Topic

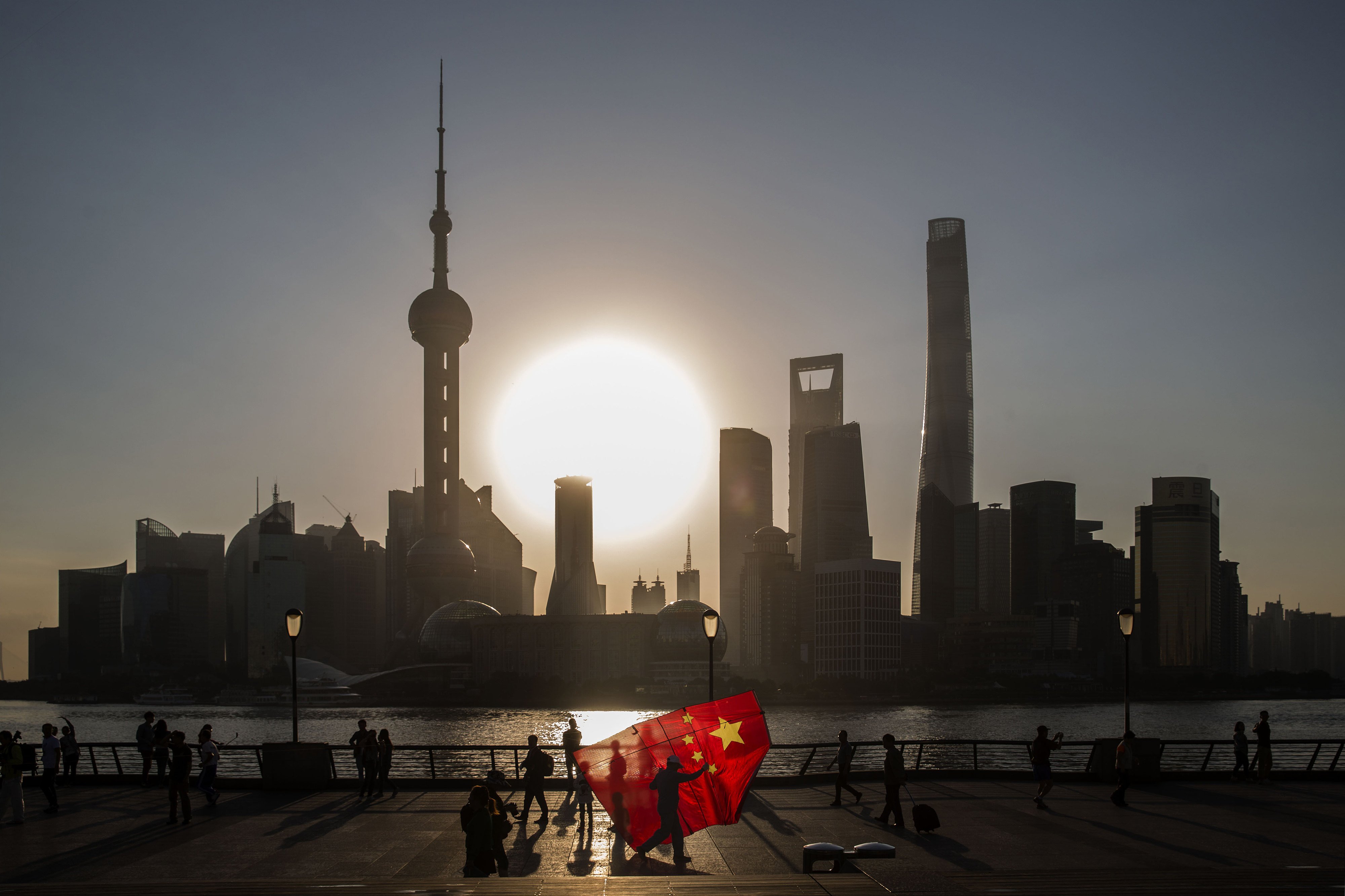

- MSCI added five Indian stocks to its Global Standard index with no deletions in its February review; it deleted 66 Chinese stocks and added five new members

- The exclusion of Chinese stocks emerges as China’s weighting in global portfolios slumps amid worries about its struggling property sector

Hong Kong Exchanges and Clearing (HKEX), which runs Asia’s third-largest stock market, reported strong growth in derivatives trading despite a big fall in new listings, in an indication that the bourse operator has successfully diversified its business model.

Index compiler MSCI has revised its China stock gauges to better track the country’s public companies at a time when local investors are flocking to undervalued SOEs, but analysts say non-state-owned firms were also worth looking at.

Just two of the 25 Chinese banks among the banking constituents of the MSCI ACWI global equity index had published analysis on the importance of climate risks to their operations as of October 30 last year.

The alignment of economic, regulatory and Covid policies for the first time in four years is likely to result in stronger stock market recovery, according to a Morgan Stanley report.

Listed companies globally are putting greenhouse-gas emissions into the atmosphere at a rate that would warm the planet by 2.9 degrees Celsius, far above a crucial 1.5-degree target, according to MSCI.

Investors should resist the temptation of using index funds – ones that invest according to the weightings of an index – to return to the market, warns Mark Mobius.

Russian stocks and government bonds are being shunned for compliance and ethical reasons while index compilers move to delete them from emerging-market benchmarks.

Singapore’s state investment firm tweaked portfolio as steep losses persisted into the final quarter of 2021 following an unprecedented crackdown on internet-platform companies.

MSCI’s optimism on China stands in contrast to investors who have pulled out, and wiped out about $1 trillion from the value of local stocks last month.

HKEX has entered into a new licensing agreement with global index provider MSCI to launch the new futures contract based on the MSCI China A 50 Connect Index.

Hong Kong-listed shares of China Mobile, China Telecom and China Unicom to be dropped at close of business on Friday, MSCI said. S&P Dow Jones and FTSE Russell in deleting the trio before Monday trading.

US chip makers have led the gains on an equity index tracking the biggest global companies that derive a big chunk of their revenue from China since 2018, when the trade war between Washington and Beijing first flared up.

MSCI said it views Hong Kong as a major international financial centre for “years and decades to come” and the move is a bet on future access to a larger base of Chinese investors.

The offshore yuan was among the biggest decliners in emerging markets Friday, weakening by the most in a month.

The change will compel US pension funds, mutual funds and other institutional investors that track the benchmarks to add billions of dollars more to yuan-denominated shares of Chinese companies.

Although mainland traders remain bullish, international institutional investors say a number of hurdles remain, including insufficient risk management tools, differences in trading holidays between China and Hong Kong, and short settlement cycle of A shares

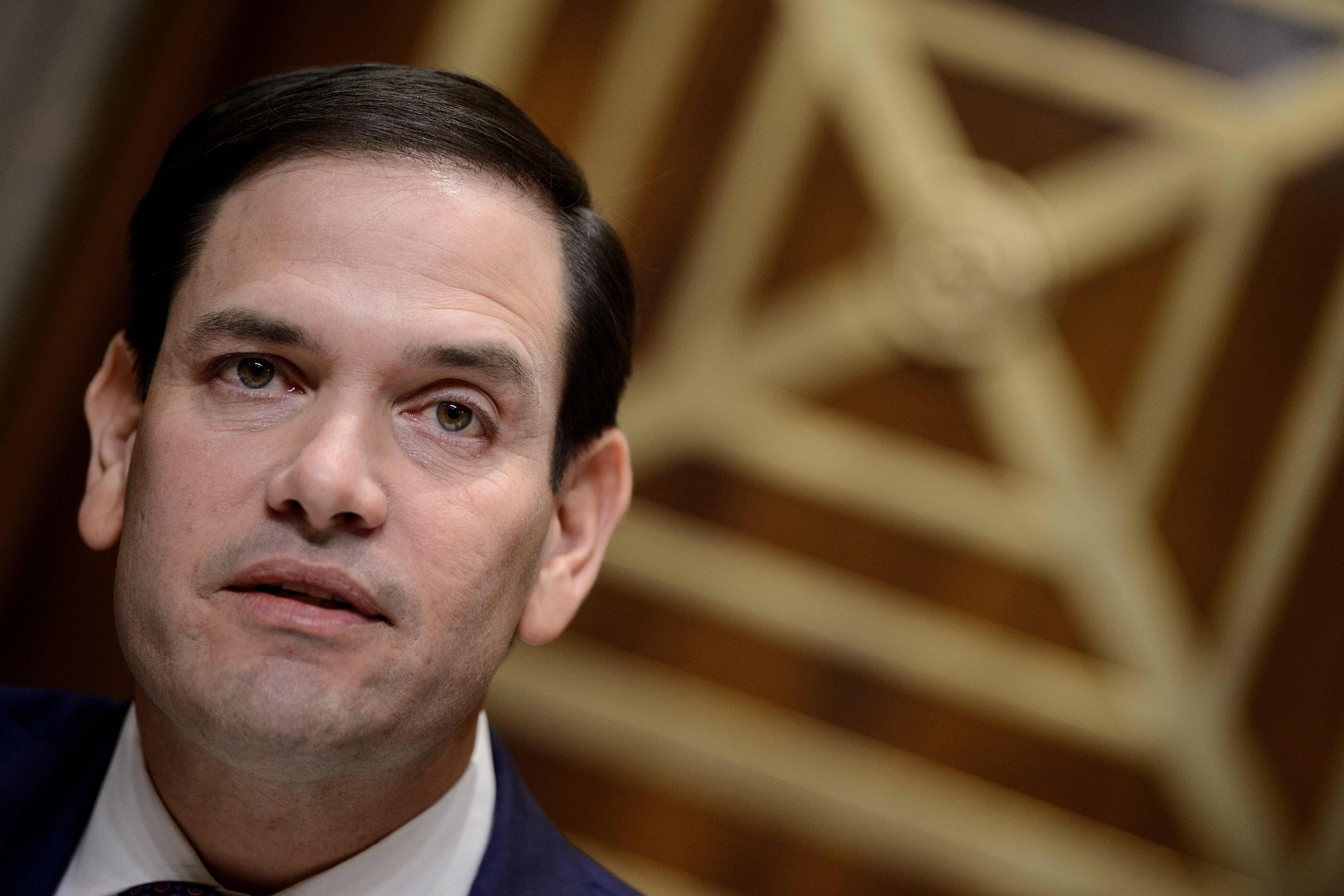

Rubio’s pressure on MSCI is part of a larger campaign by US lawmakers to slow the spigot of money that has flowed from US investment funds into Chinese companies.

Massive trading suspension cannot happen again as global investors have a higher exposure to A shares, says Jessie Pak, managing director for Asia at FTSE Russell.

MSCI is buying Zurich-based climate analytics firm and will unveil a new metric to help investors understand the impact of climate change on their investments

Senator Marco Rubio says he is building on Trump administration’s efforts ‘confronting the Chinese government and Communist Party’s predatory economic behaviour’.

The letter forms part of a broader push by Rubio and other Washington lawmakers to crack down on Chinese companies operating in the US equities markets.

Listed Chinese company and MSCI global index constituent Kangmei Pharmaceutical is facing a 600,000 yuan fine for falsifying its cash position by as much as 29.9 billion yuan, top watchdog CSRC said on Friday.

Chinese stocks’ representation in MSCI’s indices will double in the first part of a three-step process.

The index compiler plans to boost the representation of Chinese stocks to 20 per cent from the current 5 per cent by November

Foreign investment could hit US$100 billion this year, as global funds increase A-share buying.

At 2.2 per cent of China’s US$6.4 trillion stock market, foreign investors don’t hold any sway in the world’s second-biggest market