Topic

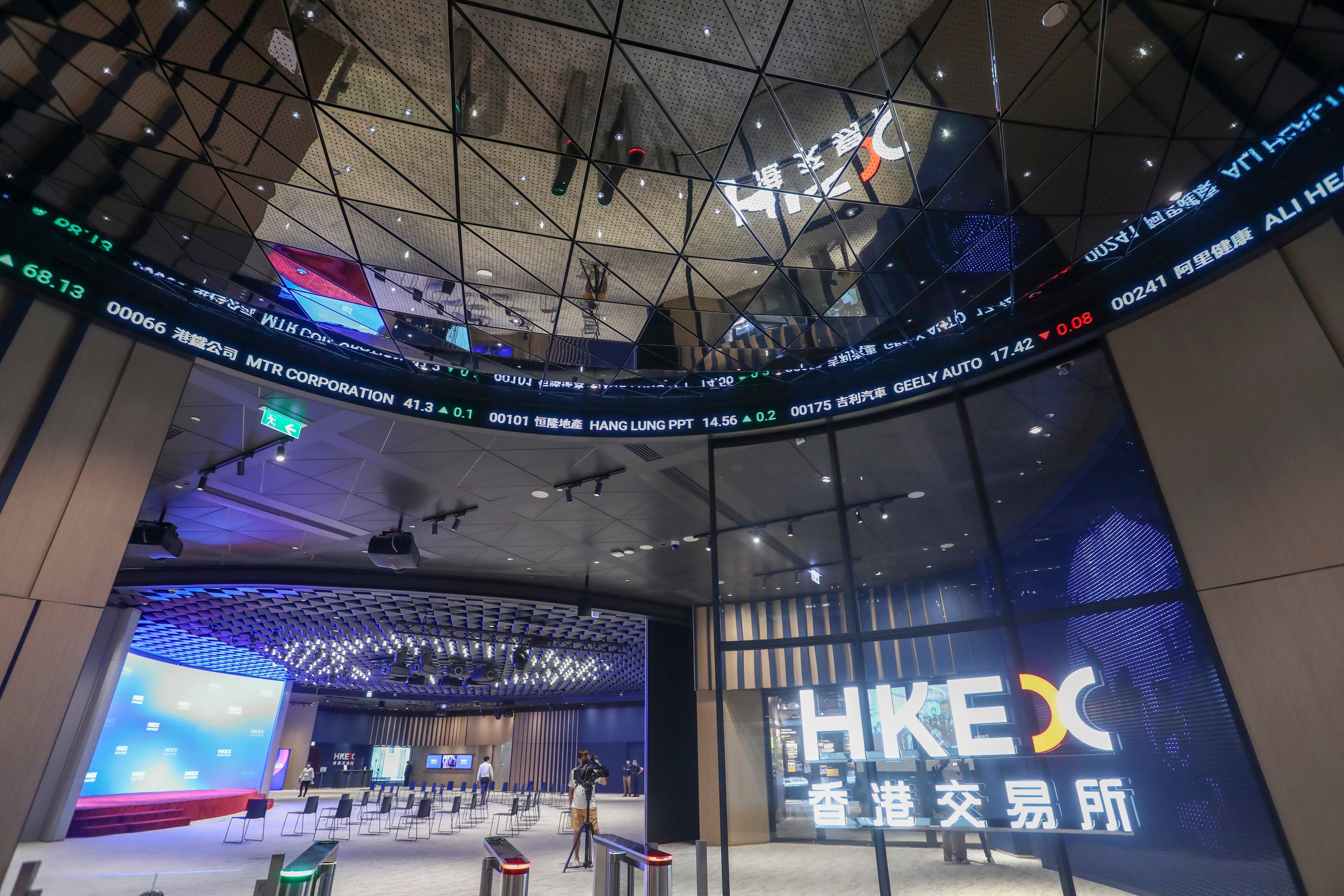

Hong Kong Exchanges and Clearing is the holding company for the city’s stock exchange, futures exchange and clearing company. Its market capitalisation made it the world’s biggest listed bourse as of the end of 2012. In December 2012, the HKEX clinched the US$2.2 billion takeover of the London Metal Exchange, the world's biggest marketplace for industrial metals.

Bonnie Chan will need a little more luck than the Hong Kong bourse’s current CEO when she takes over in May next year

Welcome Hong Kong move made as battle among exchanges globally to attract and retain listings becomes cutthroat.

Hong Kong’s best years as a financial hub are still ahead as stock exchange launches derivatives based on mainland Chinese equities to attract deep-pocketed institutional investors from across the world

Openings in the US and Europe by city’s stock exchange aim to attract more initial public offerings and Chinese companies that face delisting on Wall Street.

- Tong will work with CEO Bonnie Chan as the exchange grapples with low market turnover and a decline in new listings

- Tong is considered by a former colleague as an ‘open-minded, highly diligent chairman who is able to bring the board to focus on the big picture’

Net profit for the January-to-March period came in at HK$2.97 billion (US$380 million), or HK$2.35 per share, beating a consensus estimate of a 14 per cent decline and improving on the fourth quarter of 2023 by 14 per cent.

Hong Kong offers plenty of wealth management and stock market opportunities despite headwinds and uncertain economic outlook in China, according to speakers at the Apec Business Advisory Council summit.

The ISSB, a sustainability-reporting standard-setting body, will vote this week to add biodiversity-related disclosures to its work plan, paving the way for such standards to become the global baseline.

China’s capital market regulators have announced a package of measures to boost liquidity, attract international investors and enhance competitiveness between the mainland and Hong Kong.

Laura Cha worked hard to elevate Hong Kong’s prominence on the international stage since she became the first and only female chairman of HKEX in 2018. As her tenure draws to a close, she believes that aim is no less important today.

Companies in Saudi Arabis and Indonesia have shown a genuine interest in Hong Kong’s IPO market, Bonnie Chan Yiting, CEO of Hong Kong Exchanges and Clearing, says at a Legislative Council meeting on Monday.

Lack of interest has more to do with lacklustre IPO activity than the reform per se, which will draw more interest when listings pick up, analysts say.

Results came despite government calls to slash rates and inject liquidity into the country’s slumping property sector.

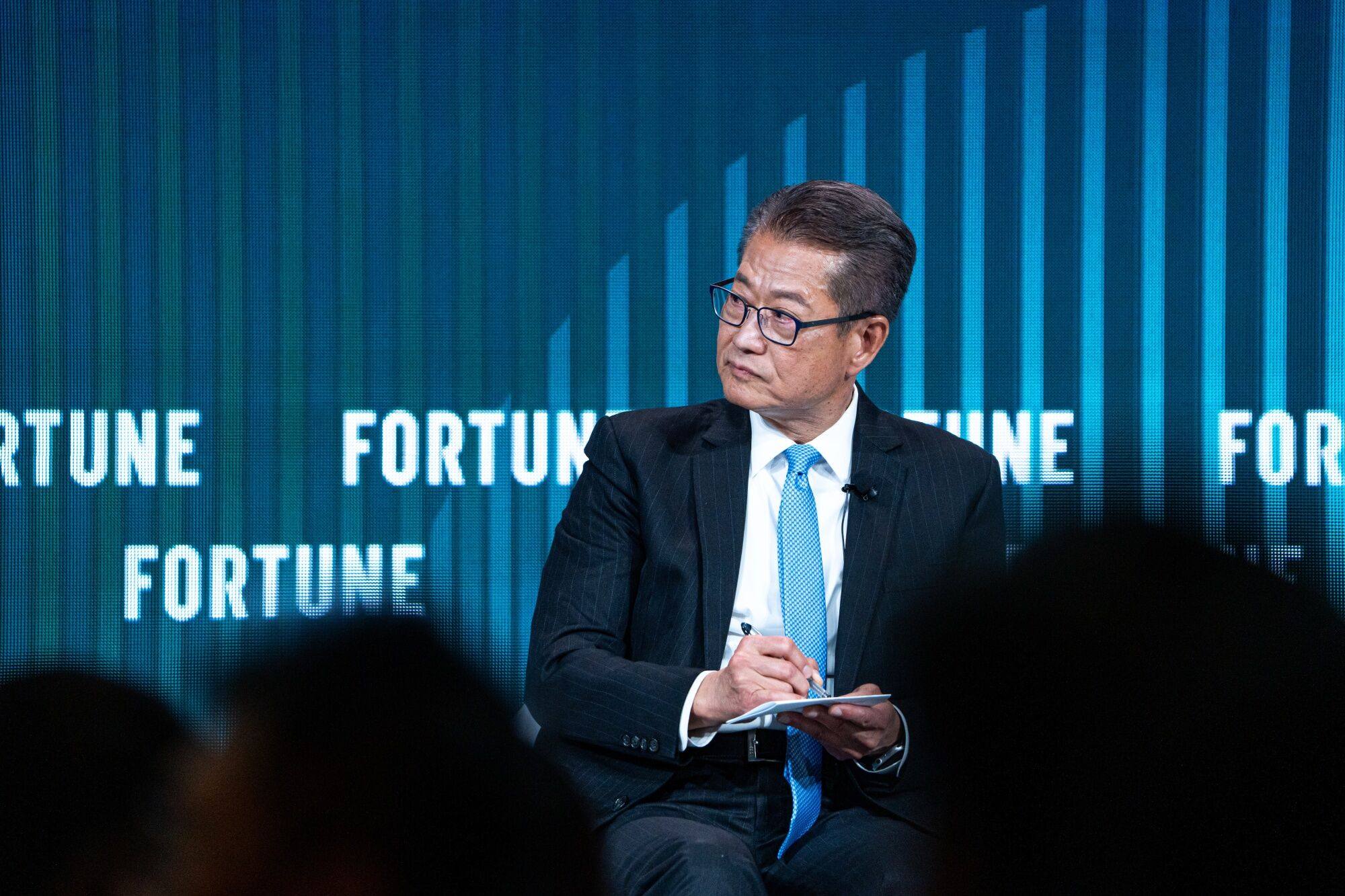

Paul Chan, Hong Kong’s financial secretary, and Bonnie Chan, the CEO of bourse operator Hong Kong Exchanges and Clearing, were speaking at Fortune Innovation Forum 2024.

Embattled property developer Country Garden said it is injecting funds into an unfinished skyscraper project by introducing a new partner, an announcement which sent its shares soaring.

HKEX received 30 per cent more IPO applications so far in 2024, with start-ups eyeing capital raising as interest rates turn a corner, says newly-appointed CEO Bonnie Chan.

Here is what colleagues and peers say about Hong Kong-born Chan, the first woman and first internal candidate to serve as CEO. How ready is she for the job at a challenging time for the city’s bourse?

Hong Kong Exchanges and Clearing delivers an 18 per cent jump in 2023 earnings as CEO Nicolas Aguzin ends his tenure after a tumultuous three years. Aguzin will pass the baton to Bonnie Chan on Friday.

Sino Land and Hysan Development, two major Hong Kong property developers, expect ‘uncertainties’ to continue to affect the city’s real estate market, they said in their latest financial reports on Thursday.

Embattled mainland Chinese property developer Sunshine 100 is evaluating the impact of a winding-up order against its controlling shareholder, Joywise Holdings, according to a filing with the Hong Kong exchange.

‘Hong Kong stocks posted positive returns in the past four Years of the Dragon,’ finance chief Paul Chan said on the first trading day of Lunar New Year, citing China’s improving economy and potential rate cuts as possible catalysts.

Nicolas Aguzin will step down as CEO of HKEX at the end of this month, passing on the top role to Bonnie Chan Yiting two months before his contract expires, according to a stock exchange announcement on Friday.

The government is actively engaging with mainland Chinese regulators to speed up the approval process for companies listing in the city. Measures will also be rolled out to attract family offices and wealthy individuals.

The LME is studying Hong Kong as a location to expand its global metal warehouse network, five sources said, hopeful success in the city might open the door to mainland China, its ultimate target.

Hong Kong’s role as a ‘superconnector’ between the capital markets of mainland China and the rest of the world will continue because of hugely untapped investment opportunities, HKEX CEO says.

Readers discuss what products are suitable for individual investors, and the prospect of interest rate cuts.

New rules effective January 1 remove a quarterly reporting requirement and streamline transfers to the bourse’s main board, but analysts say the bar is still too high for many small companies

Hong Kong’s listing reforms include easier rules to help connect specialist tech companies with global capital. Fundraising in the city is expected to cross US$12.8 billion this year.

HKEX’s two major listing reforms over the past two years to encourage fundraising by SPACs and specialist technology firms, has yielded little success as IPO volumes plunge to a two-decade low.

For deal flows to be revived, buyers need to be more confident about China’s growth, and they need to see some strong and high-profile deals go through first, industry insiders say.

Hong Kong’s IPO ranking sank to the 8th this year. But analysts are confident the stock exchange can shrug off a dismal year, pointing to potentially lower rates next year and China’s policy boost for the economy.

Hong Kong attracts a wave of financial services providers eyeing opportunities in the wealth management and family offices space even as dozens of home-grown brokerages pull down shutters.