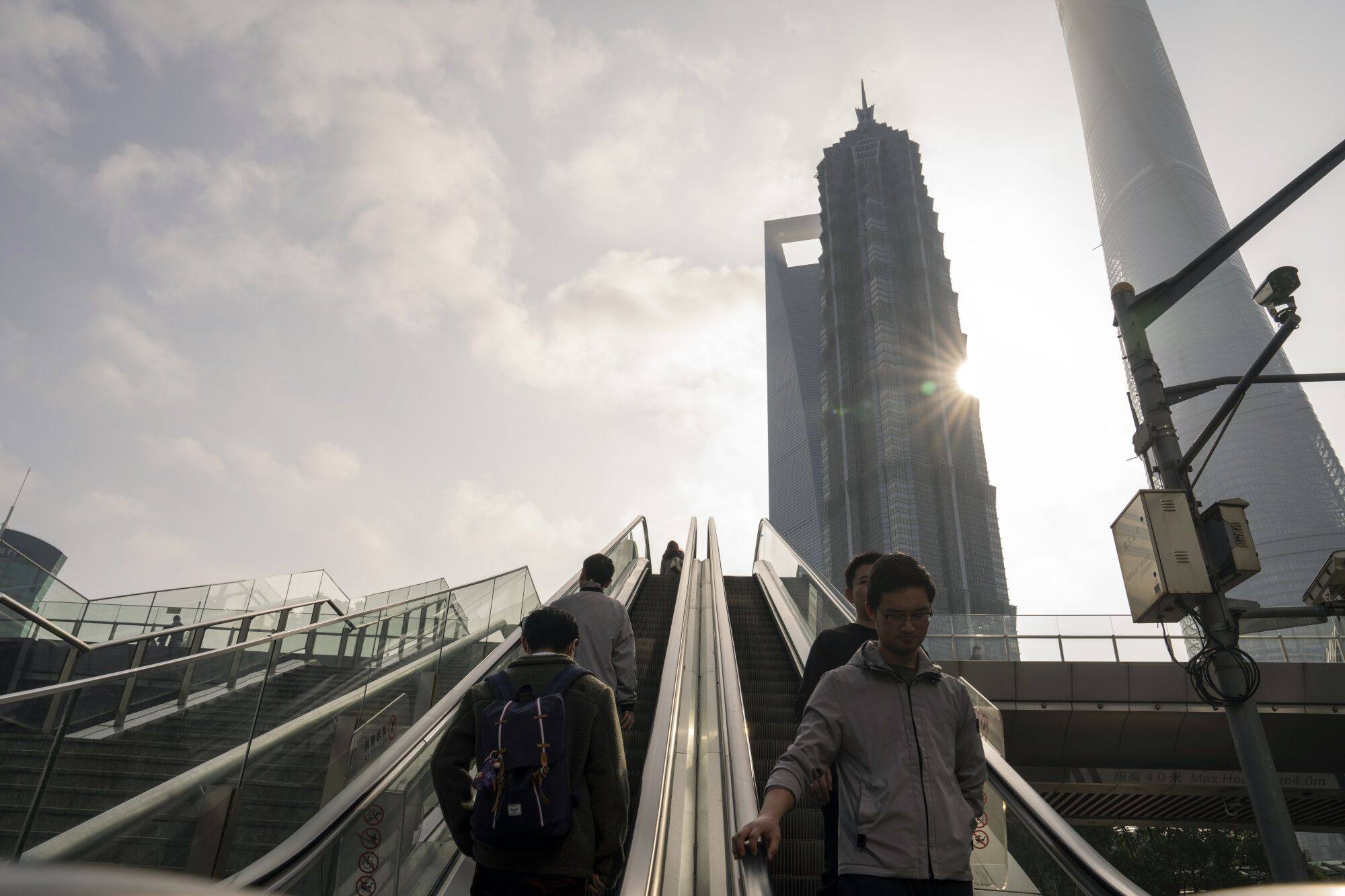

Study finds groundwater changes and building weight appear linked to subsidence; a quarter of China’s coastal land will sink below sea level within a century.

China is the world’s top producer and consumer of electric vehicles, and Beijing is now seeking the lead in hydrogen-powered vehicles.

Ampace is betting on a boom in home energy storage systems and the ‘batterification’ of tools and electronic devices as it aims to solidify an already dominant position in a part of the market away from electric cars and smartphones.

Energy-related trade between China and the Middle East is likely to increase significantly and reshape the sector globally in the wake of the Saudi-Iran peace deal brokered by China last year, according to Swiss bank UBS.

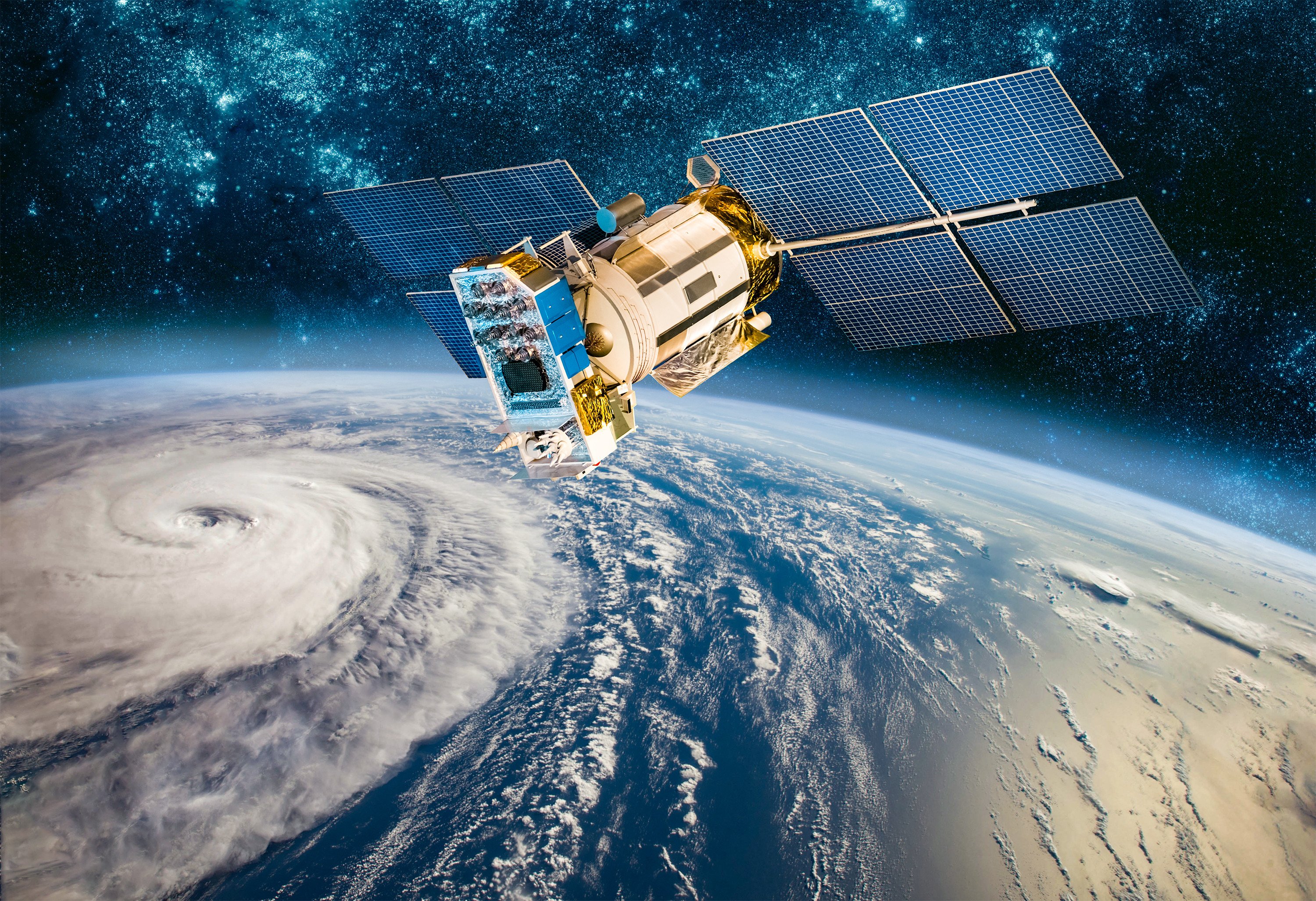

Hong Kong is building an arsenal to assist the world with raising funds for managing losses from natural disasters, the Insurance Authority said. It is discovering more issuers, investors and data, as well as cultivating its modelling capabilities and talent.

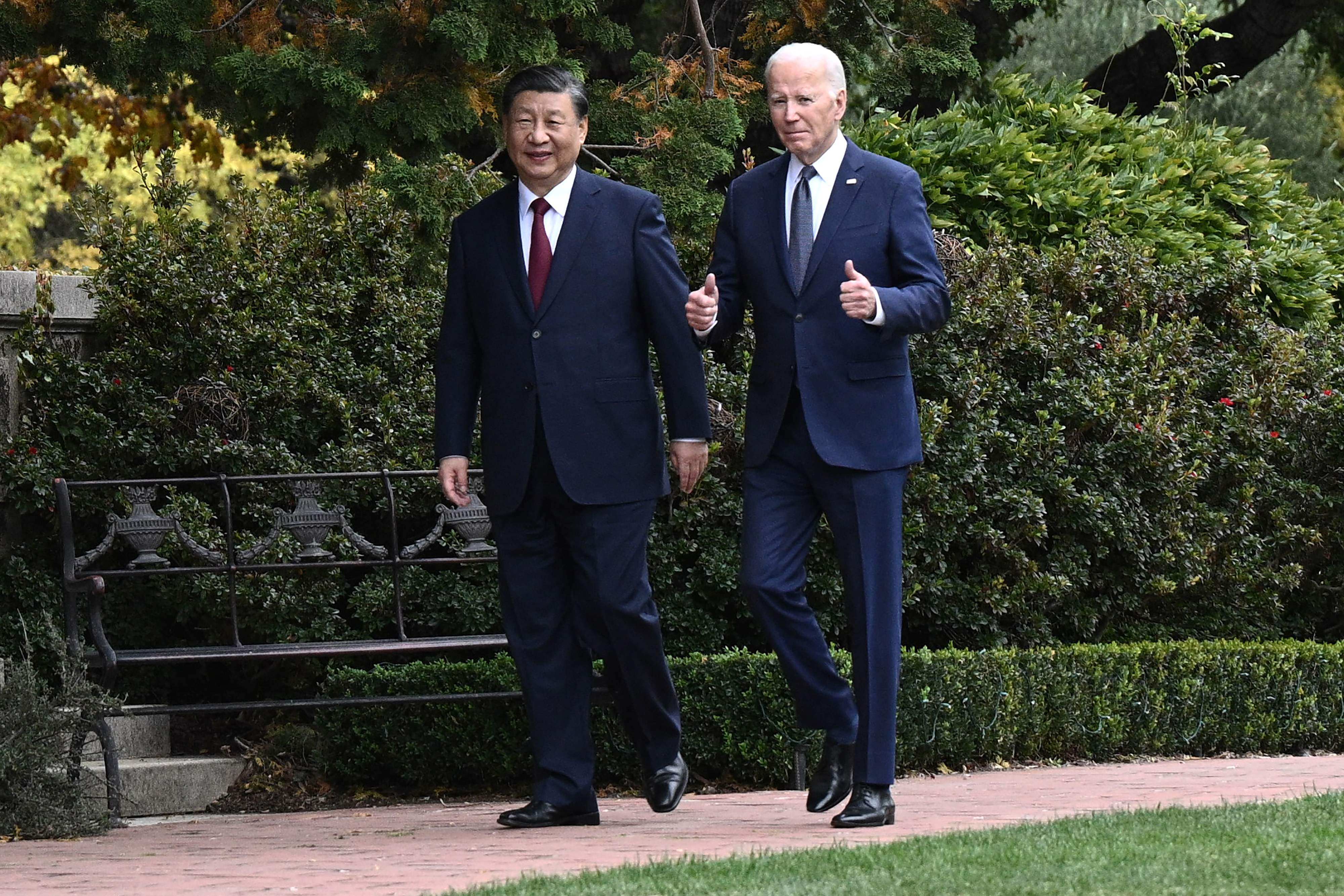

At the Harvard College China Forum, participants said existential threats such as global warming cannot be solved unless the two countries move beyond their mutual distrust.

All financial institutions licensed by the SFC should be required to submit ESG reports for the development of a comprehensive ecosystem of sustainability disclosures, City University of Hong Kong says.

China accounted for two-thirds of the coal-burning power capacity that came online last year, according to Global Energy Monitor, which ‘starkly contrasts with the global trend, putting China’s 2025 climate targets at risk’.

An anti-subsidies investigation into Chinese wind turbine manufacturers by the EU could saddle the bloc’s renewable project developers with high costs and slow down their decarbonisation efforts, analysts say. The impact on Chinese firms could be limited.

New-energy vehicles will make up about half of new car sales in China by 2030, as state incentives and expanding charging stations win over more customers, Moody’s Investors Service says.

The global drinks giant said all 500ml bottles for Coca-Cola Original, Coca-Cola No Sugar and Coca-Cola Plus in Hong Kong have shifted to recycled polyethylene terephthalate (rPET), the first such use of the material in China.

Speaking in Paris to Chinese makers of electric vehicles and lithium batteries, commerce chief Wang Wentao vows Beijing will ‘fully support and defend’ their rights as Western pressure mounts.

Hong Kong needs more innovative and automated solutions on top of government incentives to help its under-utilised, money-losing sustainability efforts.

The Chinese stock market is poised to see the emergence of shareholder resolutions on ESG issues next year, as incoming corporate governance reforms start allowing many more minority owners to present proposals for voting, a stewardship expert says.

Climate mitigation and adaptation projects that ‘stand on their own’ appeal to more mainstream investors, one financier says, especially after controversies that dented confidence in voluntary carbon credits.

EnerVenue, a rechargeable batteries start-up co-founded by the family office of tycoon Peter Lee Ka-kit, aims to build factories in the US and China to commercialise an old technology deployed in outer space for use on Earth.