Topic

A capital gains tax (CGT) is a tax on capital gains, the profit realised on the sale of a non-inventory asset that was purchased at a lower price. The most common capital gains are realised from the sale of stocks, bonds, precious metals and property. Not all countries implement a capital gains tax and most have different rates of taxation for individuals and corporations.

Why should Hong Kong’s wage slaves pay up to two months of their earnings in taxes while profitable stock punters and property speculators – and our tycoons – get to keep all their gains?

These days, mainlanders and Hongkongers may not see eye to eye on many things - political developments in Hong Kong and even the number of baby formula tins that may be bought, to name two examples. But there is one thing that is sure to rile both sides - property prices soaring far beyond the means of ordinary people.

- The Asian finance hub’s upcoming spot cryptocurrency ETFs could attract regional investors who do not want to bother with US accounts and tax forms, experts say

- Hong Kong is the first major financial market to offer spot ether ETFs, but some were dismissive, noting the city’s small ETF market relative to the US

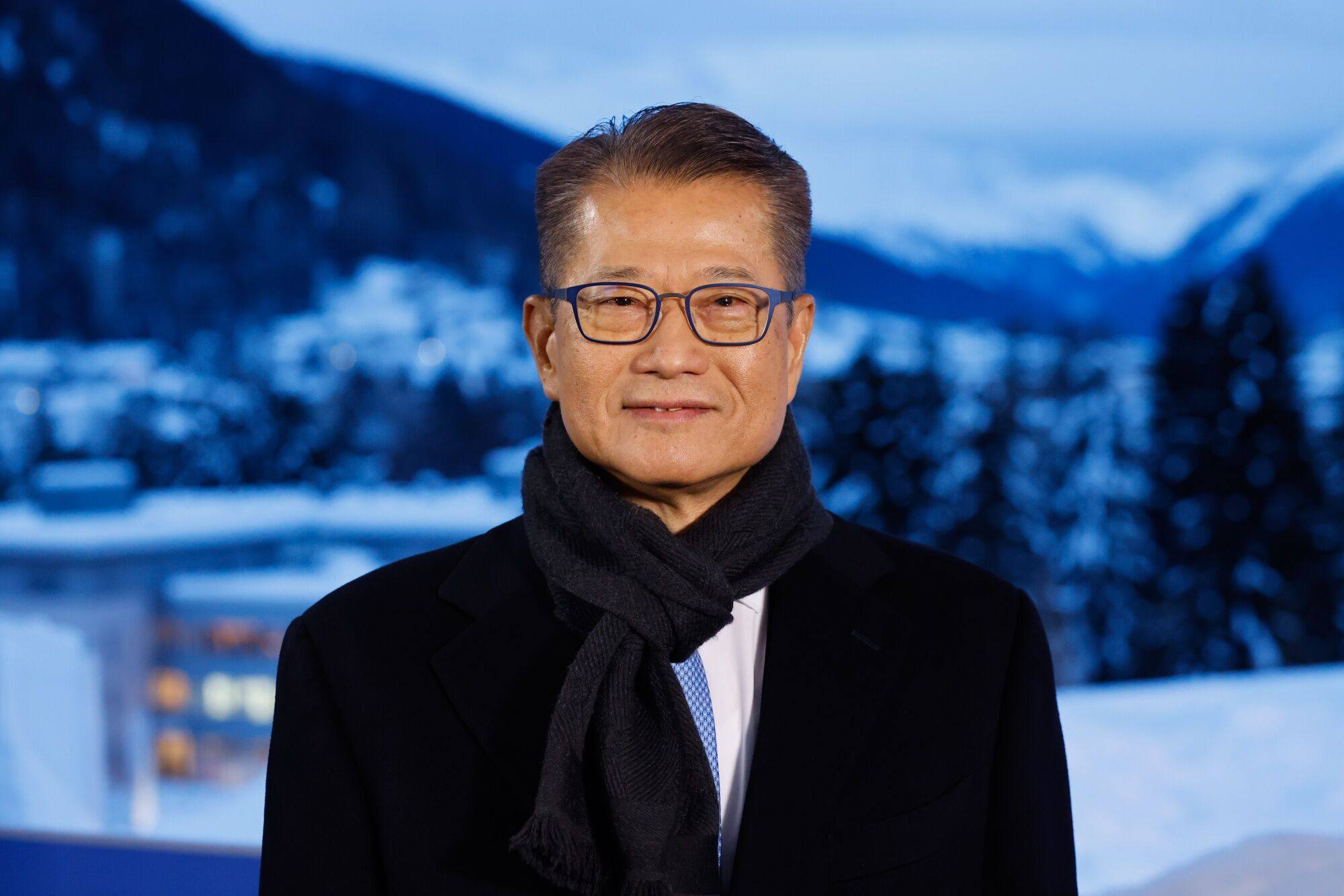

The introduction of a capital gains tax was just a suggestion brought up during the budget consultation period, Paul Chan has told the Post.

Finance chief says surplus may take longer than original estimate of 2025-26 financial year and also offers assurances that efforts to secure new land will continue despite developers’ lack of appetite.

We look at the impact of the policy and monetary moves since 2009 to cool home prices. Now, stakeholders want the government to roll these back. But will that have the desired effect?

An improved economy, a better jobs outlook and a turnaround in stock market performance are also needed to boost homebuying confidence and sentiment in the city, they say.

President Xi Jinping’s report to the 20th party congress signalled more robust regulation to evenly distribute the spoils of China’s rapid development, sparking speculation about who might be targeted and how.

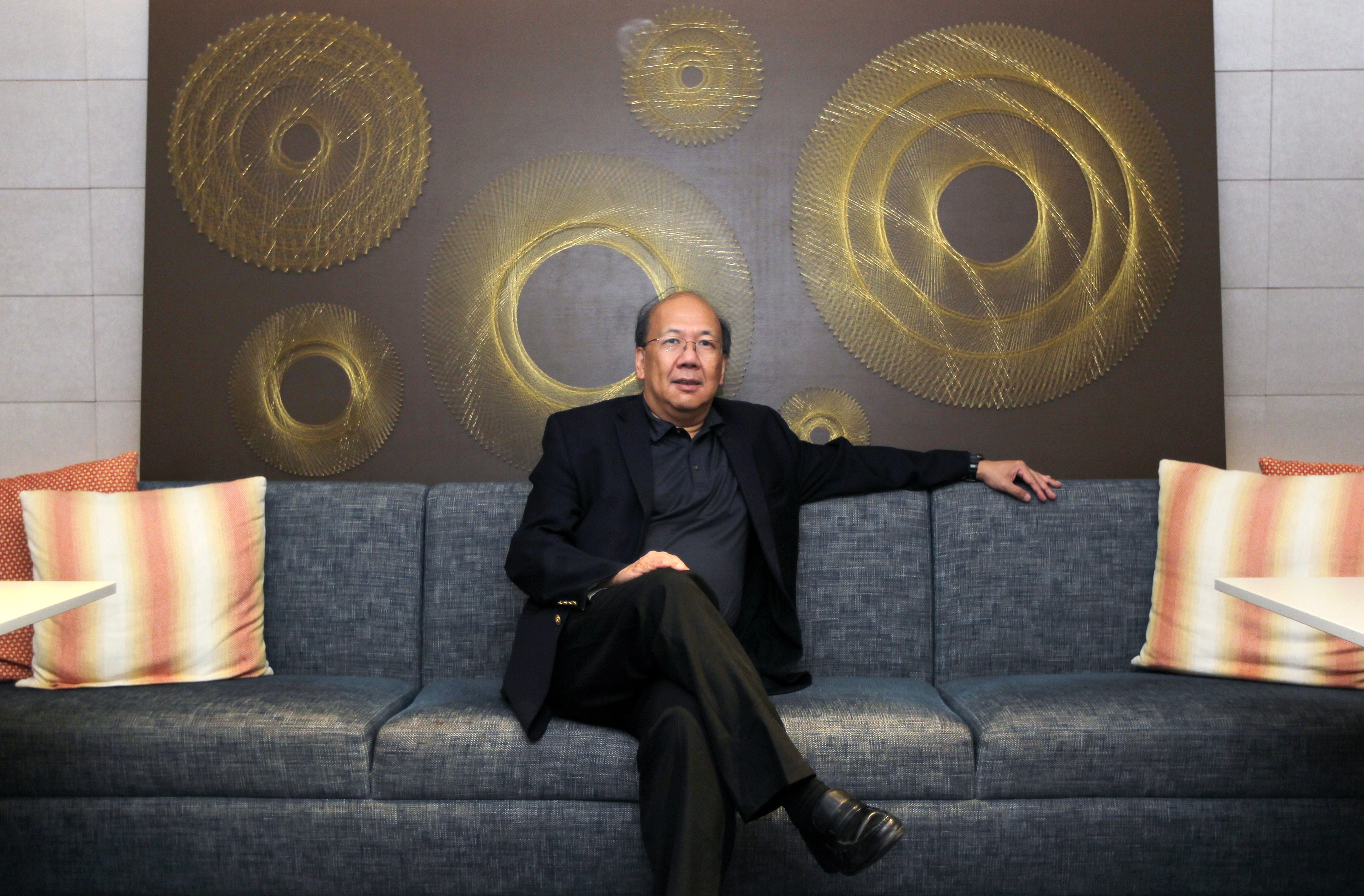

The Southeast Asian financial hub has been a magnet for the well-to-do thanks to its low tax rates and modern infrastructure. But it’s already planning to raise income taxes – and its next prime minister has indicated that the government needs to do more to tackle inequity.

China’s government, harking to its socialist roots, is anxious to make housing affordable to young families particularly during politically significant periods such as the ruling Communist Party’s centenary in 2021.

China plans to trial property taxes in certain parts of the country as the next step in its ‘common prosperity’ drive to reduce inequality.

Stocks that have gained the most may get hit hardest in the short-term drawdown, a lit that would include Tesla, FAANG block of tech megacaps and other S&P 500 members with more than 200 per cent gain in the past 12 months.

Homebuyers could face higher transaction costs globally as governments raised wealth taxes or mulled new ones to refill state coffers after spending almost US$20 trillion in stimulus to keep economies afloat during the pandemic.

Hong Kong’s economy contracted for the fourth consecutive quarter in the three months ended June, forcing the local government to dig deep for ideas to stanch the slump, restore confidence and restart activity.

Monaco’s tiny principality and friendly tax regime are irresistible magnet for the ultra-rich and celebrities, making its luxury property market more expensive than in Hong Kong and New York.

Calls to ‘reboot’ capitalism, and the new Business Roundtable pledge, are both welcome and necessary. But only with universal and high-quality disclosure can words be turned into actions.

Executives from the Chinese community are buying flats across the country.

Real estate funds and private real estate investment trusts, which enjoyed lower levels of tax, will have same tax applied to them as regular companies

There is an answer to Beijing’s property bubble conundrum: either a single tax on land value that Sun argued for, or a pragmatic land tenure system that Singapore has adopted.

As those profiting from technological progress are increasingly paid in stock options, and companies invest more in intangible assets like data, branding and software, a change in tax rates may be necessary to pay for public services.