Topic

The Global Financial Crisis of 2007-2008 was widely blamed on the subprime crisis and its fallout, which led to the collapse of Lehman Brothers in 2008, with the US government forced to bail out AIG, and to rescue both General Motors and Chrysler, while also adding liquidity to avert a severe credit crunch in the banking sector. Banks in Europe, the US and Britain also came under extreme pressure and the GFC contributed to the euro zone sovereign debt crisis.

- Interest-rate increases by monetary authorities across the world provided the biggest tailwind for the global banking industry in more than a decade

- Banks in Europe and the US as well as China and Russia have struggled to generate their cost of capital unlike lenders in Singapore, India and Dubai

From intentionally setting up ‘bad banks’ in the ’90s to more recent bank takeovers, Beijing has a history of reaching into its deep bag of policy tools to make economic repairs.

The government’s stamp duty reduction and move to lower margin requirements for investors to buy securities form part of new stimulus measures to invigorate the country’s capital market.

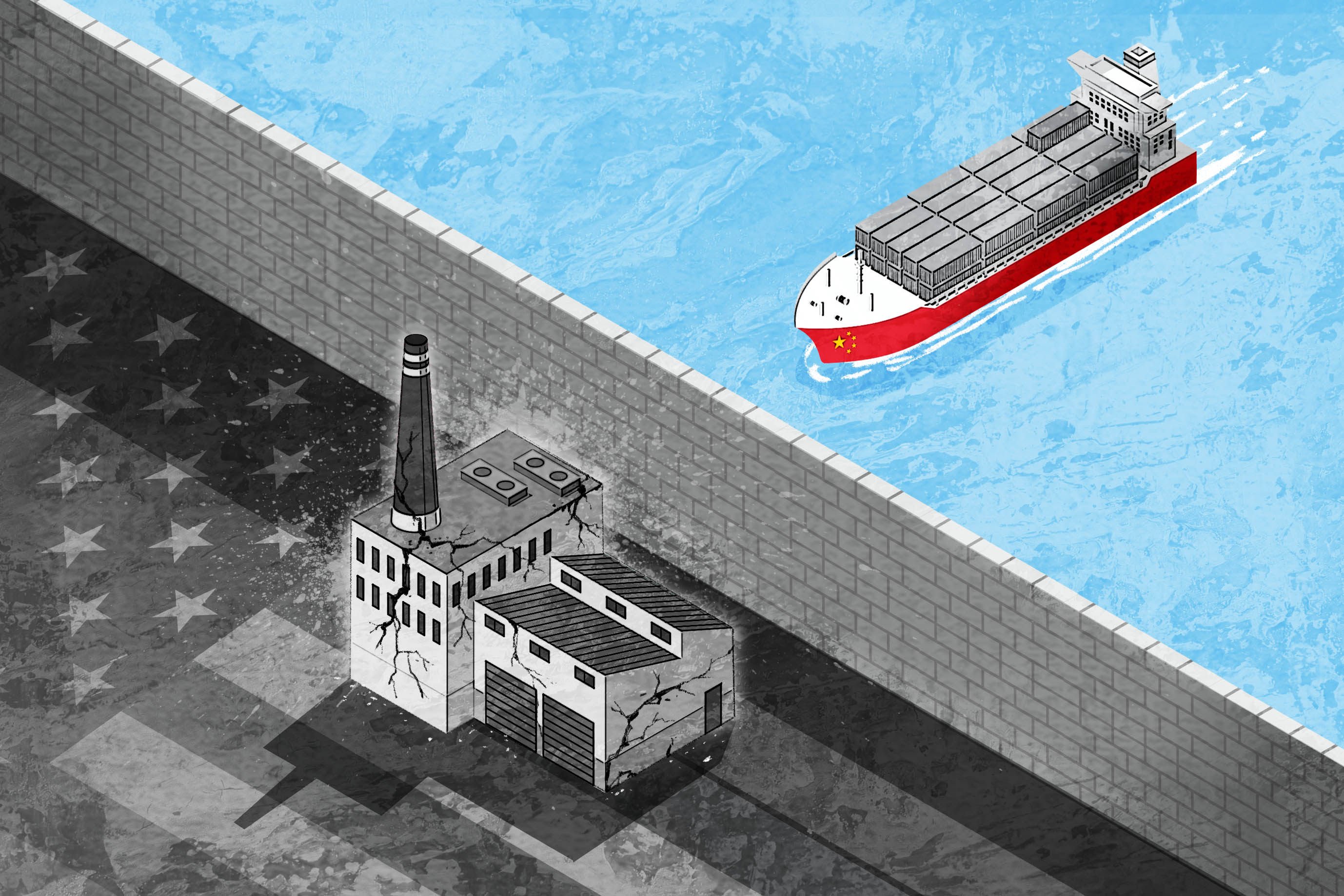

Businesses whose stateside production depends on components from China decry costs they bear due to Trump-era policy continued by Biden administration.

China is trying to boost domestic demand, improve confidence and prevent risks for the remainder of the year, while looking to avoid past stimulus fallout as it intensifies efforts to shore up growth.

About one-fifth of Japan’s population are millennials. They’ve spent their entire lives in an economic slump and are mostly just happy to stay afloat – with no plans to have children, own a home, or get rich.