Topic

Baijiu is a liquor (the word means white liquor) distilled in China that is sought after for official banquets and for gifts. Kweichow Moutai is probably the best known baijiu. Sales of the potent white spirit have risen in recent years, powered by a boom in the luxury market in China.

- Consumers, spooked by concerns about job prospects amid a bleak economic outlook, are hunting for bargains when they buy consumer goods, the study found

- The top brands on the list include liquor distillers Kweichow Moutai and Wuliangye Yibin, drug manufacturer Tong Ren Tang and China Construction Bank

The index compiler will add 10 stocks and remove 45 as it reflects China’s drive towards technology self-reliance.

The latest sell-off in Chinese bellwether stock, Kweichow Moutai, is being interpreted by analysts as a harbinger of a market bottom after shares in the liquor giant posted their biggest decline in almost a year.

Zhang Kun, China’s biggest fund manager, has latched onto the country’s biggest companies and is betting that their moating advantage will deliver sustainable returns over time as the economy recovers.

Chinese mutual fund operators have been investing in their own products on bets the dip-buying strategy will help them to ride out the uncertainty prevailing on the stock markets.

The controlling shareholders of Kweichow Moutai, have spent 1.75 billion yuan (US$242.2 million) on share buy-backs which they say reflected confidence in the company’s growth outlook and investment value even as analysts predict a hefty upside for the shares.

ZJLD Group on Monday started selling up to 490.7 million shares at a price range of HK$10.78 to HK$12.98, giving international investors additional access to a growing market amid China’s consumption recovery.

ZJLD Group’s IPO would be the largest in Hong Kong since electric-vehicle battery maker CALB’s US$1.3 billion listing in October. Only US$860 million has been raised in the city so far this year.

Chairman Mao’s favourite tipple led China’s top brands in 2022, as consumer firms outperformed technology giants and social-media platforms during a volatile year, according to the latest Hurun brand rankings.

Zhang Kun, who manages the US$8.3 billion E Fund Blue Chip Selected Mixed Fund, had Tencent, Kweichow Moutai and Yili among his top 10 holdings as of the end of 2022.

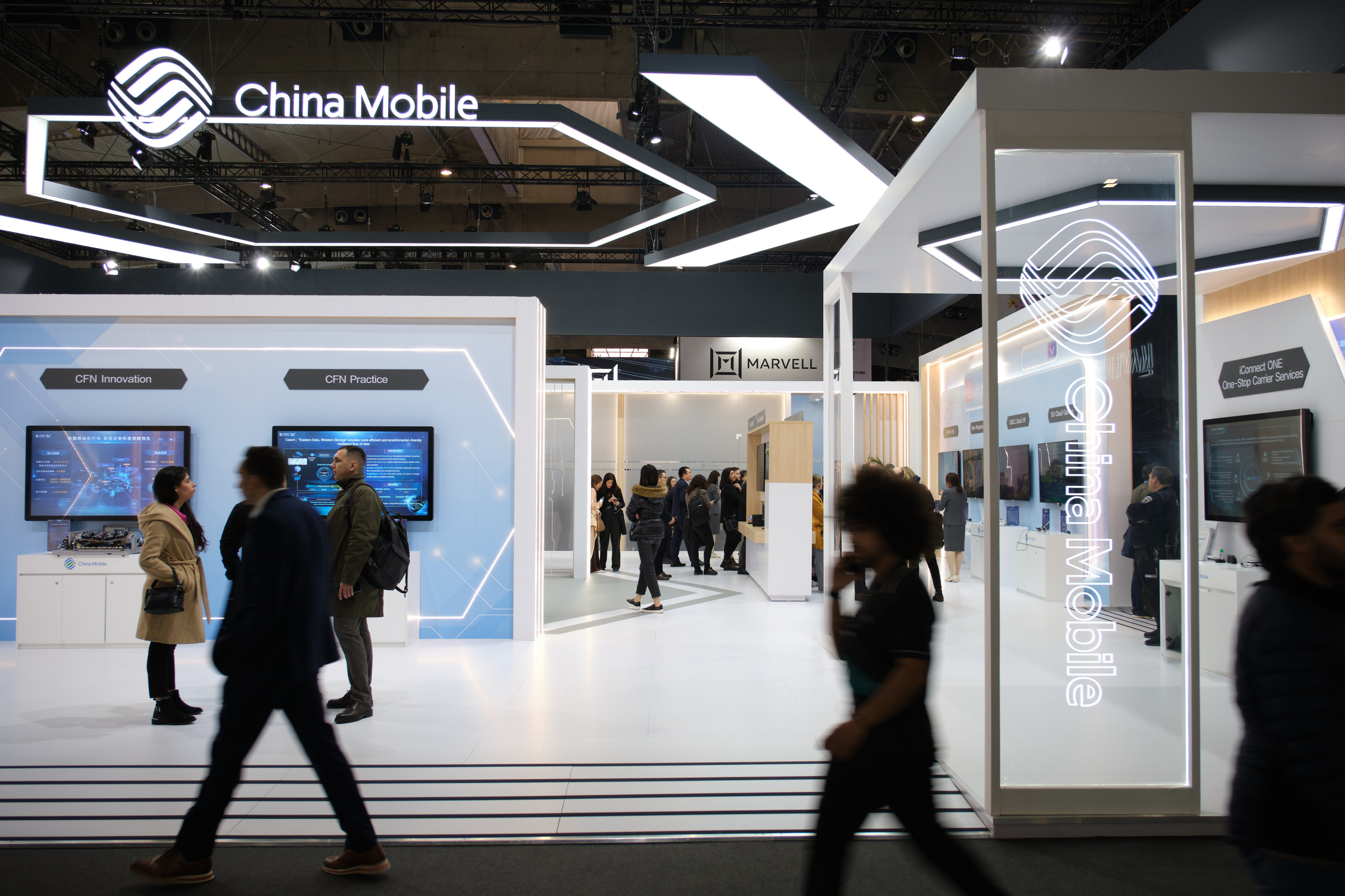

China Mobile’s market capitalisation is 2.1 trillion yuan (US$304.8 billion), second only to Kweichow Moutai’s 2.2 trillion yuan, as traders bet the mobile-network operator will benefit from Beijing’s plan to digitise the economy.

Consumer companies have led a rally in China’s stocks since the easing of Covid-19 restrictions released pent-up demand, even as major cities experience a spike in infections.

Like AMTD Digital’s incredible stock surge in New York, China’s army of retail investors covet so-called ‘demon stocks’ that can produce similar feat in onshore markets.

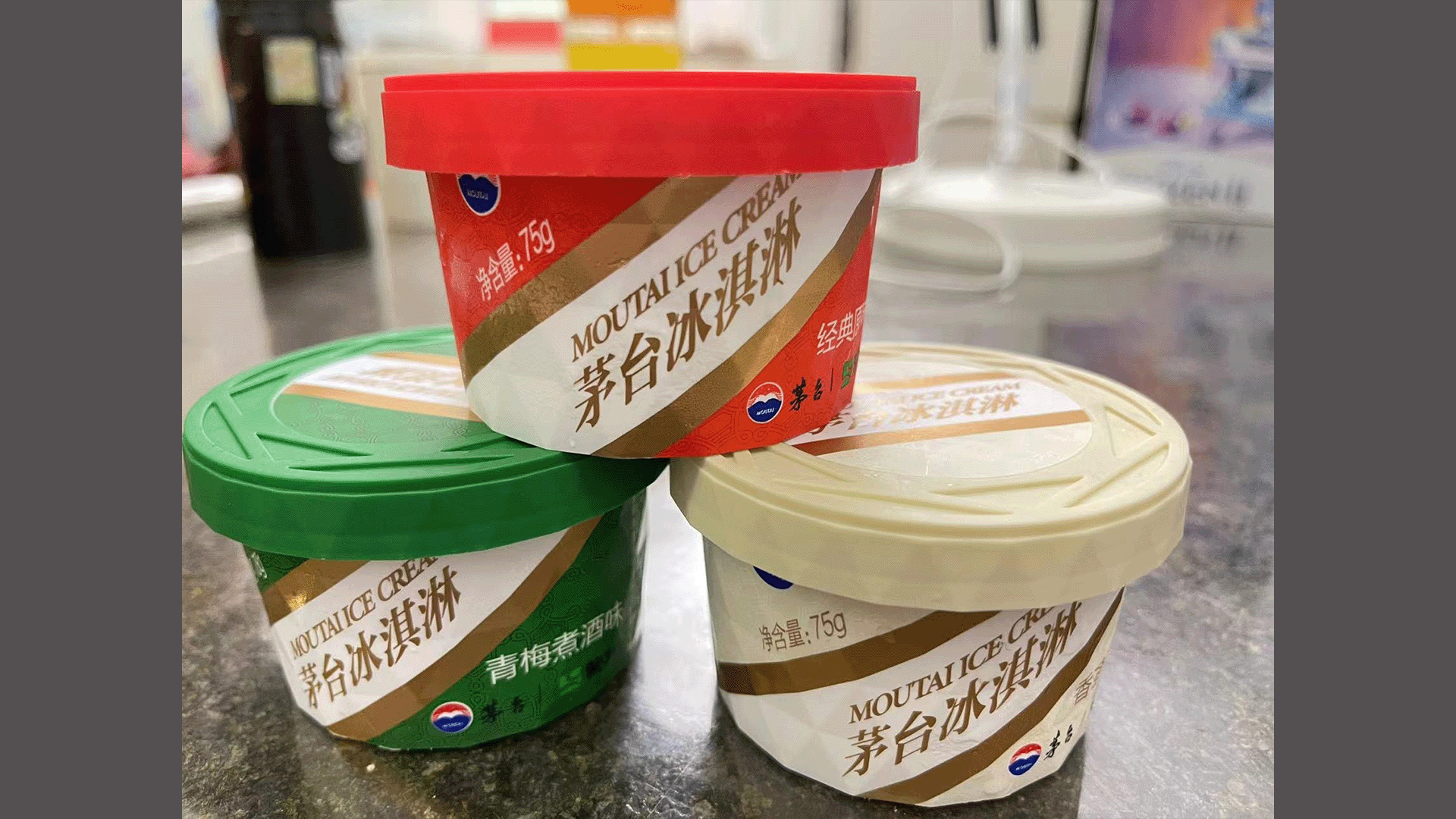

In this week’s Quirky China, a lion goes viral for his fabulous fringe, Mao-tai wants to launch an ice cream product and a police officer designs a box to dampen square-dancing noise

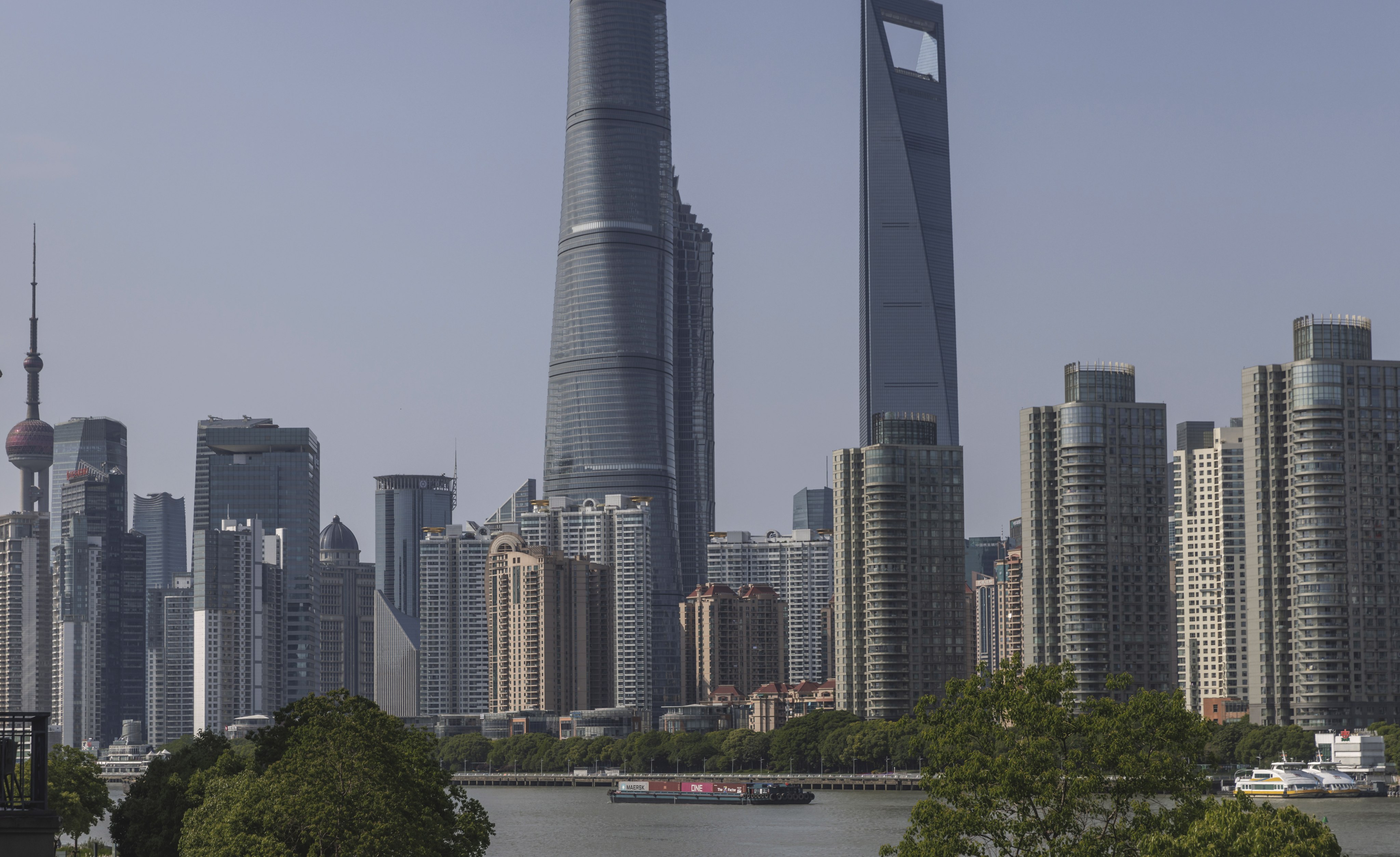

The mainland’s commercial and financial hub accounts for an outsize portion of national GDP and plays home to the country’s biggest companies and busiest port.

Kweichow Moutai is launching its own online sales platform as the Chinese liquor maker seeks to overhaul its marketing network

A scarce bottle of 1959 Mao-tai is valued at upwards of US$250,000 at a Christie’s auction that features 100 lots of the expensive baijiu.

China’s national drink surged in popularity during the pandemic and brands both big and small – from Kweichow Mao-tai to Ming River – are riding the spirit’s rising tide at home and aboard

Yuan Renguo accepted over US$17 million in bribes and was given a ‘light’ sentence for confessing and volunteering information, court says.

Ping An Insurance joined the list of top 10 most admired companies for the first time in a ranking based on public perception. Dutch semiconductor equipment maker ASML knocked Apple off its perch.

Kweichow Moutai, the stock with the biggest weighting on the Shanghai Composite Index, tumbled 4.4 per cent to 1,552.24 yuan on Friday, while rival Wuliangye Yibin, the most valuable stock on a gauge tracking the sector on the Shenzhen exchange, sank 7.3 per cent to 206.38 yuan.

China’s fintech clampdown is souring market sentiment while the mutual fund industry loses all its gains amid the biggest sell-off in months. An ongoing rotation out of crowded bets into safer value stocks is expected to persist, some managers say.

Recommendation of chief engineer for China’s best known liquor brand revives debate about how scientific excellence is rewarded.

The liquor distiller surpassed lender ICBC by market value in 2020 and should become more than valuable than Shenzhen’s economy in 2021, based on some of the bullish targets among analysts covering the stock.

Investment bank CICC has set a share-price estimate of 2,739 yuan for Kweichow Moutai, implying a gain of over 30 per cent from its current stock price.

The maker of fiery baijiu, Mao Zedong’s favourite tipple, ended 2020 with a 10 per cent gain in sales while earnings trailed consensus. The stock jumped 69 per cent to an all-time high, making it the world’s most valuable distiller.

The government should grow Hong Kong as a hub for Chinese artefacts such as vintage stamps and Kweichow Moutai spirits, CEO of art and collectibles platform Oriental Culture says.

The market-beating run of China’s biggest liquor distillers are keeping many investors in jubilant mood in a catastrophic year of pandemic. Others are preparing to greet the new year with caution.