Topic

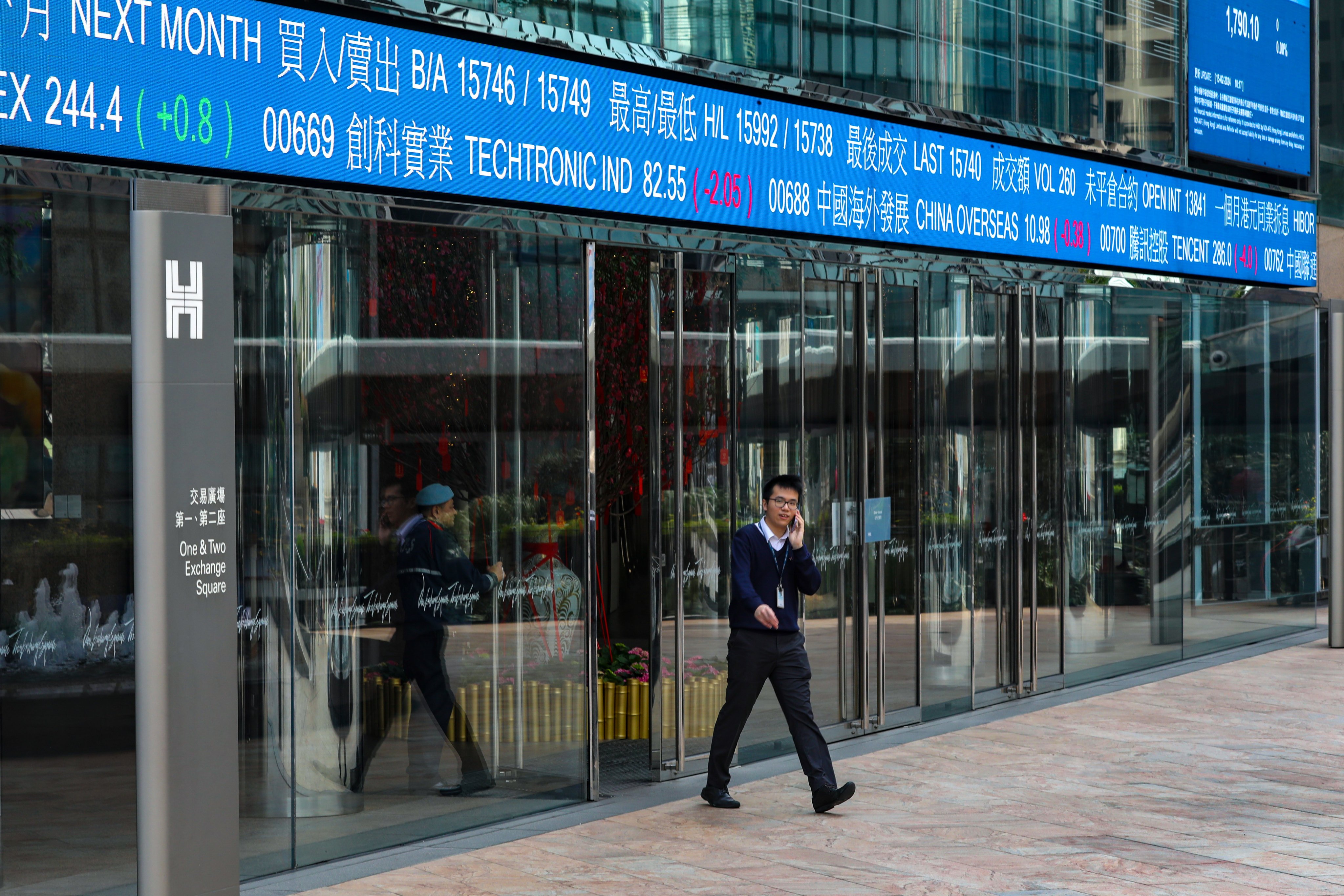

Latest news and analysis about the Hong Kong stock market, including market movements, policies, stock sales, and related exchange filings.

The chronic decline of stock prices in Hong Kong is a worrying trend, lending support to a narrative that the city’s financial prowess is in ‘ruins’, requiring concrete measures from Beijing to shore up confidence.

Hong Kong’s financial system is robust, but prudence is called for as even steady interest rates are likely to remain high for a while next year.

- Regulator said it would deepen its cooperation with Hong Kong through measures that aim to optimise the city’s status as an international financial centre

- Move comes days after Xia Baolong, Beijing’s top man on Hong Kong affairs, said more support policies were in the pipeline

Hong Kong stocks fell on Friday as investors were rattled by reports of Israeli missiles hitting Iran, with the heightened Middle East tensions triggering a scramble for safe haven assets.

It is only a matter of time before the currently depressed market stages a rebound, according to Fred Hu of private-equity firm Primavera Capital.

Hong Kong stocks gains were driven by insurance, banks and casino stocks with some investors saying conditions are right for a substantial rally in Chinese shares.

The erratic performance of Chinese stocks is not giving investors the confidence to commit their funds for the long haul, so some are betting on proxies outside the country, according to top wealth managers.

Country Garden is pushing back some onshore bond payments to later dates despite a round of extensions last year, underscoring the financial stress at the Chinese property developer.

Hang Seng Index hovers near a five-week low after comments by Fed chairman Jerome Powell, who said it could take ‘longer than expected’ to get inflation back on target.

Hong Kong stocks struck five week lows as consensus-beating GDP data reduced expectations of a rate cut in China, while weak retail, industrial and property data weighed on sentiment.

Hong Kong stocks declined to three week-lows as rising geopolitical tensions dealt a further setback to investor sentiment, already jittery ahead of a batch of economic data due to be released during the week.

Hong Kong stocks eased, pressured by the weak Chinese yuan currency and following trade data that showed a contraction in exports from the world’s second-largest economy.

Hong Kong stocks tumble after data suggested China’s consumption demand remains weak and as investors lowered their bets on the US Federal Reserve cutting rates in June.

Hong Kong stocks rose as a growing number of corporate buy-backs triggered bets that the market is nearing a bottom.

L’Occitane’s billionaire owner Reinold Geiger and Blackstone are nearing a deal to take the US$5.6 billion skincare company private, people familiar said. The stock is halted in Hong Kong pending an announcement.

Sentiment has been recovering after a visit to China by US Treasury Secretary Janet Yellen, as traders await March economic data due later this week.

First-time stock offerings in Hong Kong are expected to improve after a dismal first quarter, according to Deloitte China. Tighter regulatory oversight could hinder bourses in mainland China.

Hong Kong stocks ended steady but the mood was cautious as ahead of economic data releases that will drive sentiment later in the week.

Stocks pare gains in week as traders continue to dial back bets on a rate cut in June amid concerns about sticky US inflation data. Trading shrinks as markets in mainland China are closed for a holiday.

Global fund managers have become more positive about Chinese stocks after the securities regulator took a flurry of forceful measures to halt a three-year decline, according to a joint-venture brokerage of HSBC Holdings.

Alibaba Group spent US$4.8 billion to repurchase its own shares in Hong Kong and New York last quarter, the most since late 2021, to boost returns to shareholders.

Hong Kong stocks retreated after expectations of rate cuts by the US Federal Reserve were dealt a setback by strong jobs and factory orders data in the world’s biggest economy.

‘The time to buy is when everyone hates the market and it’s cheap, which is now the case in Chinese equities,’ especially as there are signs that the country’s economic leaders are preparing stimulus measures, the hedge fund billionaire said in his LinkedIn blog.

Hong Kong stocks jumped by the most in three weeks, with investor sentiment lifted by a manufacturing rebound in the world’s second biggest economy and as Chinese smartphone and gadget maker Xiaomi reported solid orders on its debut in the world’s biggest electric vehicles (EV) market.

Investors should exercise more caution when it comes to the valuations of Chinese stocks, as corporate earnings growth is set to slow because of Beijing’s pursuit of high-quality economic growth, according to China’s biggest money manager.

Chinese state intervention has tentatively put a floor under stocks, but corporate earnings show little sign of providing upwards momentum as pressure is building for investors to pocket profits from the decent gains the market has made.

Global fund managers have increased their exposure to Chinese yuan-traded stocks for a second month in March, indicating that foreign appetite for these shares is recovering.

Chinese stocks advanced on the back of an earnings-fuelled rally in state-owned banks which reported steady financial results and gold stocks after bullion hit a fresh peak.

Hong Kong outperforms the region as President Xi Jinping assures US business leaders about China’s commitment to a market-oriented business environment.

Hong Kong stocks underperformed the region as sentiment was dealt a blow by the cancellation of a Hong Kong IPO by Alibaba Group’s logistic unit and a cautious outlook from electric vehicle maker BYD, with the yuan’s slide adding to the gloom.

Hong Kong stocks closed higher as China Merchants Bank and China Resources Land posted better-than-estimated results and China’s central bank governor struck an upbeat tone about the property market.