Topic

Established in 1933 as a money-changing shop in Hong Kong, Hang Seng Bank is the second largest bank in Hong Kong. The bank is majority owned by the HSBC Group through The Hongkong and Shanghai Banking Corporation and is a Hang Seng Index constituent stock.

The dozen MPF account providers are due to complete the shift to the new electronic platform, which allows for day-to-day adjustments of holdings, by the end of 2025

With the Fed expected to start cutting rates before the end of the year, margins for lenders will narrow, potentially exposing threats in other areas. Hong Kong’s banks have made provisions and shored up balance sheets to ward off China property risk

- Winding-up petition against debt-laden developer Times China Holdings relates to US$266 million debt

- Times China is seeking to restructure US$11.7 billion worth of offshore debt in its latest efforts to avoid liquidation

‘We’ve always been at the cutting edge of the whole blockchain evolution, including CBDCs,’ Yue, CEO of the Hong Kong Monetary Authority, the city’s de facto central bank, tells the Post.

HSBC, Standard Chartered and Hang Seng Bank are rolling out more products tied to the Wealth Management Connect scheme amid a drive by Beijing to boost the Greater Bay Area’s financial markets.

Qianhai’s tax incentives are among measures that have attracted major Hong Kong banks to invest in grade-A office buildings, and to develop a wide range of banking, securities and insurance businesses in the area.

Many financial firms including UBS, Julius Baer, and KGI Asia have opted to use the dragon’s image on their lai see envelopes as opposed to a generic design, illustrating the mythical creature’s popularity with the public.

Hong Kong banks have launched marketing campaigns to kick off the Year of the Dragon. The giveaways include fireworks dinners, lucky draws and air tickets to lock in new clients and entertain wealthy customers.

The banks’ decisions followed the Hong Kong Monetary Authority (HKMA), which left the city’s base rate at 5.75 per cent hours after the Fed kept its target range unchanged in its first policy move of the year.

The China branches of Hang Seng Bank and Fubon Bank are also in the first batch of overseas banks to join more than 40 state-owned banks in launching their services on the e-CNY app.

Tickets to Disneyland, afternoon tea at The Peninsula and fine dining with wine pairings – these are just some of the incentives with which major banks such as HSBC and Standard Chartered plan to woo high-flying mainland Chinese customers during the ‘golden week’ holiday.

HSBC’s pre-tax profit was US$8.77 billion, ahead of US$7.96 billion expected by analysts, as it benefited from a strong interest rate environment.

Higher interest rates are expected to help drive profit gains at big Hong Kong lenders, including HSBC and Standard Chartered, in second quarter as US Federal Reserve prepares to hikes rates further.

Consumers might need to brace for bad news next week, with analysts predicting banks will raise their prime rates after the Federal Reserve’s projected rate hike. That could hurt the city’s nascent economic rebound.

Hang Seng Qianhai Fund Management, a joint-venture of Hang Seng Bank and local authorities in Shenzhen Qianhai, is launching more diverse products to capture cross-border opportunities in China.

Four core League of Social Democrats members have personal accounts at several banks closed, as well as three business accounts at HSBC.

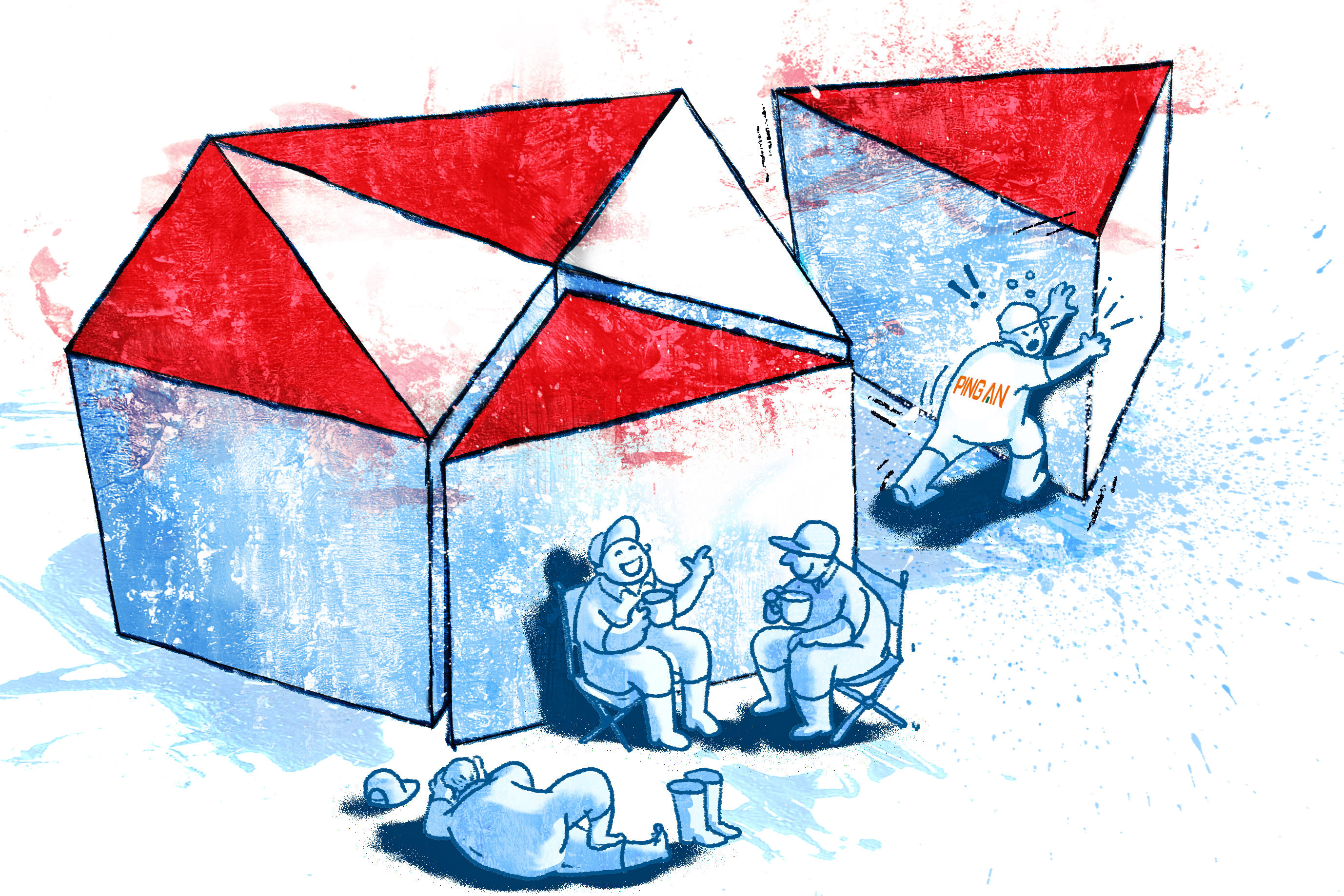

A group of minority shareholders had called for the bank to consider radical change, including spinning off its Asia business. HSBC’s biggest shareholder Ping An Insurance Group has also been pushing the lender to make changes to enhance shareholder value.

Ping An Insurance Group, China’s biggest insurer, said its recommendation to list HSBC’s Asian operations in Hong Kong would not result in value destruction or higher costs for the bank.

Structural reforms proposed by Ping An Insurance Group, including a spin-off of HSBC’s Asian business, would “significantly dilute” HSBC’s international business model, the London-based lender said.

Ping An In, HSBC’s biggest shareholder, said the bank should remain a majority shareholder of a separately listed Asia business as part of a restructuring, similar to its majority stake in Hang Seng Bank.

FInancial Secretary Paul Chan says economic recovery ‘fragile’ and needs to be shored up by new round of consumption vouchers.

Hong Kong’s biggest banks plan to present lai see, gift hampers and tickets to Disneyland as gifts for their staff as they return to the office on the first working day in the Year of the Rabbit.

Hong Kong’s note-issuing banks report stronger demand for new banknotes as people expect to hand out more lai-see envelopes during the first Lunar New Year since 2020 without social-distancing measures.

‘Unless the government rolls out more supportive measures, I’m worried we will see more people going bankrupt in the coming months,’ economist says.

Hong Kong’s Financial Secretary Paul Chan Mo-po has warned the city to expect “negative growth” in the local economy this year.

The banking giants could face weaker results as market uncertainty hit global deal making and China’s economic slowdown could prompt additional provisions for their onshore commercial property portfolios, according to analysts.

Ping An’s push to break up HSBC has failed to spur gains in bank’s Hong Kong share price, which is lagging the benchmark Hang Seng Index.

The calm that greeted the halt of branches prompted banks to double down on their digitalisation, raising the question whether outlets that typically cost HK$1 million a month each to run still makes commercial sense.

HSBC, Standard Chartered, Bank of China (Hong Kong), the city’s three currency-issuing banks, will reopen all branches on April 19 along with Hang Seng, Citi and Shanghai Commercial Bank.

The new mandate comes more than a year after State Street flip-flopped over its compliance with Donald Trump’s November 2020 ban on American ownership in Chinese state-owned companies.