Topic

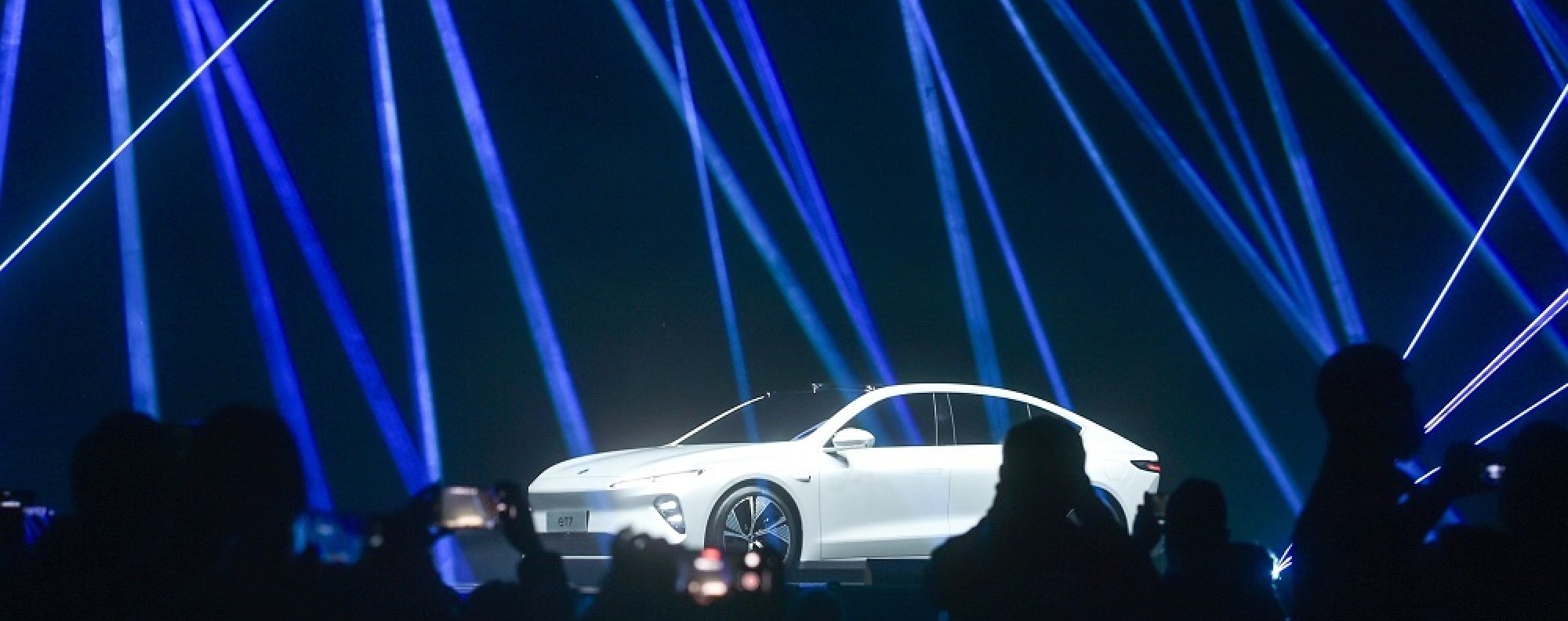

Nio builds premium electric vehicles in China. The company’s EVs feature swappable batteries that allow drivers to get back on the road minutes after pulling into battery-swap stations. It has signed partnership agreements with other carmakers, Zhejiang Geely and Changan Automobile, to build cars with the technology and expand the country’s network of swap stations. It operates two plants, both in Hefei, the capital of Anhui province.

If America really is not afraid of free and fair competition, it must rise to the challenge presented by Chinese electric vehicles and not apply its ‘national security’ brake.

- Beijing-based Li Auto has priced the new L6 SUV from 249,800 yuan (US$34,509) onwards, 5 per cent cheaper than Tesla’s popular Model Y

- The L6 can go up to 212km on a single charge, and as much as 1,390km using the extended-range battery technology

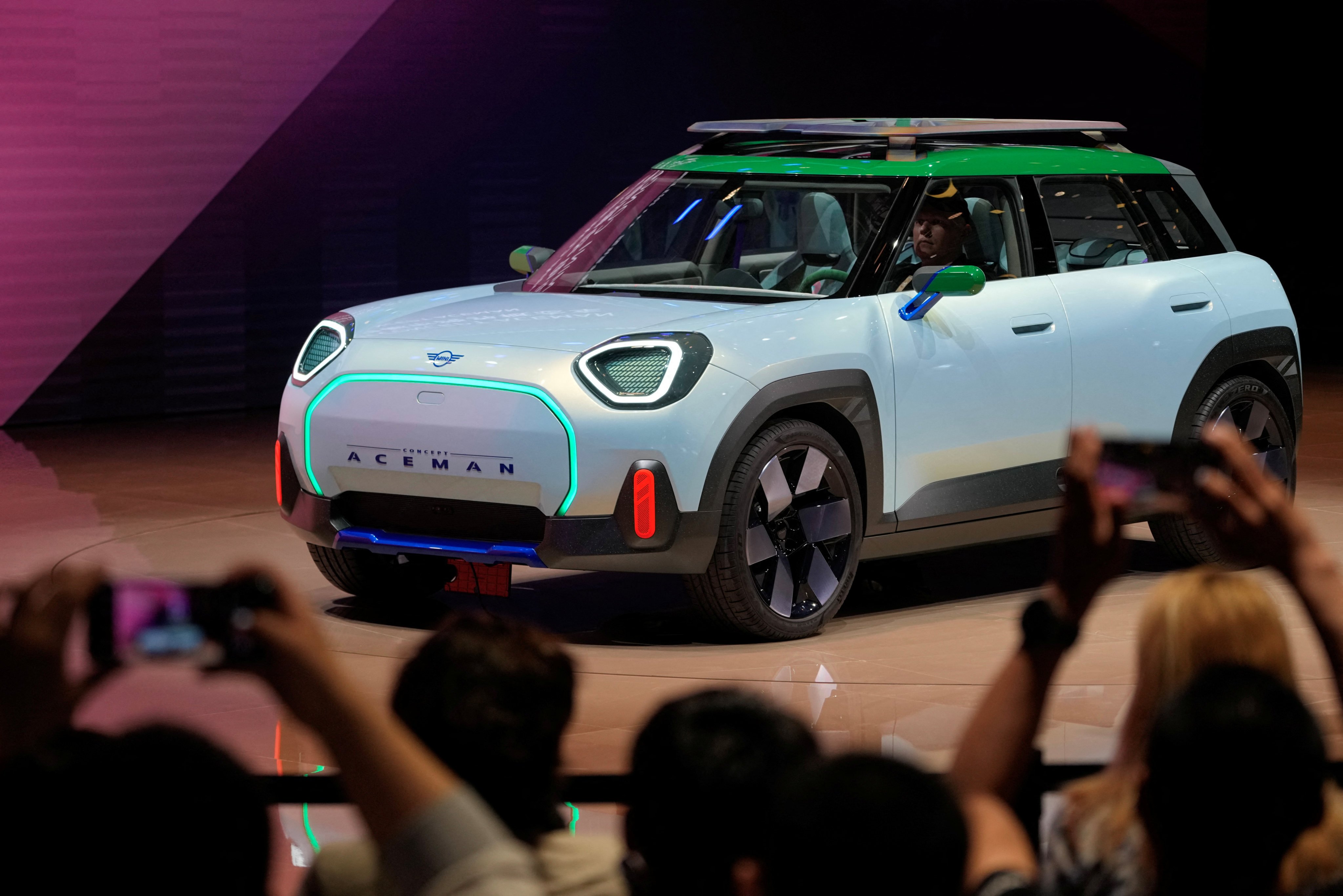

Spotlight Automotive, BMW’s 50-50 EV venture with mainland Chinese partner Great Wall Motor, is designing new models that it hopes to sell globally.

Li Auto, Tesla’s nearest rival in mainland China, plans to start selling a new, more economical model aimed at families amid a price war in the country’s electric vehicle market.

Strong sales of smartphone vendor Xiaomi’s first electric car have exacerbated a price war in the sector that is squeezing the profit margins of most players in China.

Tesla is the world’s largest maker of pure electric cars again after outselling its closest rival, BYD, during the first quarter of this year, according to data published by the companies.

Li Auto, Nio and Xpeng, China’s top three premium EV manufacturers, have reported a strong rebound in deliveries in March, while BYD said the sales of its pure electric and plug-in hybrids had surged as well.

The US giant raised the price of its Shanghai-made Model Y on Monday, bucking the trend set by a discount war that is squeezing the profit margins of most of its rivals in the world’s largest electric vehicle (EV) market.

Xiaomi off to a flying start in EV sector with its new SU7, which is priced to take on Tesla’s Model 3 in the competitive Chinese market.

BYD, the world’s largest electric-vehicle maker, is targeting a 20 per cent increase in sales this year, just a third of last year’s tally, as overcapacity concerns and a price war loom over the sector in mainland China.

BYD, Xpeng and GAC Aion’s Hyper brand announced expanded collaborations with Nvidia on Monday.

The global automotive industry is making a “strategic transformation” towards electrification, said Gou Ping, vice-chairman of the State-owned Assets Supervision and Administration Commission.

The two companies aim to churn out EV batteries that can last for as long as 15 years, nearly double the current average lifespan, which could help EV users save tens of thousands of yuan, they say.

The world’s largest EV maker is taking the offensive in a market-share battle, with rivals including Xpeng, Zeekr and SAIC-GM-Wuling also slashing prices.

The Chinese smartphone maker, which has started taking orders for its maiden EV model, will start deliveries on March 28. The market estimates the car to be priced from 200,000 yuan (US$27,865) to 370,000 yuan.

Chinese electric vehicle (EV) maker Xpeng plans to launch its first right-hand drive model in the second half of this year as it accelerates its push to go global, targeting markets such as Hong Kong and Southeast Asia.

The US carmaker’s Gigafactory in Shanghai handed over 30,141 Model 3s and Model Ys to mainland customers last month, a year-on-year decline of 24.4 per cent, according to China Passenger Car Association data.

The Shanghai-based carmaker expects to hand over 31,000 to 33,000 EVs to mainland Chinese customers between January and March, down 34.1 to 38.1 per cent from the fourth quarter of 2023.

The price war in China’s EV sector is likely to intensify further as carmakers undercut each other amid faltering sales, market observers say.

The decline ‘bodes ill’ for the market as a bruising price war may be imminent, sales executive says. EV makers are grappling with fiercer competition amid a drop in demand and signs of overcapacity.

The US$77,764 Li Mega, Beijing-based Li Auto’s first pure-electric model, has a range of 710 kilometres. It costs nearly twice as much as market leader General Motors’ petrol-powered competitor.

Volkswagen has signed an agreement with Chinese EV maker Xpeng to jointly develop two mid-sized battery-powered vehicles for the highly competitive mainland market in 2026.

Deal highlights the increasing influence Chinese companies have on the development of the global EV industry, analyst says.

The bearish forecast was revealed after Li Auto reported a record quarterly profit that beat analysts’ expectations.

The Warren Buffett-backed carmaker is accepting bookings for the 1.68 million yuan (US$233,400) supercar with a deposit of 300,000 yuan. Deliveries are expected to start in the summer.

The company, a division of British sports car company Lotus Group in which Chinese carmaker Zhejiang Geely Holding owns a majority stake, will focus on the premium segment despite cheap models dominating the mainland EV market.

Analysts says lower battery costs are enabling EV makers to discount prices amid tougher competition and efforts to take more share from petrol car manufacturers.

Chinese electric vehicle (EV) maker Xpeng will spend a record 3.5 billion yuan (US$486 million) in 2024 and hire 4,000 new workers, as it unveils plans to churn out 30 new models over the next three years.

The car starts at just over US$11,000, lower than bestselling petrol-powered cars like Volkswagen’s Lavida and Toyota’s Corolla.

Li Auto plans to give its 20,000 employees annual bonuses of up to eight months’ pay for exceeding the 300,000-unit sales target last year. The carmaker has set a goal of delivering 800,000 units this year.

Mainland Chinese EV builders’ 2024 has got off to a bumpy start, after car deliveries dropped sharply amid mounting concerns about a slowing economy and job losses.