Topic

Li Auto was founded in China in 2015 by entrepreneur Li Xiang. It primarily produces hybrid electric vehicles. The company has also started to manufacture pure electric vehicles, targeting the luxury segment with its maiden launch in March 2024 of a seven-seater multipurpose vehicle.

If America really is not afraid of free and fair competition, it must rise to the challenge presented by Chinese electric vehicles and not apply its ‘national security’ brake.

- Leading EV players are either offering price cuts or are unveiling cheaper models to cater to budget-conscious consumers: Shanghai analyst

- The mid-sized, five-seater Li L6 SUV will be priced below 300,000 yuan (US$41,470), carmaker says

Strong sales of smartphone vendor Xiaomi’s first electric car have exacerbated a price war in the sector that is squeezing the profit margins of most players in China.

Li Auto, Nio and Xpeng, China’s top three premium EV manufacturers, have reported a strong rebound in deliveries in March, while BYD said the sales of its pure electric and plug-in hybrids had surged as well.

Xiaomi off to a flying start in EV sector with its new SU7, which is priced to take on Tesla’s Model 3 in the competitive Chinese market.

BYD, Xpeng and GAC Aion’s Hyper brand announced expanded collaborations with Nvidia on Monday.

The US carmaker’s Gigafactory in Shanghai handed over 30,141 Model 3s and Model Ys to mainland customers last month, a year-on-year decline of 24.4 per cent, according to China Passenger Car Association data.

The Shanghai-based carmaker expects to hand over 31,000 to 33,000 EVs to mainland Chinese customers between January and March, down 34.1 to 38.1 per cent from the fourth quarter of 2023.

The decline ‘bodes ill’ for the market as a bruising price war may be imminent, sales executive says. EV makers are grappling with fiercer competition amid a drop in demand and signs of overcapacity.

The US$77,764 Li Mega, Beijing-based Li Auto’s first pure-electric model, has a range of 710 kilometres. It costs nearly twice as much as market leader General Motors’ petrol-powered competitor.

From Xiaomi to Xpeng, leading Chinese electric vehicle makers have expressed disbelief that Apple is ending its decade-long effort to build a car.

Hong Kong developers charted a late rebound after a weak home-price report added pressure on officials to revive the industry. EV maker Li Auto and power distributor CLP surged after their stellar earnings reports.

Deal highlights the increasing influence Chinese companies have on the development of the global EV industry, analyst says.

The bearish forecast was revealed after Li Auto reported a record quarterly profit that beat analysts’ expectations.

Chinese electric vehicle (EV) maker Xpeng will spend a record 3.5 billion yuan (US$486 million) in 2024 and hire 4,000 new workers, as it unveils plans to churn out 30 new models over the next three years.

Li Auto plans to give its 20,000 employees annual bonuses of up to eight months’ pay for exceeding the 300,000-unit sales target last year. The carmaker has set a goal of delivering 800,000 units this year.

Mainland Chinese EV builders’ 2024 has got off to a bumpy start, after car deliveries dropped sharply amid mounting concerns about a slowing economy and job losses.

Tesla became the fund’s 11th biggest holding in 2023 as it increased its stake to 0.98 per cent, or about US$7.7 billion. The fund held 0.57 per cent of BYD at the end of last year, up from 0.38 per cent.

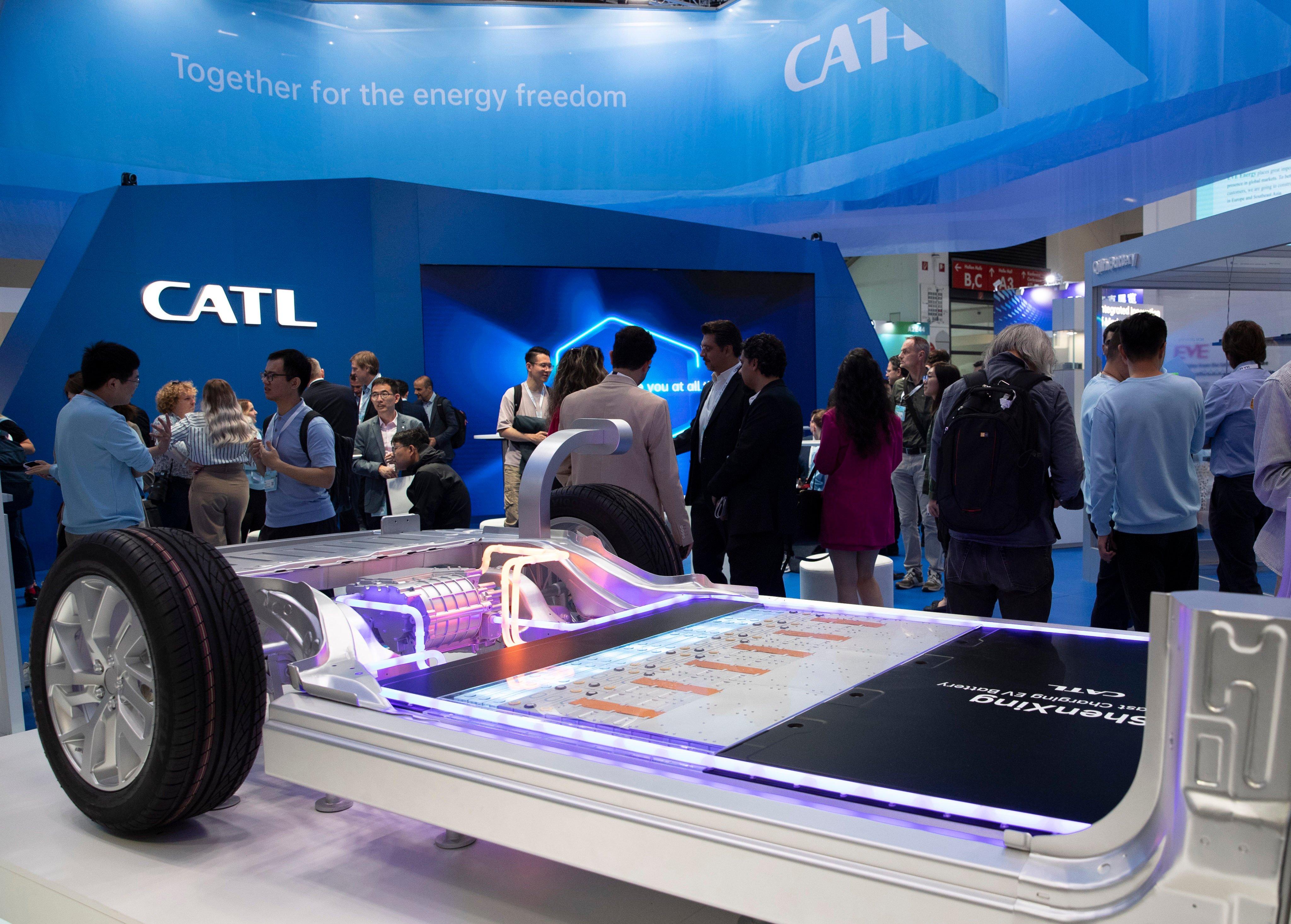

CATL, which had a 37.4 per cent share of the global battery market last year, will start construction on the Beijing plant this year, city’s economic planner says.

The biggest drags on the MSCI benchmark since the end of September 2023 include Alibaba, Yum China and BYD, which have all been offering big discounts.

Li Auto, Great Wall Motor, Zeekr and the new electric vehicle unit of Chinese smartphone vendor Xiaomi will use Nvidia’s Drive technology to power their next-generation fleets.

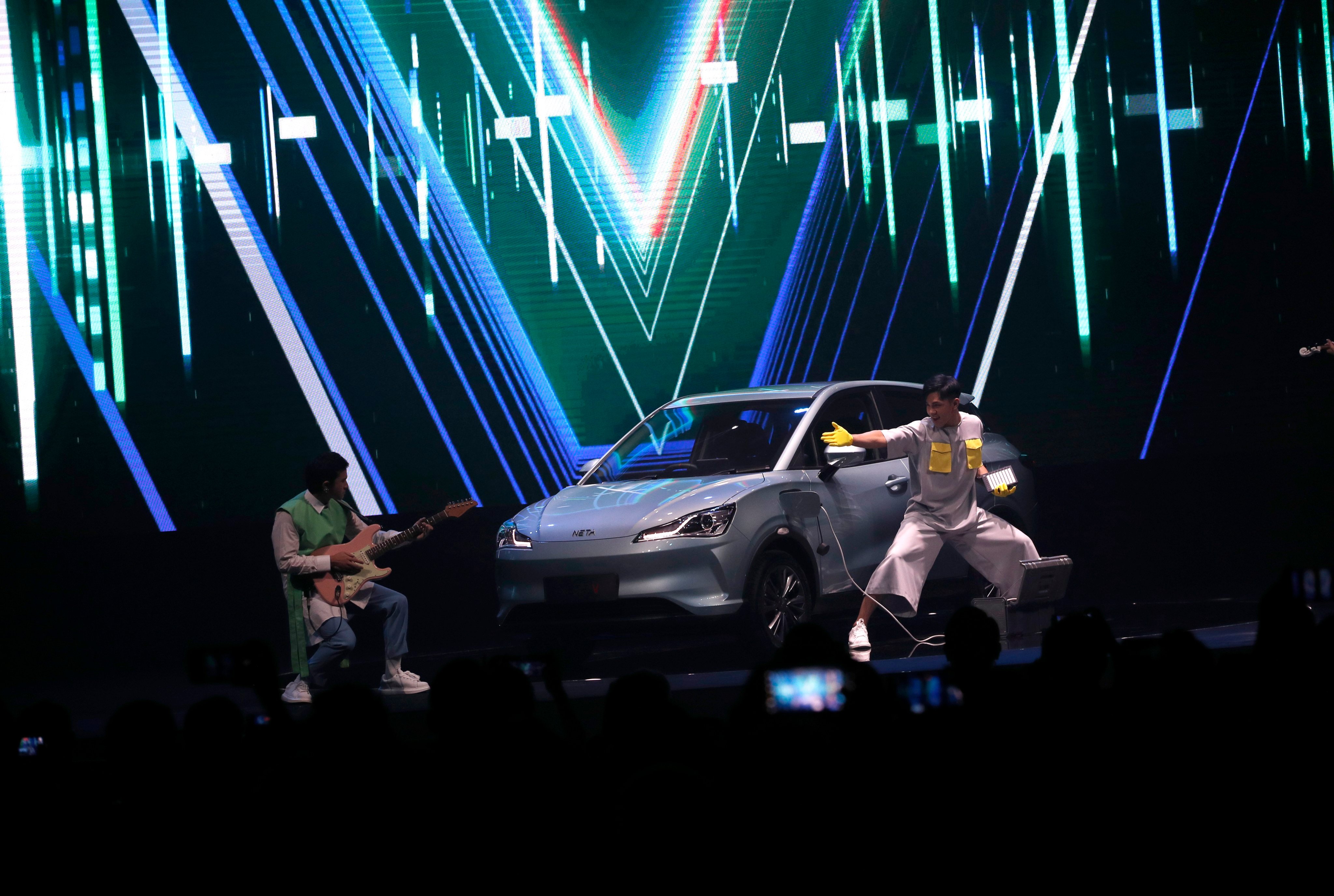

The Shanghai-based maker of Neta-branded cars aims to deliver 100,000 units in 60 overseas markets this year, mainly in Southeast Asia.

China’s leading EV makers are battling for supremacy in the MPV segment, targeting wealthy families amid sluggish sales and looking to grab a bigger share of the market from traditional carmakers like GM.

Slowing growth, intensifying competition and a bruising price war will pile pressure on the 200-plus Chinese EV makers this year, with some underachieving players likely to buckle and fold.

Gotion, China’s fourth-largest EV battery maker, has commenced operations at the first of its three plants in the US. The factory in Fremont, California, has an annual capacity of 1 gigawatt-hours.

The Shanghai-based carmaker posted a third-quarter net loss of 4.56 billion yuan (US$639 million), 24.8 per cent narrower than in the previous quarter.

Deliveries hit a record 940,000 units in November, industry body CPCA estimates, as a strong second half of the year puts EV makers on course to meet an ambitious sales target for 2023 despite a bumpy start.

Li Auto and Xpeng, two top premium electric vehicle builders in China, rewrote sales records in November, as their new car models amplified the popularity of battery-powered vehicles.

The surprise announcement shows Huawei’s ambitions in the car business despite repeatedly denying that the company will make its own vehicles.