Topic

Richard Li Tzar-kai is founder and chairman of Pacific Century Group (PCG), an Asia-based long-term private investment group founded in 1993 with interests in financial services, technology, media and telecommunications (TMT), and property. Li founded PCCW, which later acquired HKT, and the company has business lines in telecommunications, media and IT solutions. He leads the asset management company PineBridge Investments, insurance business FWD Group and runs Hong Kong-based Pacific Century Premium Developments and Singapore-based Pacific Century Regional Developments. Li was awarded the Lifetime Achievement Award by the Cable & Satellite Broadcasting Association of Asia in 2011, and is a member of the Center for Strategic and International Studies' International Councillors Group in Washington.

- Billionaire, 95, praises university institute championing new generation of entrepreneurs and backs research of two prominent scholars to fight diseases

- University president says retired tycoon’s contributions will ‘provide profound benefits to so many in our own community and well beyond’

Hong Kong billionaire Richard Li Tzar-kai will retain control of Hong Kong-based insurer FWD Group amid speculation about a potential stake sale. A stock offering will be considered at an opportune time, its major shareholder says.

The 23-minute National Day show will start and end with breathtaking effects, pyrotechnics expert Wilson Mao pledges.

FWD, which announced positive six-month results two weeks ago, said it ‘will assess the appropriate time’ to re-file the application, which it first submitted in February 2022.

City leader John Lee’s warm welcome in Malaysia, Indonesia and Singapore bodes well for investors.

Exclusive | How FWD married two of Richard Li’s ‘loves’ to create only home-grown, pan-Asian insurer

A serendipitous meeting more than 10 years ago between a telecoms titan and a former Vietnamese refugee sowed the seeds for an insurance company that today covers against risks in seven countries along the ancient Silk Road.

Hong Kong-based start-up alfred24 has been chosen as the first investee of a collaboration between MTR Lab and tech hub Cyberport to nurture digital and sustainable solutions in the city.

Hong Kong’s government is eager to promote the city as the Asian hub for wealth management and philanthropy, and is poised to unveil incentives on Friday to attract family offices to set up.

The Hong Kong government will announce a slew of measures at a key wealth summit on Friday as it takes aim at Singapore and attract more wealthy people to set up family offices here.

FWD Group Holdings on Monday afternoon refiled its application to list on the city’s stock exchange, having postponed its planned listing in May last year due to ongoing market volatility.

Hong Kong tycoons Richard Li Tzar-kai and Ronnie Chan Chi-chung, as well as a number of global financial and philanthropic heavyweights, are expected to attend a high-level forum aimed at attracting the world’s biggest family offices to Hong Kong.

FWD and a group of investors will buy a 70 per cent stake in Gibraltar BSN Life from a subsidiary of Prudential Financial. The expansion is part of the insurer’s long-term strategy to expand across Southeast Asia.

Ant Group, ByteDance, Syngenta, Amer Sports, FWD Group and Didi Global among the highly anticipated IPOs this year. Over 100 new listings are expected to raise around HK$200 billion (US$25.6 billion).

After a lacklustre year for IPOs globally, 2023 could yield a bumper crop of listings from sectors ranging from insurance to chemicals and electric vehicles.

Sources say preliminary findings show ‘criminal elements’ and ‘human negligence’ may be involved.

Well-wishers send best wishes to dancer, still in hospital after giant television screen fell on him at July concert.

Billionaire Richard Li says he will provide financial support to Mo Li and his family, in addition to covering the performer’s medical fees.

Ma’s appointment as chairman is expected to help the insurer resume its postponed initial public offering, brokers said.

Hong Kong’s Hang Seng Index has fallen 9.3 per cent this year, a slump that deterred companies from raising capital through IPOs, driving the city to sixth place among global IPO destinations in the first quarter.

SPACs face a ‘more challenging’ environment amid a slowdown in global fundraising for the investment vehicles, with only three such listings in Singapore this year since new rules were introduced.

FWD’s switch to Hong Kong followed the regulatory roadblock over US concerns about potential risks associated with the Chinese government extending its authority over Hong Kong-based firms.

FWD Group Holdings, the Asian insurer backed by Hong Kong billionaire Richard Li Tzar-kai, is close to filing an application for an IPO in the city this year, according to people familiar with the matter.

Hong Kong is being caught up in the crossfire amid rising geopolitical tensions between the US and China, giving the insurer cause for caution, the source said, citing Didi Global’s decision to delist from the New York Stock Exchange as an example.

The Securities and Exchange Commission is asking about potential risks associated with Beijing extending its authority over Hong Kong-based firms, people familiar with the matter said.

Hyphen Group’s merger with blank-cheque company Provident Acquisition could value combined entity at around US$1 billion, say sources.

FWD Group, which plans to go public on the New York Stock Exchange, is seeking to raise US$2 billion to US$3 billion from its IPO, according to sources.

The property tech company plans to go public in the US following its merger with a SPAC backed by Hong Kong billionaire Richard Li.

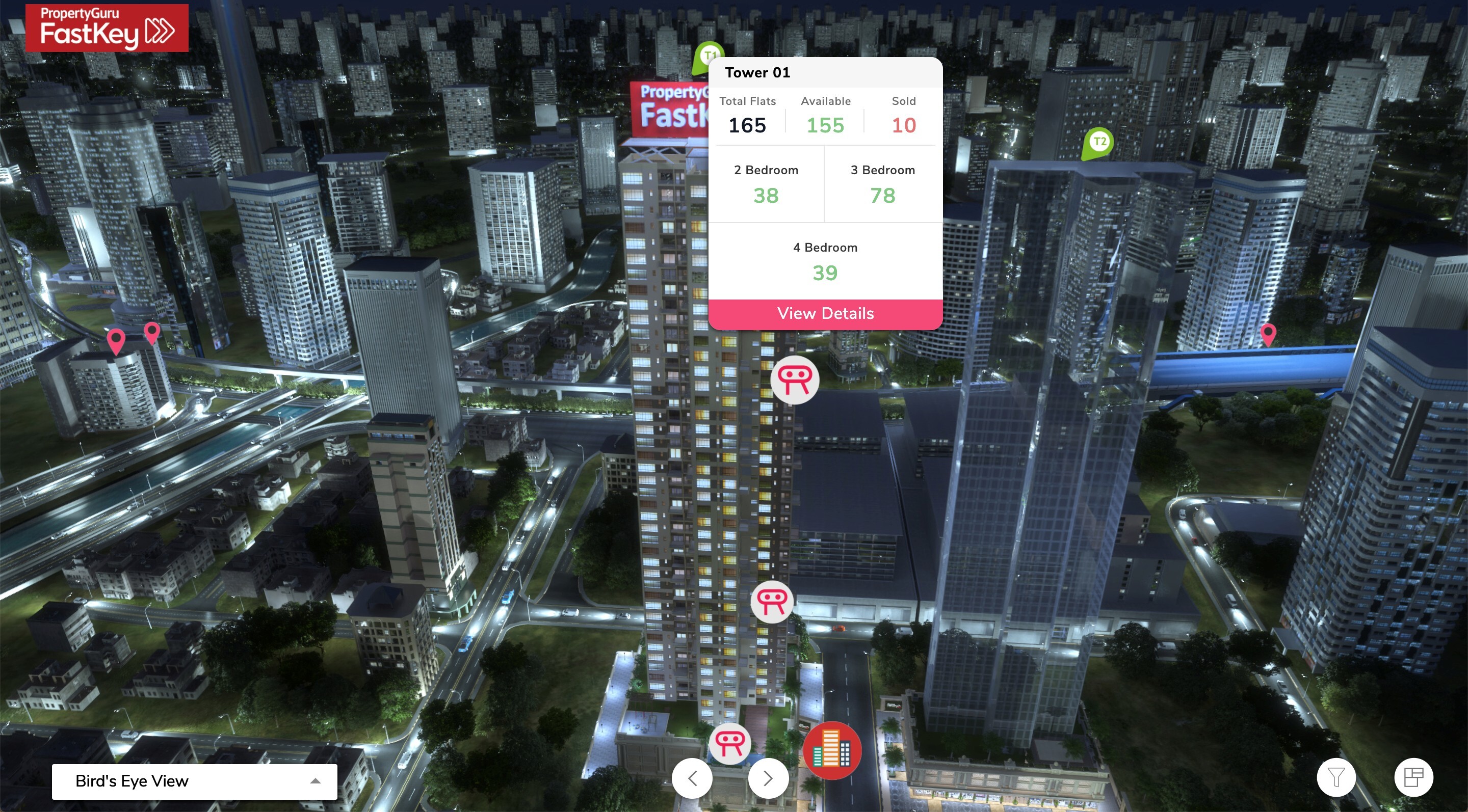

PropertyGuru is Southeast Asia’s biggest property technology company and the first acquisition by one of Li’s three US-listed blank-cheque companies.

Asian investors are still keen to tap what has been one of the hottest fundraising trends in the past two years, after blank-cheque companies raised nearly US$94 billion in the first quarter.

PCGI Intermediate, FWD’s holding company, said that it had made a confidential filing with the SEC for the IPO. Rumours of a listing by the insurer have been circulating in the market for two years now.