Topic

Daily insight on the hottest topics in the global economy, central bank policymaking and international trade flows, putting developments in their perspective for a China-oriented audience.

- The IMF is warning regulators about the systemic risks of the rapidly growing private credit market, a largely opaque sector involving direct lending to corporations

- But as in the past, this could be a case of locking the stable doors after the horse has bolted

While China’s downturn tops the list of risks in developing economies, less attention is paid to the difficulties in sustaining India’s boom. Yet India’s weaknesses, such as a low labour participation rate, a lack of jobs and a large fiscal deficit, should not be overlooked.

In a matter of three months, amid strong US economic data and all-time S&P 500 highs, the outlook for interest rates has changed considerably. The Fed may want to see inflation quashed without triggering a recession, but the more likely scenario is rates will come down only if the economy slows sharply.

Markets and banking systems are stumbling on blindly and greedily towards a repeat of past mistakes both recent and distant. Banks being so big they can lend irresponsibly and ignore those meant to regulate them must change, and the coming crisis could do just that.

Investors banking on Chinese policymakers providing aggressive stimulus are trapped in an old view of China and its economy. The news is far from all doom and gloom, but investors need to accept that China’s economy will remain vulnerable and recovery will take time.

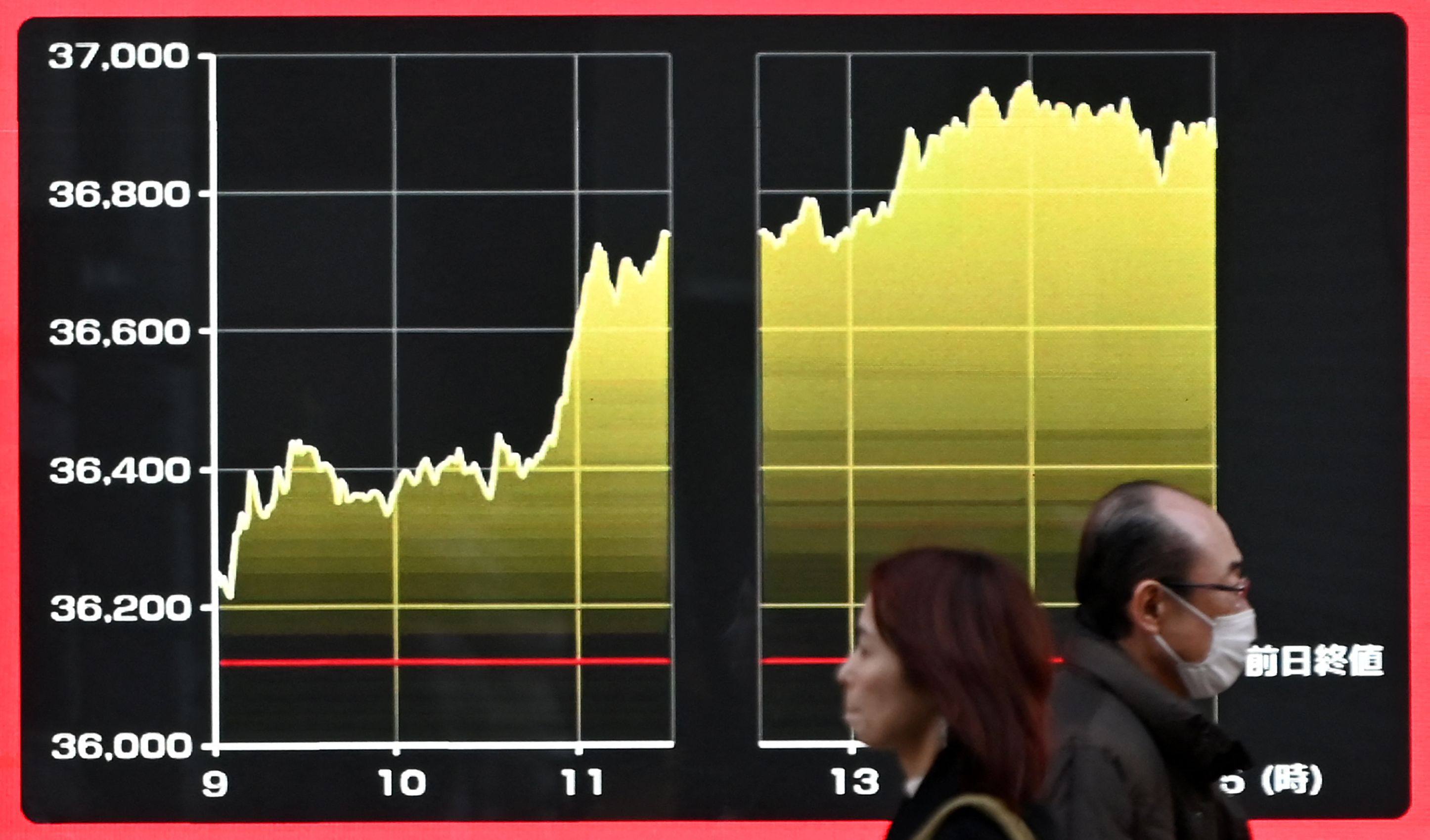

Japan’s central bank ending its negative interest rate regime comes not a moment too soon, but that alone will not return the economy to its heyday. Uncertainty over the outlook for growth and inflation persists, and the internal issues that led to the adoption of ultra-loose policy are still in place.

The apparent inability of markets to see more than one step ahead is alarming at a time when stocks are surging and markets chase quick profits above all. Multiple underlying problems are being overlooked, and a market failure to comprehend the fundamental causes of rising costs could spell financial disaster.

Bitcoin has staged a comeback from a difficult 2022, with its price rising higher than US$73,000 on the back of support from US regulators. The approval of spot bitcoin ETFs is driving interest but also raising fears of the cryptocurrency losing its status as an unregulated, decentralised product.

China’s growing dominance in solar panels, electric cars and batteries is putting US and European manufacturers at a disadvantage and is attracting defensive hostility.

Li Qiang admitting Beijing will have a hard time delivering on its pledge of 5 per cent GDP growth is a wild understatement given China’s economic struggles. The government’s policy response has been piecemeal, equivocal and confusing, frustrating investors and sapping confidence among domestic consumers.

Investors around the world have been dazzled by the performance of the “Magnificent Seven” US tech stocks and, to a lesser degree, Europe’s “Granolas”. The size and influence of these giants are taking investment away from essential socioeconomic causes such as climate change, infrastructure and more.

Just months after investors were convinced interest rates would come down sharply this year, expectations have been significantly reduced. The experience of Australia and New Zealand shows that when inflation remains sticky and employment holds up, there is little room for central bankers to consider rate cuts.

The mountain of global debt is of particular concern because of the sharp series of interest rate increases in the US. The threat that debt levels in different sectors of the economy pose to financial markets should be more clearly communicated.

The Magnificent Seven’s dominance of US stocks and its outsize impact on the performance of global equity markets has amplified fears of a new tech bubble. These fears ignore that the grouping is built on sound fundamentals and is driving structural mega trends rather than being a threat to financial stability.

The country’s sizzling stock market and high-profile push for governance reforms are spurring optimism that the economy is finally turning around. However, investors would be well advised to look more closely at its economic fundamentals.

While Donald Trump has taken credit for the fall in Chinese stocks, the truth is that domestic, not external, factors are at play in China. Instead, the focus should be on Trump’s threat to US democracy, the rule of law and the credibility of American economic policy should he be re-elected.

Despite the gloom, there is a glaring lack of consensus about the outlook as Beijing signals more aggressive support. Critically, Wall Street banks are not ready to give up on China.

Stock market prices in Japan, the US and elsewhere are being inflated by stimulus, suggesting a picture of economic health. But a correction delayed is not a correction averted.

The US, the largest commercial property market in the world, has seen prices tumble since the Federal Reserve started raising interest rates. The knock-on impact of falling property prices on the banking system, securities markets and real economy could be serious, and reverberate into international financial markets.

Tokyo has overtaken Shanghai to become Asia’s largest stock exchange, driven by investors keen to get exposure to the region while mitigating risks in China. However, China is an important source of revenue for Japanese firms in crucial industries, which would be hard hit by a deeper downturn in the world’s second-largest economy.

China’s grand infrastructure initiative needs wider ownership, a stronger institutional structure and more money. It could gain these if it were incorporated into the newly enlarged Brics grouping.

The Fed must make the tough call on when to ease rates. Amid heightened risks of a major policy blunder, the impact of its decision on Asia – where the case for a looser policy is stronger – cannot be ignored.

Much of Asia’s growth in recent years has been built on a foundation of strategic stability, but that under threat in a series of potential flashpoints. Leaders and policymakers must know it is dangerously irresponsible to risk lives and livelihoods in the hope of scoring points against their opponents.

The 2024 electoral calendar is jam-packed as more than 4 billion people around the world will go to the polls, but one election has world-changing potential. The return of Donald Trump to the White House would be a gift to US adversaries while eviscerating its security commitments and crippling climate change efforts.

Whether we call it belief in God or a guiding external force or simply superstition, inculcating faith or the conviction that we are accountable to someone or something greater than ourselves can both defeat nihilism and provoke great creative actions.

From decoupling efforts to unfavourable demographic trends, the impact of the most-cited factors affecting China’s growth prospects is overstated. Instead, the recent weakness of China’s economic performance largely reflects the temporary costs of necessary policy interventions.

A growing number of investors in developing economies are carving China out of their portfolios, but they are merely trading one set of risks for another. Fund managers cannot ignore the influence China has over emerging markets, especially in Asia, and alternatives are not as cheap as they used to be.

While certain countries are trying to entrench the current world order, there is a vast transition taking place that will alter the global balance of power and efforts to stop it are akin to putting a finger in the proverbial dyke.

The prospect of positive spillovers from mainland China’s economy stabilising and the US Federal Reserve’s dovish turn could mean a brighter 2024 for Hong Kong.