Topic

Beijing again looks to Wu Qing, who cracked down on malpractice at brokerages, to bring a firm hand and pave way for new investment measures.

Some officials in the Chinese government are so desperate to get their desired narrative across that they have started to disregard basic principles, an approach which may carry a high cost in the long run.

The pain of this colossal corporate failure will be worth it if the country can diversify its growth strategy away from the addiction of property development.

- Goldman sees a ‘potentially stronger risk appetite and a more conducive trading environment for A shares in the near term’

- UBS raises rating on the MSCI China Index and Hong Kong stocks to overweight, citing earnings resilience and policy support

Chabaidao’s stock ended the day 27 per cent lower after slumping as much as 38 per cent. It raised about HK$2.6 billion (US$331.7 million) from the sale of 147.8 million shares at HK$17.50 each.

Role of fund managers will be strengthened as cost of rule violations increases ‘substantially’, a lawyer says, while Goldman Sachs predicts higher ‘quality premium for large-cap stable growers’.

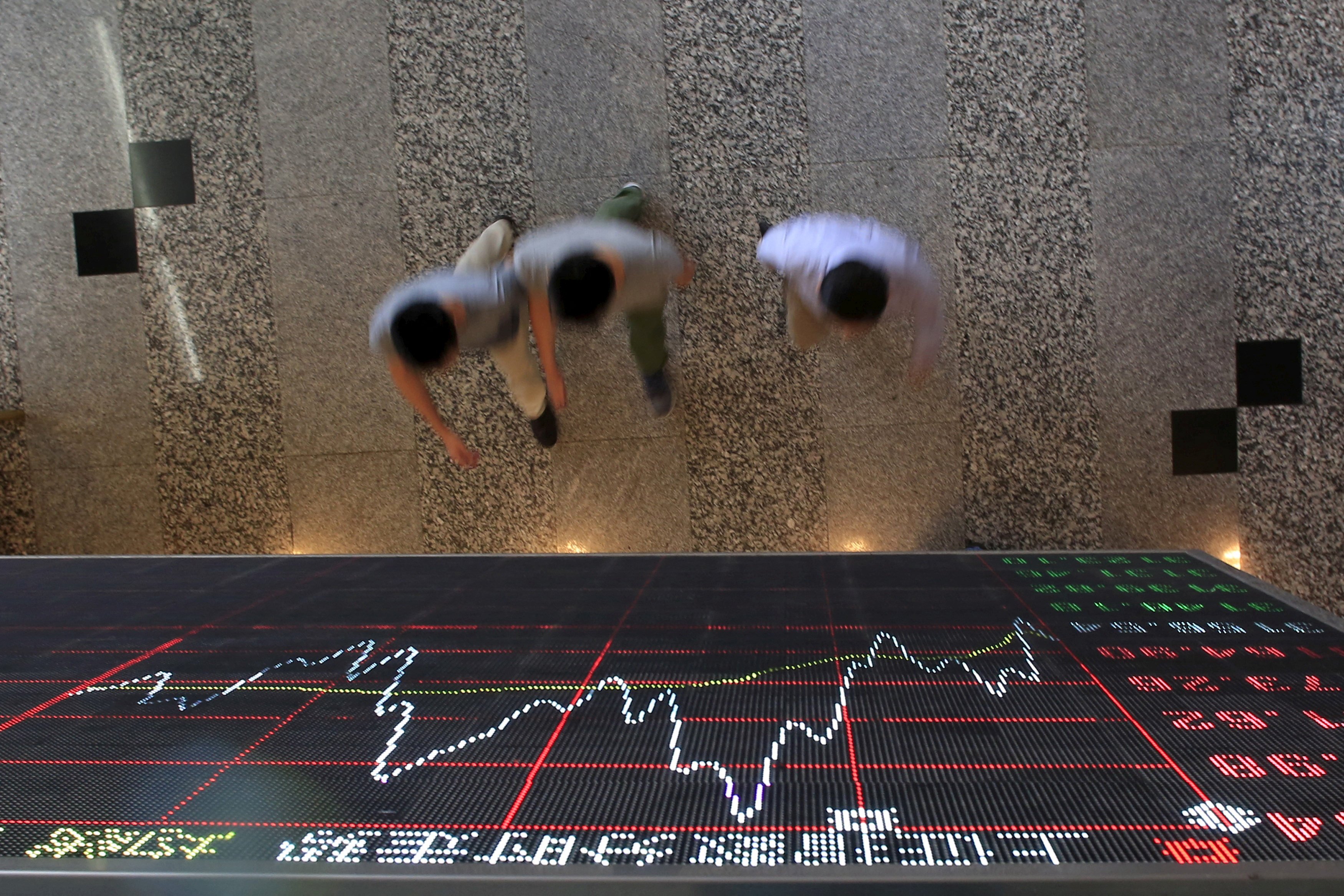

Hong Kong stocks climbed most in three weeks as investors ramped up their buying on expectations that a slew of supportive measures from the Chinese securities watchdog will aid sentiment.

Hong Kong stocks extended gains amid expectations the latest measures announced by Chinese authorities will broaden the investor base

China Securities Regulatory Commission on Friday announce five measures to further enhance connectivity between mainland and Hong Kong capital markets.

‘There is an increasing demand for diversification from domestic Chinese customers,’ says Joseph Pinto, CEO of London-based money manager M&G Investments.

CSRC’s new chief Wu Qing has sought to improve corporate governance and close deep valuation discounts in a bid to revive investors’ faith in China’s US$9 trillion stock market and these bold moves have met with some early success.

China’s capital market regulators have announced a package of measures to boost liquidity, attract international investors and enhance competitiveness between the mainland and Hong Kong.

Hong Kong stocks fell on Friday as investors were rattled by reports of Israeli missiles hitting Iran, with the heightened Middle East tensions triggering a scramble for safe haven assets.

It is only a matter of time before the currently depressed market stages a rebound, according to Fred Hu of private-equity firm Primavera Capital.

Hong Kong stocks gains were driven by insurance, banks and casino stocks with some investors saying conditions are right for a substantial rally in Chinese shares.

The erratic performance of Chinese stocks is not giving investors the confidence to commit their funds for the long haul, so some are betting on proxies outside the country, according to top wealth managers.

While worries about Chinese consumers and government debt are making investors cautious, attractive investment opportunities exist, according to asset managers from Pimco and Amundi at a summit in Hong Kong.

Country Garden is pushing back some onshore bond payments to later dates despite a round of extensions last year, underscoring the financial stress at the Chinese property developer.

Asia looks ready to turn a corner in quarterly earnings growth this results season. Here are five key themes to watch as the report cards roll in over the next few weeks.

The cutbacks, described by people familiar with the matter, come as a prolonged market slump reduces trading commissions and authorities tighten limits around what research analysts are allowed to publish.

Hang Seng Index hovers near a five-week low after comments by Fed chairman Jerome Powell, who said it could take ‘longer than expected’ to get inflation back on target.

Hong Kong stocks struck five week lows as consensus-beating GDP data reduced expectations of a rate cut in China, while weak retail, industrial and property data weighed on sentiment.

Geopolitics is the biggest uncertainty and foreign interest in Chinese assets will depend on the direction of Beijing’s next set of policies, according to executives at the Harvard College China Forum.

Hong Kong stocks declined to three week-lows as rising geopolitical tensions dealt a further setback to investor sentiment, already jittery ahead of a batch of economic data due to be released during the week.

A document published by the nation’s cabinet on Friday promises to promote the ‘high-quality’ development of China’s capital market by strengthening supervision and guarding against risks.

Hong Kong stocks eased, pressured by the weak Chinese yuan currency and following trade data that showed a contraction in exports from the world’s second-largest economy.

China’s state-owned enterprises are shifting into new gears to raise their game and earnings by adding innovation and supply-chain security to their performance metrics, industry analysts said.

Hong Kong stocks tumble after data suggested China’s consumption demand remains weak and as investors lowered their bets on the US Federal Reserve cutting rates in June.

Hong Kong stocks rose as a growing number of corporate buy-backs triggered bets that the market is nearing a bottom.

China’s stockbrokers took another pay cut in 2023 as the double whammy of a slumping equities market and a government crackdown on corporate extravagance eroded the incomes of financial workers. Things don’t look much better this year, one fund manager says.

Sentiment has been recovering after a visit to China by US Treasury Secretary Janet Yellen, as traders await March economic data due later this week.

First-time stock offerings in Hong Kong are expected to improve after a dismal first quarter, according to Deloitte China. Tighter regulatory oversight could hinder bourses in mainland China.