Topic

HNA Group is primarily an aviation services company that also has business that spans investment management, tourism development and other industries.

- Bohai Leasing, a Shenzhen-listed arm of failed Chinese conglomerate HNA Group, is kicking off the sale of its container leasing business Seaco, sources say

- Seaco, one of the world’s largest lessors of shipping containers, offers dry freight, refrigerated, specialised and tank containers

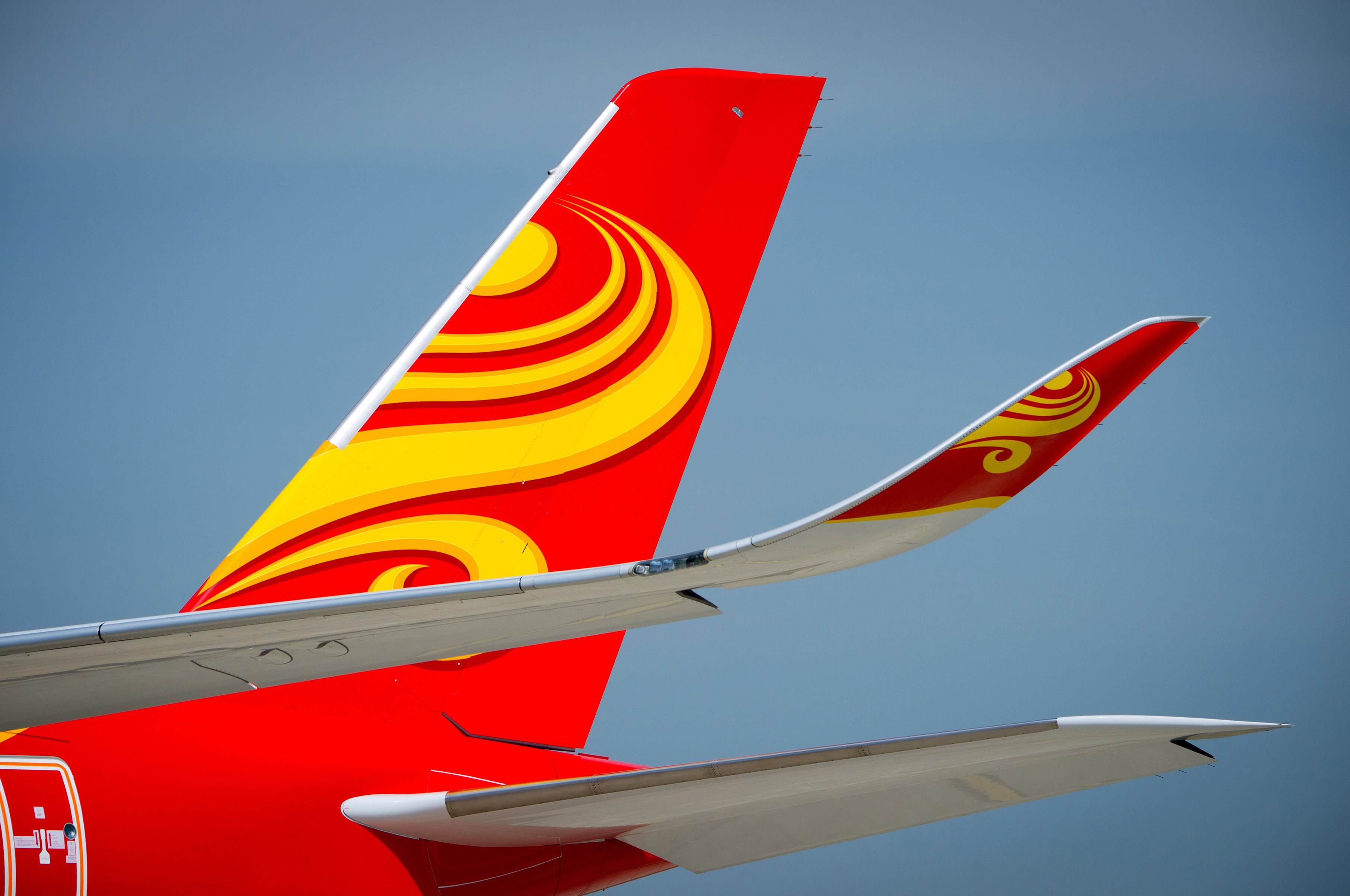

Hong Kong Airlines says popular destinations Japan and Thailand already back to pre-coronavirus levels as it launches ticket giveaway.

The procurement is a boost for Comac in helping China to fulfil President Xi Jinping’s aspiration to challenge the dominance of Boeing and Airbus in the home or even the global market.

Hong Kong Airlines’ debt restructuring plan has been approved by creditors, the Post has learned, removing a key hurdle for the carrier to tackle US$6.2 billion of liabilities.

Hong Kong Airlines is set to face a second hearing next month on its US$6.2 billion debt restructuring in a British court, as bondholders plan to vote against the proposal.

House 6 at Twelve Peaks was sold to Guo Deying, who shares the same name as the founder of Coolpad Group, for HK$387 million.

The tide has turned on Chinese asset buyers and their grab for land in Hong Kong, after a regulatory crackdown on leveraged acquisitions by Chinese regulators in 2017.

The stock issue is the latest step in China’s efforts to unravel HNA’s US$309 billion of debt after the group’s rapid borrowing-fueled expansion.

French luxury group is considering opening its first Louis Vuitton duty-free store in China in Hainan in a move that would mark a strategy shift, according to two sources.

HNA Group, founded by Chen Feng around Hainan Airlines, grew into one of China’s largest private conglomerates and biggest offshore asset buyers over two decades.

The detentions bring the curtains down on HNA, built on the foundations of China’s most successful private carrier Hainan Airlines.

HNA will be split into four independently run businesses: aviation, airport, financial and commercial, says executive chairman Gu Gang, who is leading the group’s revamp.

Liaoning Fangda will be the strategic investor for the group’s flagship HNA Airlines while Hainan Development Holdings will invest in HNA Infrastructure.

The flat was previously owned by Billion Able, which had HNA chairman Chen Feng as its director. The firm bought it in 2015 for US$55.6 million.

Embattled Chinese conglomerate HNA Group will delay the submission of a proposal for its restructuring, as China’s state-owned carriers have steered clear of bailing out the country’s biggest private-sector carrier, according to sources familiar with the matter.

HNA, whose flagship business is Hainan Airlines, used a US$50 billion debt-fuelled acquisition spree to build an empire that included stakes in businesses from Deutsche Bank to Hilton Worldwide

Yuyuan’s shares rose by the daily limit of 10 per cent to 13.08 yuan on Thursday amid speculation that its aviation investment company would target Hainan Airlines.

Hit by the outbreak of Covid-19 and provisions for asset losses linked to a restructuring at its parent firm, the Haikou-based carrier reported a loss of 64 billion yuan (US$9.9 billion) for 2020

Hainan Airlines Holding sheds as much as 9.8 per cent in Shanghai, with other HNA Group entities also falling after parent’s bankruptcy restructuring.

Shareholders and other related parties had embezzled 61.5 billion yuan, Hainan Airlines Holding, HNA Infrastructure Investment and CCOOP Group said.

The rallying cry by the leader of HNA Group, appointed in February 2020 by regulators and the Hainan provincial government to lead the company’s debt workout, comes a day after one of China’s largest private conglomerates received a court petition to undergo bankruptcy restructuring.

HNA Group’s acquisition spree came to an end in 2017 when China’s financial regulators, fearful of risks to the banking industry, cracked down on the debt-fed binge.

The omission is a dramatic exit by an entrepreneur whose global shopping spree of everything banks to hotels totalled at least 1 trillion yuan (US$154.8 billion) of assets as recently as in 2017, fuelling his ambition to make it among the Fortune 100 list of the world’s largest companies by assets.

City’s third largest carrier tells staff that extended grounding of planes during pandemic forced a rethink of staffing levels.

At US$7 billion, the sale would be the biggest asset disposal by a Chinese company to a buyer outside the country in the year to date, according to data compiled by Bloomberg.

Cash-strapped carrier has its own set of problems, but hopes flight-to-nowhere model, pay cuts and government subsidies bring respite.

Flight attendants who sign up will have pay cut from November until February and will be on duty for two months and off for two.

Chen Feng, founder and chairman of HNA Group, cannot travel on planes or high-speed trains without prior approval from court.

Senior creditors have wrested control of the airport cargo handling group from struggling HNA, helping secure the future of this key piece of aviation infrastructure.

The debt-for-equity swap would see Chinese conglomerate HNA Group lose its grip on beleaguered airport cargo handling company Swissport International.