Topic

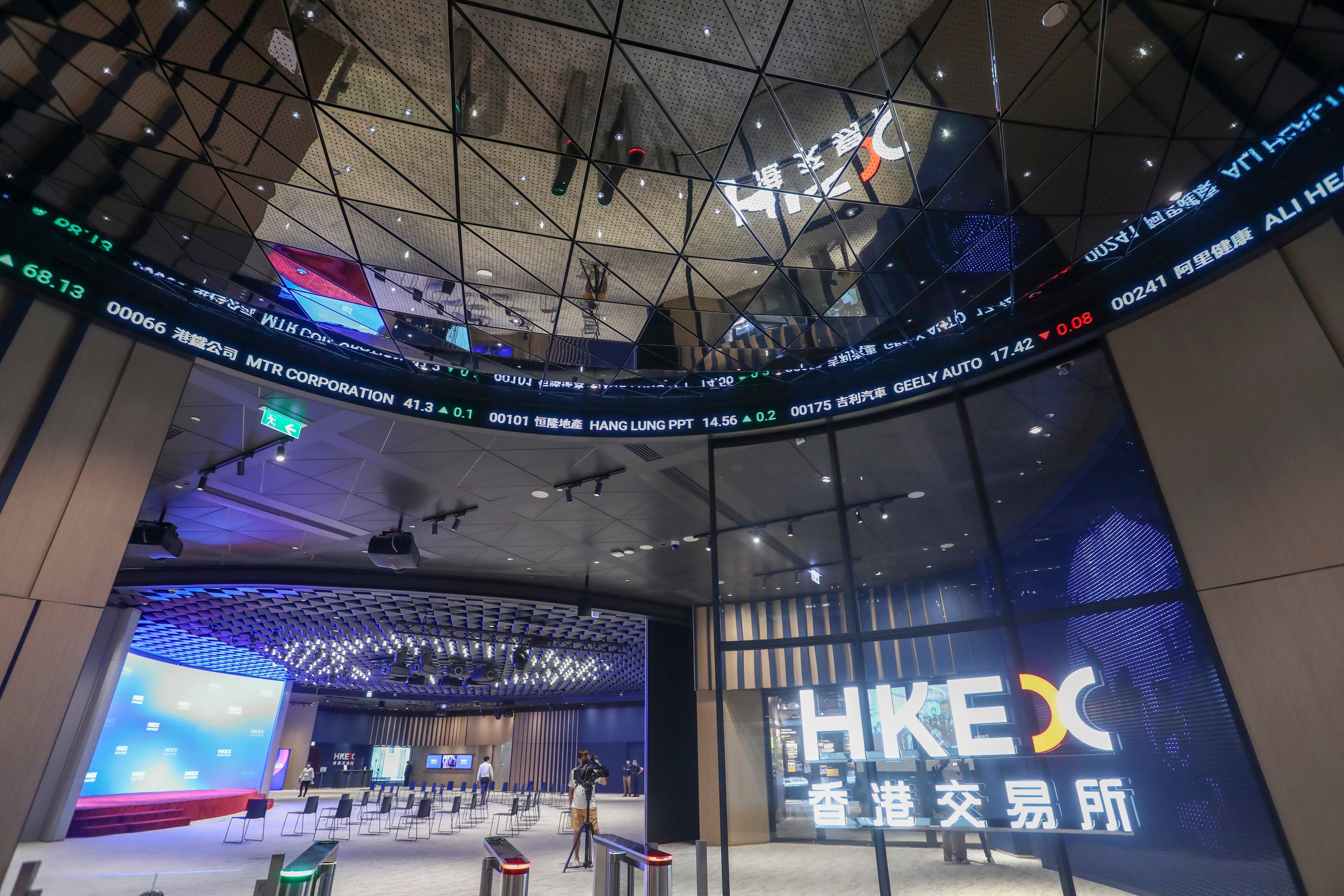

Hong Kong Exchanges and Clearing Ltd is the holding company for the city’s stock exchange, futures exchange and clearing company. Its market capitalisation makes it one of the world’s biggest listed companies.

Team set up by Hong Kong financial secretary will not only consider business and finance, but also geopolitics and US-China tensions.

- Fund manager Allspring Global said in a note that valuations call for a ‘substantial rally in Chinese shares, but sustainability is harder to determine’

- Index gains were driven by insurers AIA and Ping An and lenders like China Construction Bank and Bank of China, which were among the most heavily traded names

The erratic performance of Chinese stocks is not giving investors the confidence to commit their funds for the long haul, so some are betting on proxies outside the country, according to top wealth managers.

Debt-laden property developer Times China Holdings is faced with a winding-up petition as it becomes the latest property company creditors are seeking to liquidate.

Hong Kong stocks struck five week lows as consensus-beating GDP data reduced expectations of a rate cut in China, while weak retail, industrial and property data weighed on sentiment.

Chinese tea shop giant Sichuan Baicha Baidao Industrial aims to raise HK$2.5 billion (US$330 million) in a Hong Kong initial public offering, set to be the city’s largest new-share sale of the year, regulatory filings show.

More divestments to come, analyst says, as conglomerate aims to cut debts by US$1.38 billion annually in the next two to three years.

Laura Cha worked hard to elevate Hong Kong’s prominence on the international stage since she became the first and only female chairman of HKEX in 2018. As her tenure draws to a close, she believes that aim is no less important today.

Shanghai-based developer, facing 61.86 billion yuan (US$8.5 billion) in debts, says it needs more time to consider restructuring plan amid slumping sales and slow asset disposal as the property market crisis grinds on.

L’Occitane’s billionaire owner Reinold Geiger and Blackstone are nearing a deal to take the US$5.6 billion skincare company private, people familiar said. The stock is halted in Hong Kong pending an announcement.

First-time stock offerings in Hong Kong are expected to improve after a dismal first quarter, according to Deloitte China. Tighter regulatory oversight could hinder bourses in mainland China.

Companies in Saudi Arabis and Indonesia have shown a genuine interest in Hong Kong’s IPO market, Bonnie Chan Yiting, CEO of Hong Kong Exchanges and Clearing, says at a Legislative Council meeting on Monday.

Stocks pare gains in week as traders continue to dial back bets on a rate cut in June amid concerns about sticky US inflation data. Trading shrinks as markets in mainland China are closed for a holiday.

Lack of interest has more to do with lacklustre IPO activity than the reform per se, which will draw more interest when listings pick up, analysts say.

Alibaba has scrapped the planned Hong Kong IPO for its logistics unit Cainiao, deciding to double down on its investment in the strategically important unit.

High Court issues bankruptcy order against Yu, who is board chairman of delisted Nan Hai Corporation, over his failure to repay investment bank CCB International Overseas.

Has China’s long march to recouping stock market losses begun, after a US$1.75 trillion bounce in value from January lows? Many sentiment indicators have reached inflection points, backstopped by state intervention. Or do market bears still hold sway?

Samsonite is exploring a dual listing plan for its shares, a surprise move that tempered market speculation about a potential offer to take the luggage maker private.

Hong Kong stocks made a firm start after the US Federal Reserve’s dovish outlook brightened the prospects of lower funding costs in the months ahead.

The Hong Kong stock market posted gains driven by corporate earnings announcements but investors were cautious awaiting central bank monetary policy moves after benchmark rates were held steady

LianLian DigiTech aims for a fifth of the US$500 million it originally sought a year ago, as market conditions continue to dampen investor sentiment.

WuXi AppTech, WuXi Biologics and Xpeng weighed on the market as fourth-quarter earnings of Chinese companies trail those of peers in the rest of Asia, according to Goldman Sachs.

In this week’s issue of the Global Impact newsletter, we reflect on what is in store for Hong Kong’s stock market and its operator, the Hong Kong Exchanges and Clearing Limited (HKEX), in the Year of the Dragon.

Hong Kong stocks recovered from a weak start after China’s economic data triggers hopes of more policy easing in the world’s second-largest economy.

Hong Kong-listed firms have been involved in US$4 billion worth of take-private deals already in 2024, compared with US$1.2 billion for the whole of last year, with investors often dismayed by poor valuations.

Hong Kong-listed stocks are witnessing a surge in share buy-backs as companies use their cash hoard to boost valuations, lift investor confidence.

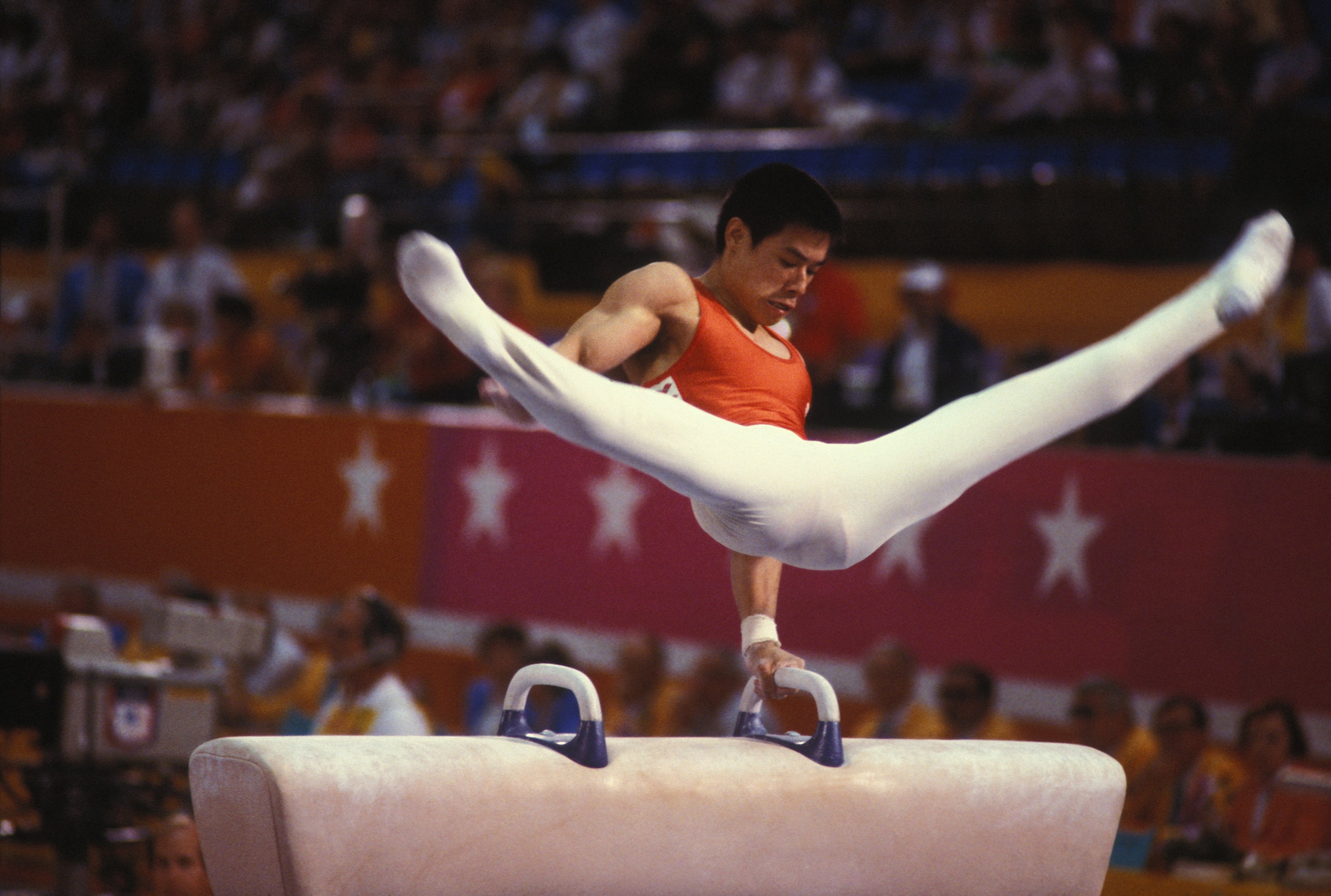

The billionaire entrepreneur and Olympic champion is considering taking his namesake sportswear company private from the Hong Kong stock exchange, four people said, adding to a string of such potential deals in a faltering market.

Once a lucrative source of fees for investment bankers, new stock offerings have become a source of stress and job insecurity amid a slump in activity. For retail investors, those first-day windfalls are also harder to come by.

Hong Kong stocks rose, amid expectations global central banks will ease monetary conditions this year following dovish comments from heads of the US Federal Reserve and the ECB.

Hong Kong stock markets weakened, led by big losses in Wuxi Biologics and Wuxi AppTec, after a US bill proposed restricting business with Chinese biotech companies on national security grounds.