TOPIC

/ company

People’s Bank of China (PBOC)

People’s Bank of China (PBOC)

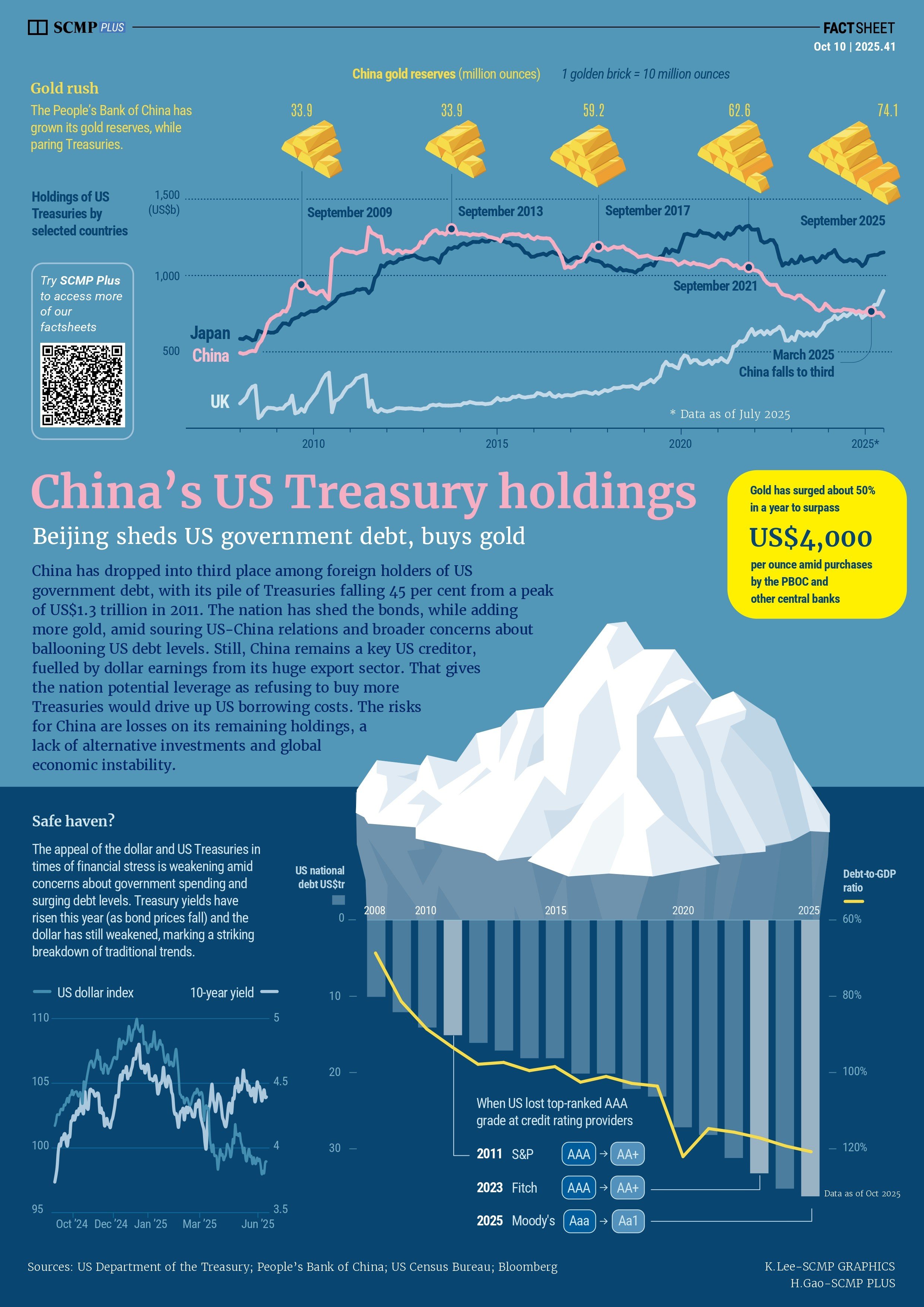

The People’s Bank of China (PBOC) is the central bank of mainland China. It is responsible for carrying out monetary policy and regulation of financial institutions, including setting interest rates.

Industry

Banking

Website

pbc.gov.cn

Headquarters address

No. 32, Financial Street, Xicheng District, Beijing 100820, China

Year founded

1948

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement