Topic

The Hong Kong Monetary Authority oversees Hong Kong’s monetary system. It was founded in 1993 when the Office of the Exchange Fund merged with the Office of the Commissioner of Banking. Its responsibilities include maintaining currency stability, monitoring Hong Kong’s banking system and managing the Exchange Fund.

- The city is considered an attractive location to build an AI or big data business because of its role as a financial hub, according to survey

- The survey’s publication comes as Hong Kong has been ramping up efforts to support the tech sector in recent years

Green bonds, fixed-income financial products designed to fund environmentally friendly projects, are an important part of Hong Kong’s plan to achieve carbon neutrality by 2050.

The city’s de facto central bank stepped into the currency market again on Saturday morning, its fourth intervention in three days to lift the local dollar from its weakest level in more than three years.

The government’s inaugural green bond aimed at retail investors has been oversubscribed by 1.2 times, underlining the city’s potential as a major fundraising hub for environmentally friendly projects.

The US economy had not seen a 50-basis point rate increase since Alan Greenspan was Fed chairman, and “irrational exuberance” was the catchphrase that defined the easy money and mood of the Dotcom era.

The Exchange Fund will have to sail through rough seas ahead, as the US Federal Reserve has flagged 10 increase in its benchmark rate through the end of 2023 to tamp down rising inflation in the US economy.

Hong Kong’s financial market held up well amid the fifth wave of Covid outbreak, as deposits and loans increased during the first quarter, according to data from the Hong Kong Monetary Authority.

The Hong Kong Monetary Authority is seeking feedback on the potential benefits and pitfalls of a digital form of the local dollar for general use.

Hong Kong Monetary Authority CEO in a rare profit warning said that the Exchange Fund could face a challenging situation with equities, bonds and foreign exchange valuation falling at the same time.

Joseph Yam, former head of the Hong Kong Monetary Authority, came out swinging against the US in a fiery webinar that set a strident tone against the economy with which the city’s currency and monetary policy are linked.

The plan would end State Street’s mandate in one of the city’s most popular investment funds after it flip-flopped over its compliance with Donald Trump’s ban on US ownership of Chinese state-owned companies.

The Hong Kong Monetary Authority on Thursday morning raised the city’s official base lending rate by 25 basis point to 0.75 per cent, the first rate rise since December 2018 which is expected to add upwards pressure to mortgage payments linked to interbank rates.

The stepped-up rule followed a record number of new infections in the city, which has sickened about 40,000 people, including dozens of bank employees, forcing lenders to shut one in every three branches in the city.

Under the pilot, the HKMA and the People’s Bank of China will select certain mainland visitors and other individuals to use e-CNY at select shops and restaurants in Hong Kong, while Hongkongers living in mainland Chinese Greater Bay Area cities will also be able to use the digital currency.

Hong Kong’s Exchange Fund, the war chest used to defend the local currency, gained HK$170.5 billion (US$21.9 billion) in 2021 as it was hit by a slump in the local stock market.

Over the next six months, banks have to make sure they can serve customers who cannot or do not want to use online services, according to the new code of conduct.

ESG-related debt, also called sustainable bonds, are fixed-income financial products that raise capital for the purpose of financing projects that have environmental or social benefits.

Hong Kong wants to position itself as Asia’s hub for sustainable finance as it seeks to reach carbon neutrality by 2050.

The Lunar New Year holiday in February interrupted stock market listings, which caused deposits in Hong Kong’s banking system to fall sharply during the month, official data showed.

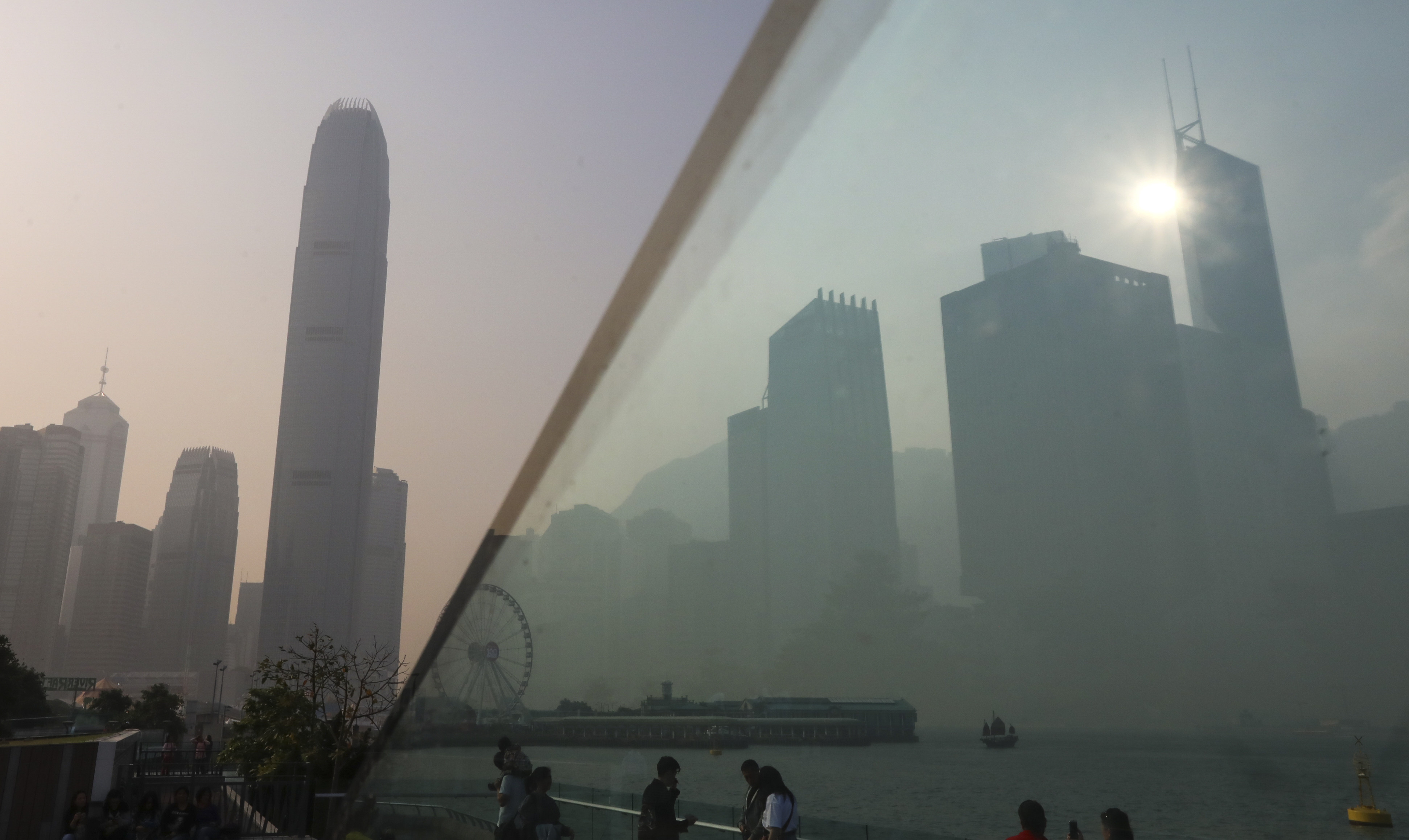

The Hong Kong currency’s weakness in recent weeks is a blip as sentiment on markets soured, the HKMA says. In due time, several large stock offerings could spur capital inflows and reverse the mini-slump. There’s still the US$579 billion war chest to defend the dollar peg.