Topic

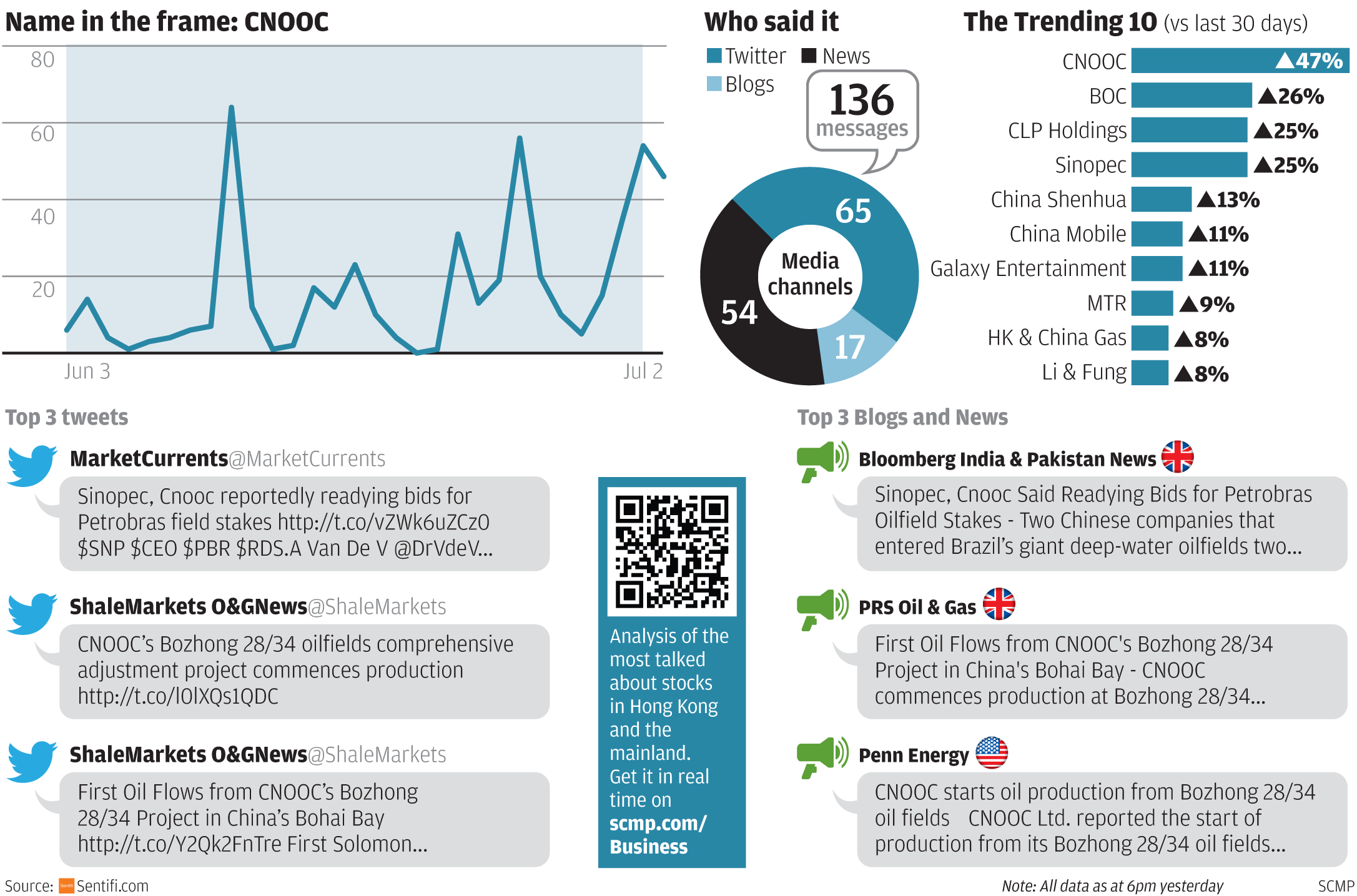

CNOOC is the third-largest national oil company in China by revenue, and one of the largest independent oil and gas exploration and production companies in the world. It focuses on the exploration and development of offshore crude oil and natural gas in China. It also has operations in the United States, United Kingdom and Canada since it purchased the Canadian oil and gas giant Nexen in 2013.

The company sees production of 470 million boe to 480 million boe this year, a rise over earlier projections and the first increase in three years

Outbound acquisitions by the mainland's state-owned oil and gas majors have fallen after a buying spree over the past few years, and officials are cautious on doing deals amid a protracted anti-corruption campaign by the central authorities in Beijing.

CNOOC, China's biggest offshore energy explorer, is expanding oil production in waters off its southern coast to reach a target missed since 2011.

State-backed mainland oil and gas titans have spent more than US$100 billion in the past five years buying overseas assets in the name of national energy security and acquiring expertise.

CNOOC, China's dominant offshore oil and gas producer, posted a 6.9 per cent year-on-year rise in unaudited oil and gas sales revenue to 59.15 billion yuan (HK$74 billion) for the year's first quarter.

CNOOC, China's dominant offshore oil and gas producer, is reportedly considering selling its stake in Argentina's Bridas although analysts said it would be tough to find a buyer willing to give the Chinese firm a profitable exit.

CNOOC shares fell the most in more than two years yesterday after the energy giant announced lower-than-expected projections for its output this year and next. Shares in the mainland's dominant offshore oil and gas producer fell 6.3 per cent to HK$13.08.

Oil and gas acquisitions in Canada by Chinese state-owned enterprises will slow in the wake of Ottawa's restrictions after CNOOC's purchase of Nexen, said speakers at the Global Resource Investment Conference last week.

Green Dragon Gas, an explorer for natural gas trapped between coal seams, is trying to resolve a disagreement with state-backed partner CNOOC and its China United Coal Bed Methane (CUCBM) unit on the sharing of reserves and output from drilling done allegedly without its consent.

Power bills on Hong Kong Island and Lamma could be cut if hopes Hongkong Electric can secure a bargain deal to buy gas come to fruition.

CNOOC, China's dominant offshore oil and gas producer, has agreed to examine the viability of building facilities on the west coast of Canada to liquefy and export natural gas produced from interior fields, as part of the country's efforts to secure more energy sources.

China National Offshore Oil Corporation (CNOOC) is working with a local company on plans to introduce liquefied natural gas as vehicle fuel, with a vision of building a network of LNG refuelling stations similar to those found in mainland cities.

The mainland's biggest state-owned oil companies, sitting on ageing fields, are scrambling to ramp up crude oil and natural gas production to meet surging domestic demand through a slew of investments that also risk pushing up their costs.

CNOOC, China's dominant offshore oil and gas producer, posted a 17.8 per cent year-on-year third-quarter rise in output, almost entirely thanks to its US$15 billion acquisition of Canada's Nexen, as domestic output fell on a dearth of new projects.

CNOOC, the country's dominant offshore oil and gas producer, says investors should give Nexen more time to judge the merit of its acquisition, after the Canadian unit posted a sharp fall in interim profit, in contrast to better-than-expected gains at CNOOC, excluding the unit.

The mainland's largest offshore energy explorer undertook a record offering of securities to replace part of a loan used to acquire Nexen, which operates in Canada's oil sands, data shows. The company paid 3 per cent to sell debt due 2023, 87.5 basis points less than a year earlier, after 10-year Treasury yields last week fell to the lowest since December. Mainland borrowers are paying an average of 45 basis points less than in 2012 for US dollar loans.

CNOOC will continue to seek growth opportunities abroad after completing mainland China's largest overseas acquisition, which its chairman said was full of challenges. China's largest offshore oil and gas producer completed on February 26 the US$15.1 billion acquisition of Canada-based Nexen, which has assets in North America, Europe and Africa.

The fact that China National Offshore Oil Corporation's US$15.1 billion acquisition of Calgary-based Nexen went through successfully, with the required US approval, shows that direct investment capital flows from China are not always subject to political hijacking, as many on the mainland claim.

A survey of more than 30 brokerages by Thomson Reuters gave an average prediction for PetroChina, the nation's largest oil and gas producer, which is due to report on Thursday, of a 6 per cent decline in net profit to 125 billion yuan (HK$156 billion).

CNOOC's purchase of Nexen includes about 200 deep-water leases in the Gulf. The company surrendered operating control of them to quell US national security concerns.