Topic

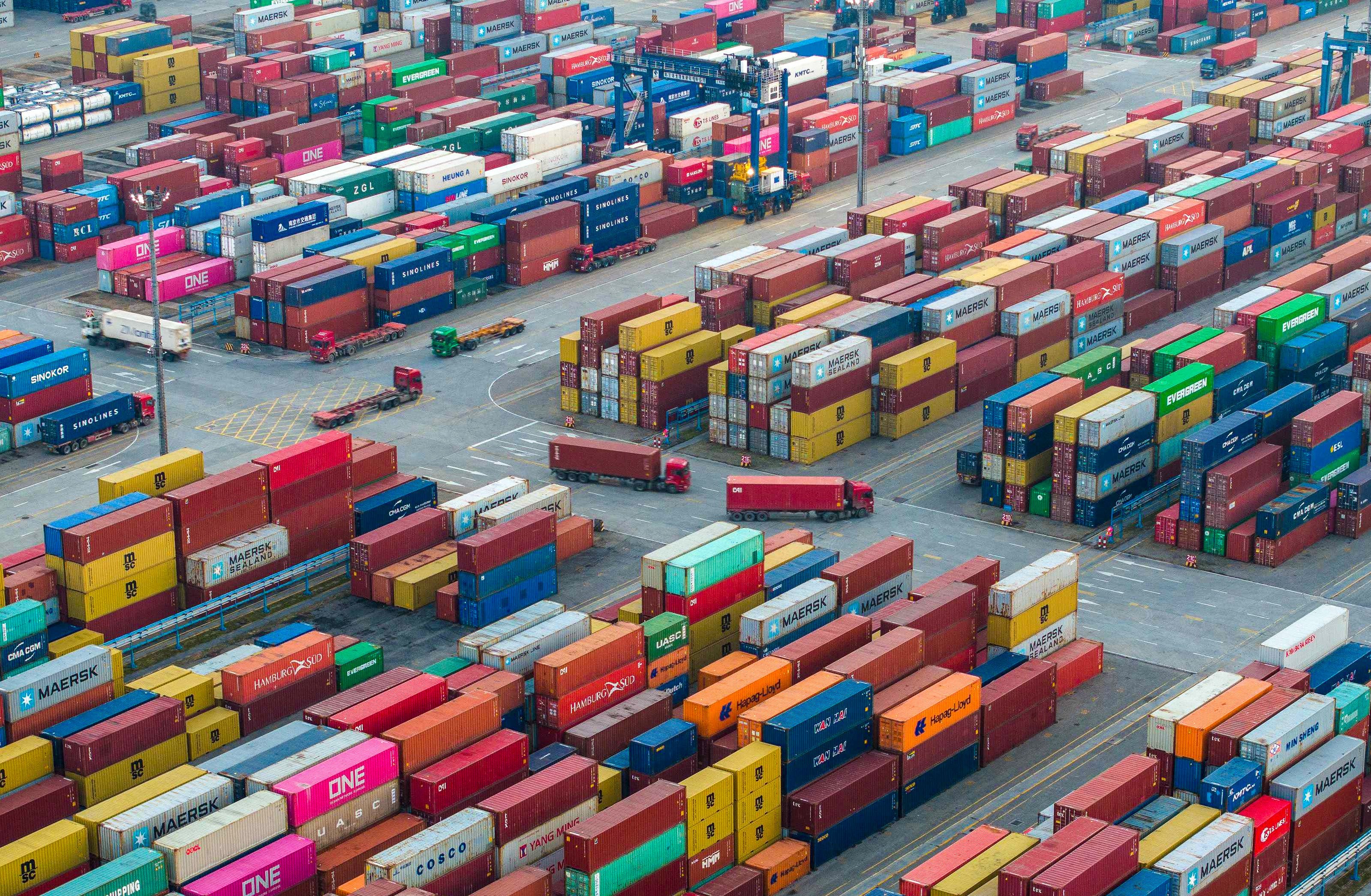

Commodity market action from around the world with a focus on the commodities that matter most to investors in Hong Kong and China.

- Unrelenting Chinese demand from retail shoppers, fund investors, futures traders and the central bank has pushed gold to all-time highs above US$2,400 an ounce this year

- The premium paid by Chinese importers jumped to US$89 an ounce at the start of April, compared with US$35 over the past year and the historical average of US$7

Energy market sanctions imposed on Moscow have already had a dramatic impact on China’s buying habits, helping Russia surpass Saudi Arabia to become the largest oil supplier to Beijing last year.

Yield-hungry Chinese investors are flocking to pockets of strength as property woes, volatile stocks and falling deposit rates reduce their options.

The move had been widely expected this month, and a formal announcement from Chinese commerce authorities shows how much ties with Canberra have improved in the past year.

‘Moment to celebrate’ hailed as boon for South American country’s producers who have faced weaker demand after sanctions on Russia over Ukraine war.

China’s imports of Australian coal increased by 3,188 per cent year on year to US$1.34 billion in the first two months of 2024 amid improving relations between Beijing and Canberra.

More than 99 per cent of Vietnam’s durian exports went to China last year, and the Southeast Asian country is expected to ship US$3.5 billion of the fruit in 2024.

Earnings at the world’s fourth-largest iron ore miner is forecast to fall by 14 per cent over the next year, the worst pullback compared with peers BHP, Rio Tinto and Vale, according to analyst estimates.

More than 80 canals have dried up in the Tran Van Thoi district of Ca Mau province, where agricultural production is entirely reliant on rainwater.

The barter deal allows sanctions-hit Iran to avoid having to use up scarce hard currency to pay for imports of popular tea. It also allowed Sri Lanka to pay with tea, as the country was short of foreign currency.

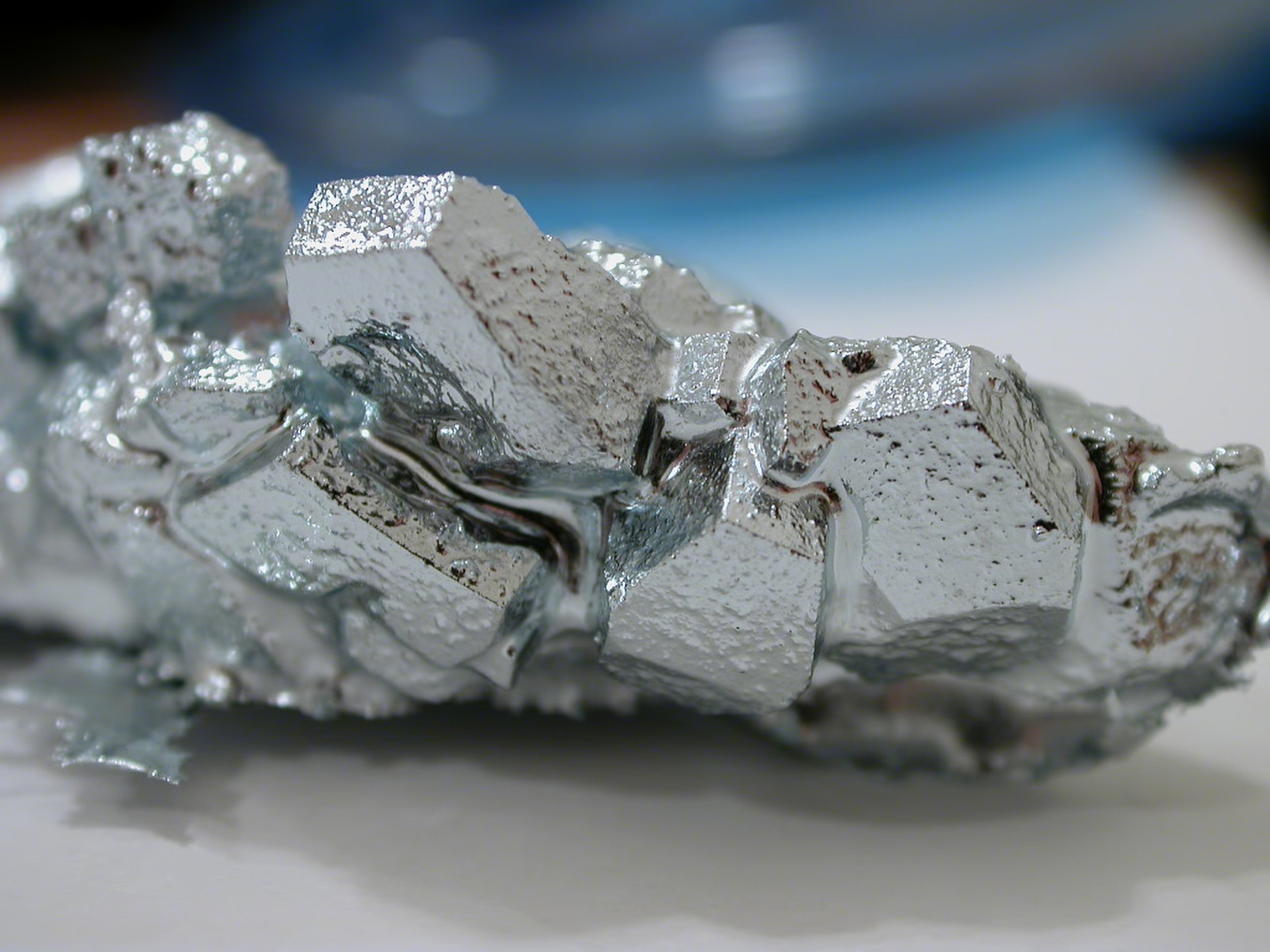

Canberra has placed nickel in its critical minerals list, which allows industry players access to billions of dollars.

The guochao or ‘China chic’ trend, which celebrates Chinese identity, coupled with gold’s increasing value, is creating a market opportunity.

Beijing’s decision to resume global shipments after months-long halt triggered a leap in sales of the mineral key to manufacturing semiconductors.

China’s other sectors like electric vehicles and demand from India are likely to offset some impact, but exporters will have to seek newer markets, analysts say.

Gold’s rising role as a safe-haven investment in China has made it the world’s top buyer while traditional assets such as real estate and stocks are seen as more risky.

Africa’s trade deficit expanded to US$64 billion as China recorded a drop in trade with top partners on continent – South Africa, Angola, Nigeria, the DRC and Egypt – which are predominantly resource-rich nations.

The precious metal rallied 13 per cent last year, touching a record in early December, on the back of economic and political uncertainty, geopolitical tensions.

The LME is studying Hong Kong as a location to expand its global metal warehouse network, five sources said, hopeful success in the city might open the door to mainland China, its ultimate target.

Drilling finds what looks to be the foundation for a new oil-and-gas resource base in a central region, and it should help the world’s biggest industrial producer reduce its reliance on oil imports.

The Department of Trade and Industry recently approved requests by manufacturers to reduce the size of products while keeping retail prices the same.

First proposed in 2018, the joint venture marks the latest in a series of tie-ups between Saudi firms and Chinese refiners.

From Indonesia to India, the world’s most populous democracies will be heading to the polls in Asia this year, a region which has traditionally been the largest gold consumer.

Huge discovery of the silvery-white alkali metal known as ‘white gold’ is expected to make its way to China’s battery makers, heating up a global resource race as Thailand also boasts a big lithium find.

China’s massive expansion in petrochemicals production capacity face fresh challenges as shipping crises in the Panama Canal and the Red Sea raise freight costs and curb access to US propane supplies.

Indonesia’s Manpower ministry said in a statement there was a strong indication of standard procedure violation and negligence in the implementation of safety requirements that allegedly led to the fire incident.

Rio Tinto forecasts China – home to the world’s largest steel industry – will hit a peak in consumption, and expects global iron ore demand will rise almost a quarter by 2050.