Topic

Goldman Sachs is a New York-based investment banking firm that engages in global investment banking, securities, investment management, and other financial services, primarily with institutional clients. Founded in 1869, the firm is recognised as one of the most prestigious institutions in the world, although its reputation has suffered after the financial sector drew fire since the global financial crisis.

Hong Kong’s securities watchdog has bared its teeth in many cases of malpractice and should spare no effort to safeguard city’s reputation as a global financial hub.

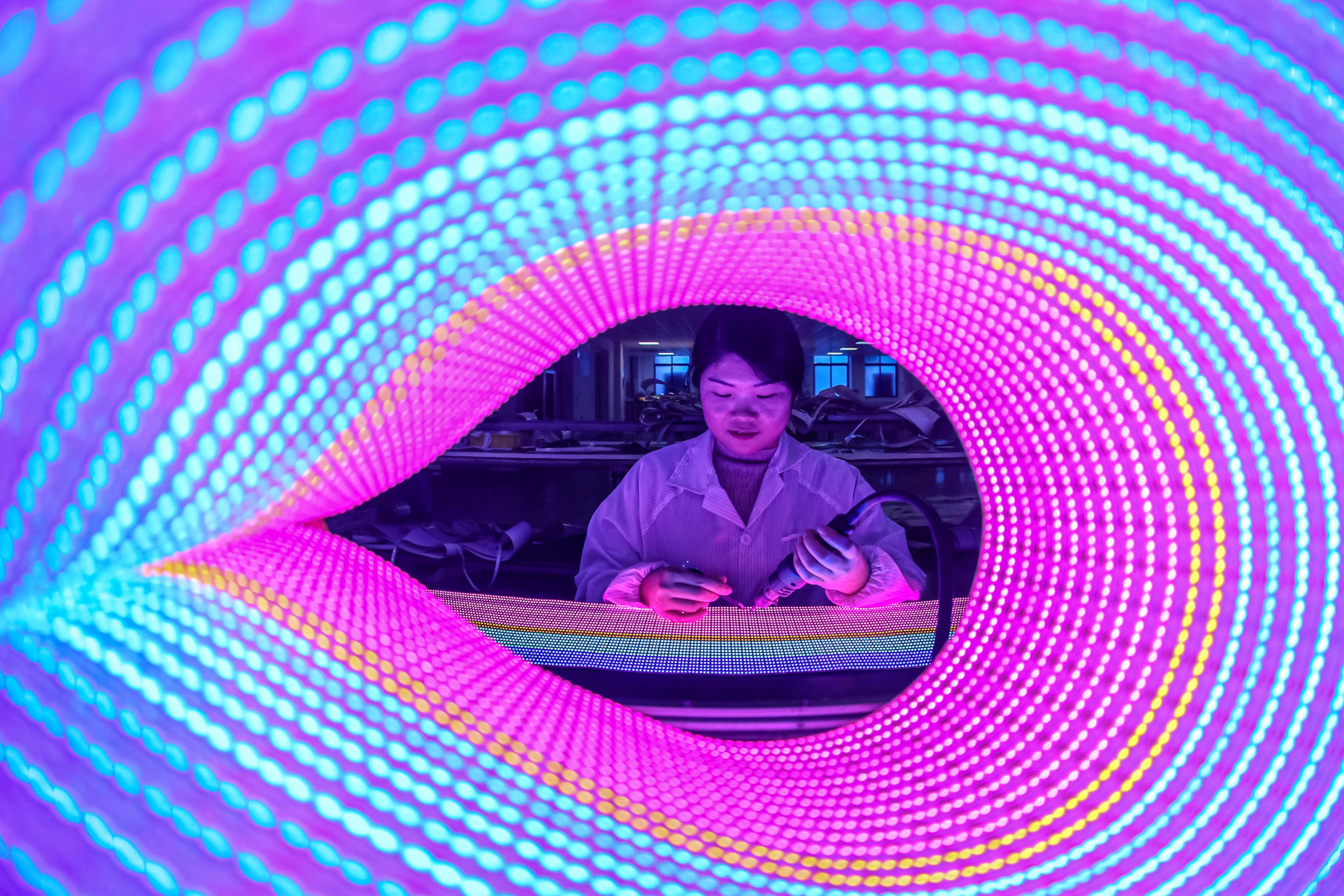

- AI stocks are already leading a US$1.9 trillion rebound in emerging markets this year, with TSMC and SK Hynix accounting for 90 per cent of gains

- Analysts see a 61 per cent increase in earnings for emerging-market AI tech firms as a whole, compared to a 20 per cent rise for US peers

US banking giant Bank of America plans to relinquish a big chunk of prime office space in Hong Kong as part of cost-saving measures, delivering a blow to the office segment.

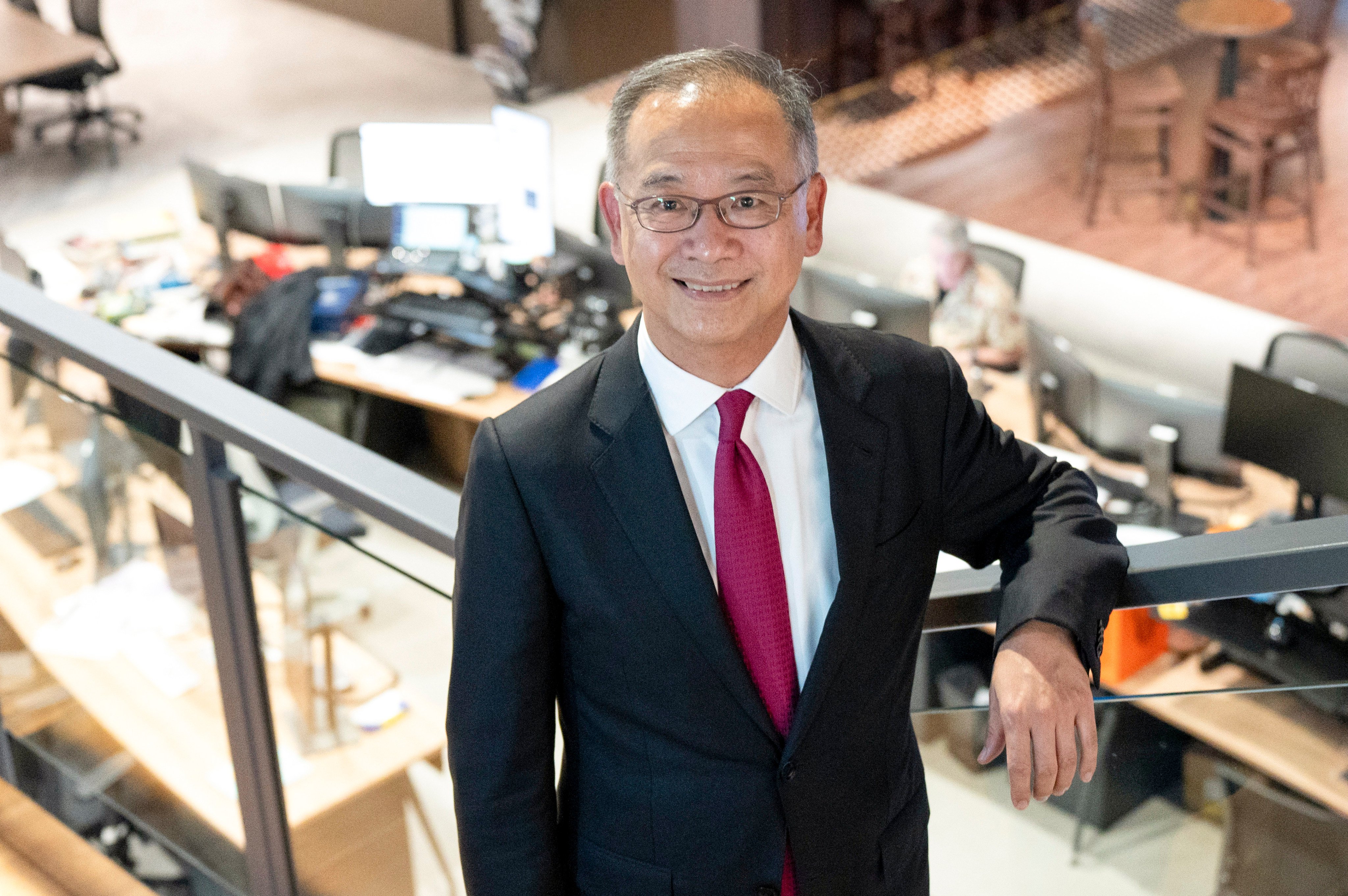

The CSRC under Wu Qing will aim to develop 10 first-class brokerages including two or three that can compete with top global names like Goldman Sachs and Morgan Stanley by 2035.

Investors should seek refuge in Chinese domestic consumption stocks and avoid hardware and semiconductor makers to ride out the US-China geopolitical uncertainty, according to Goldman Sachs.

San Francisco-based Matthews International, which had fewer than 10 people in the Shanghai office, will centralise its regional research business in Hong Kong.

Bearish call reflects jitters among overseas investors even as both onshore and offshore shares show nascent signs of stabilisation amid state support and the return of foreign inflows.

The US investment bank and the Abu Dhabi sovereign wealth fund will extend long-term capital to ‘high-quality companies and sponsors’ across Asia-Pacific to capitalise on private-credit opportunities.

Artificial intelligence will become an important part of Reddit’s business, the San Francisco-based social media company says.

The US investment bank says the residential sector will see a gradual recovery this year after the US Federal Reserve begins to cut rates and Hong Kong mortgage rates are lowered from the second quarter onwards.

Malaysian authorities are counting on the convicted former Goldman Sachs banker, Roger Ng’s cooperation, to recover as much as possible from the billions looted from the fund.

China’s property downturn and recent slew of defaults are unlikely to rattle overseas creditors or deter domestic banks from channelling resources towards cash-strapped developers, according to the American investment bank.

Several economic researchers and observers have emphasised the need for measures to boost demand, particularly direct cash payments to households, but have lamented such action is unlikely to be taken at present.

‘People are interested in India for several reasons, one is simply it’s not China,’ says Vikas Pershad, a money manager at M&G Investments in Singapore. ‘There’s a genuine long-term growth story here.’

The Fed will lower rates starting in March for a total of four times this year and inflation will hit the US central bank’s 2 per cent target, according to Joshua Schiffrin, Goldman’s global head of trading strategy.

Goldman’s decision to upsize its loan facility is a testament to FundPark’s capability and track record, CEO Anson Suen says. The start-up has disbursed US$2 billion to 16,500 SMEs since its founding in 2016.

Taken together, China’s purchasing managers’ index (PMI) data for December showed that there was ‘some improvement in economic momentum’ thanks to services and construction, analysts said.

Three out of China’s four tier-1 cities saw new-home prices fall in November, with only Shanghai showing an increase, according to National Bureau of Statistics data, as the market waits for stimulus measures to take hold.

As part of the 2020 settlement with Malaysia, Goldman made an initial US$2.5 billion payment, but lawyers involved in that deal are now under scrutiny.

The scandal-plagued lawmaker lied his way into Congress and is accused of stealing donor cash to pay for Botox and OnlyFans.

Valued at more than US$60 billion, Shein is expected to become the most valuable China-founded company to go public in the US since Didi Global’s debut in 2021 at a US$68-billion valuation.

The index compiler will add 10 stocks and remove 45 as it reflects China’s drive towards technology self-reliance.

Nomura Holdings’ Shanghai-based securities joint venture has struggled to grow since its launch in 2019, dealing another blow to the top Japanese investment bank’s global expansion strategy.

Leaders from the world of finance and business convened in Riyadh issued a warning on Tuesday about the many perils the world currently faces, including geopolitical conflicts, economic uncertainties, high inflation and climate issues.

Two former Goldman Sachs traders in Hong Kong are raising money to lend to financially strapped borrowers, including the growing number of down-on-their-luck Chinese property tycoons.

The government has become more active in buying Chinese stocks since August as it attempts to breathe life back into the flagging market, according to Goldman. The US investment bank says this will help engineer a rebound in equities for the rest of the year.

Executives at the Wall Street firm took the unusual step after growing increasingly frustrated with the country’s demands to renegotiate an existing settlement.

It is unclear how long the former Goldman Sachs banker will be in the country of his birth. Ng has been sentenced to serve a 10-year term in the US for his role in the 1MDB scandal.

Ng was sentenced to 10 years in prison in the US for helping loot billions of dollars from Malaysia’s sovereign wealth fund.

About 90 top-level executives such as CEOs and chairmen are expected at this year’s event, more than double last year’s attendance.