Advertisement

Advertisement

TOPIC

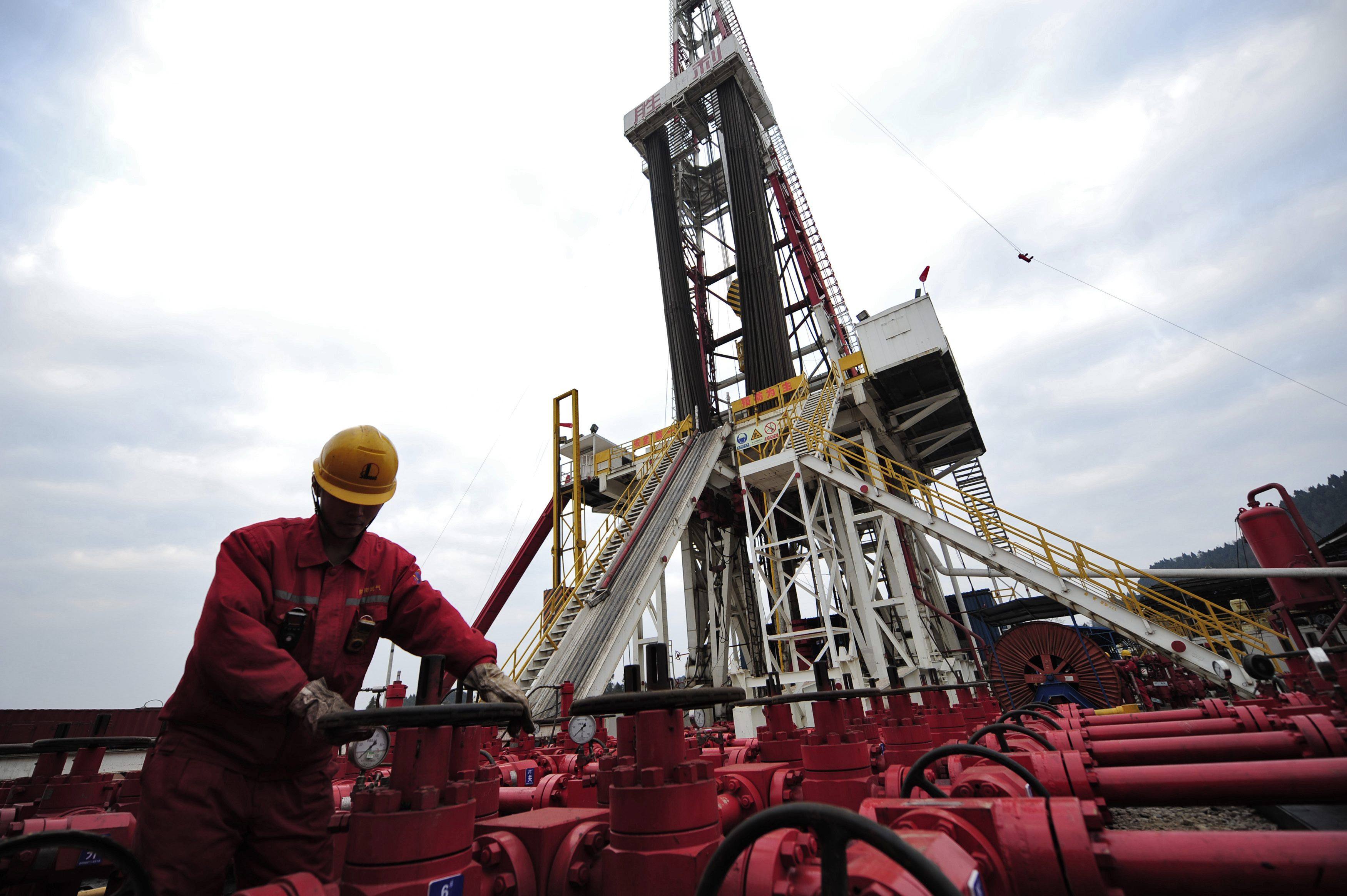

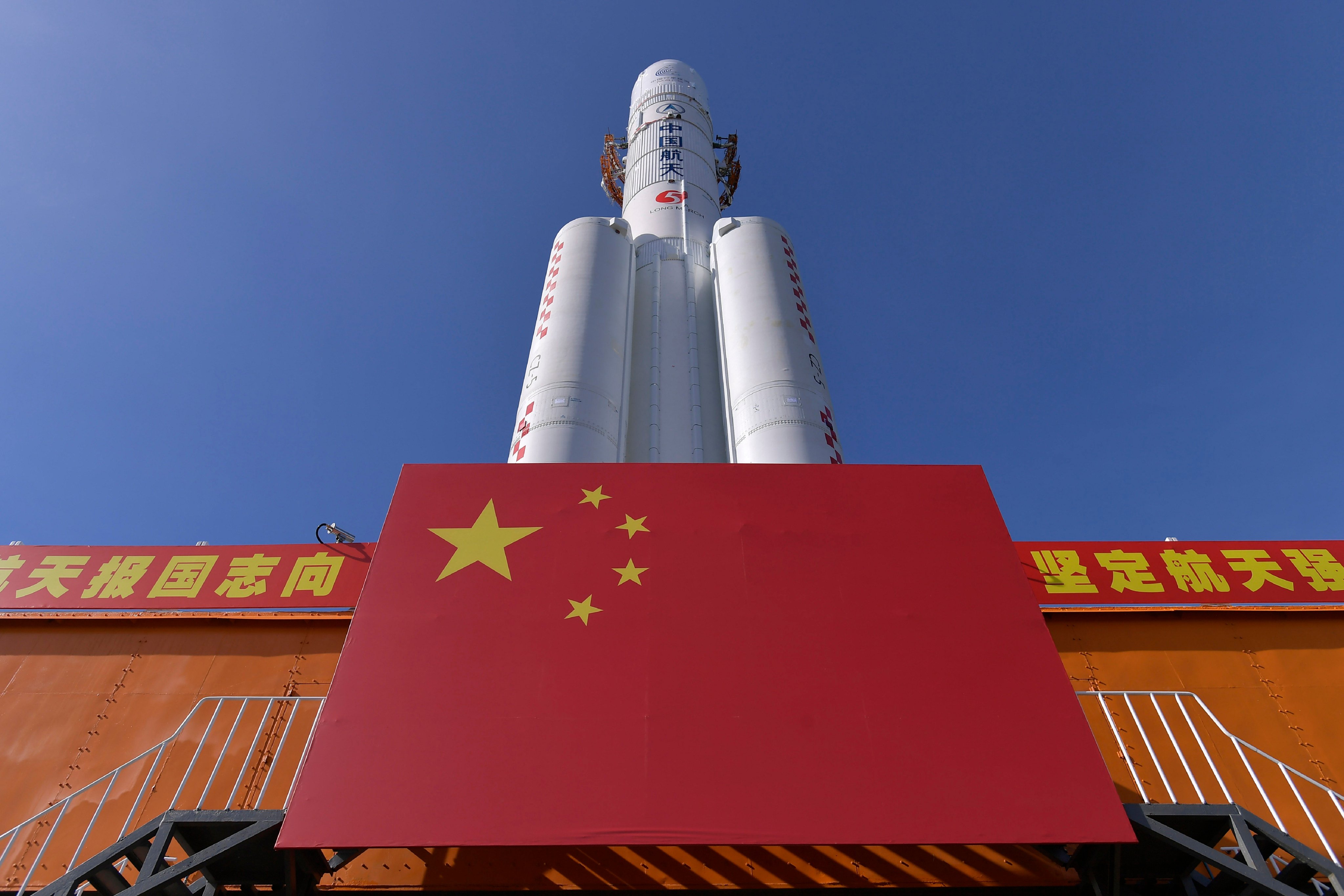

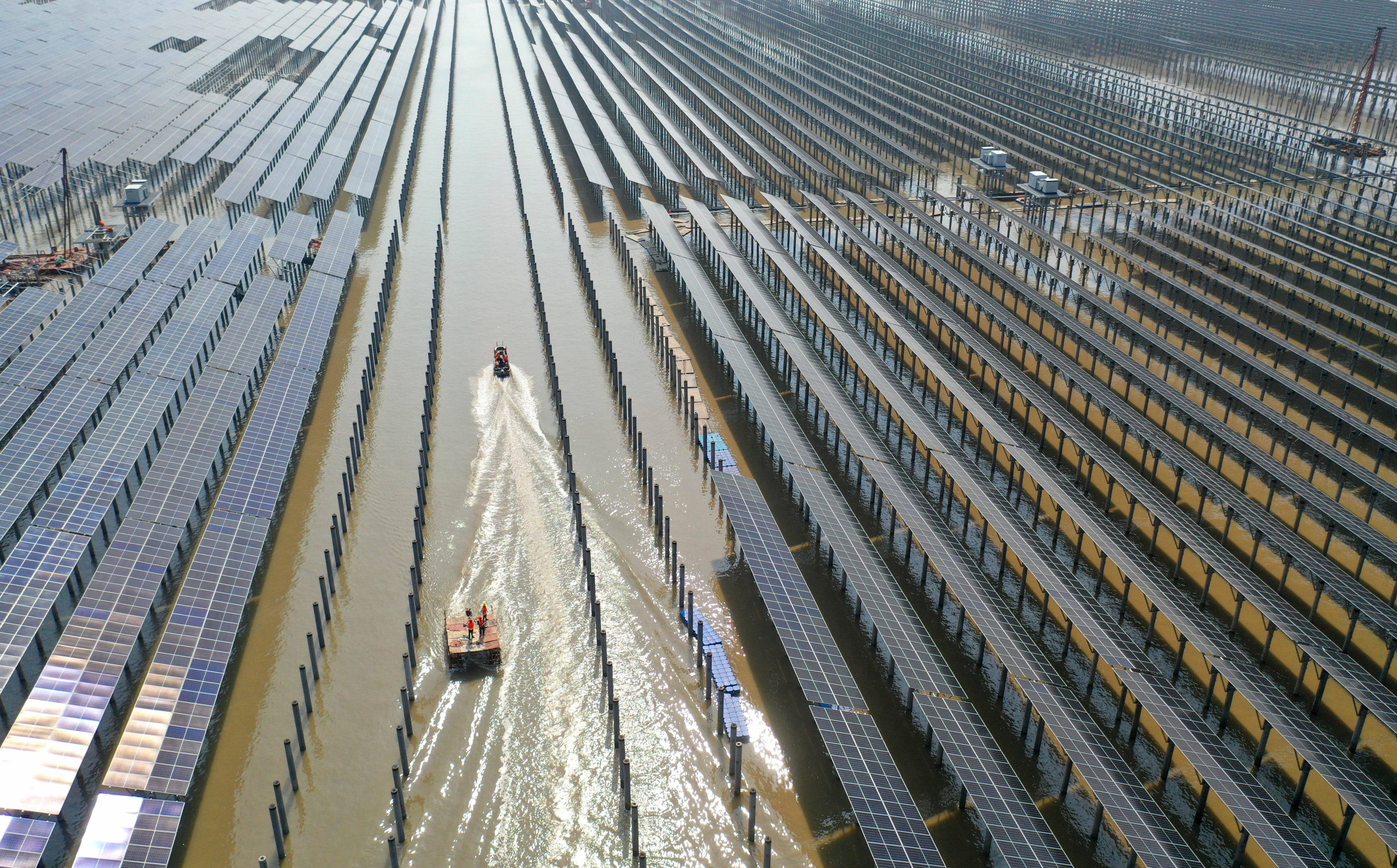

China’s power crisis

Related Topics:

China’s power crisis

China is used to seeing power supply cuts in parts of the country each year, but their frequency has increased sharply since the second half of 2020, escalating to a crisis in September 2021. Potential causes include Beijing-dictated carbon reduction targets to lower emissions, and an urgent shortage of coal.

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement