Topic

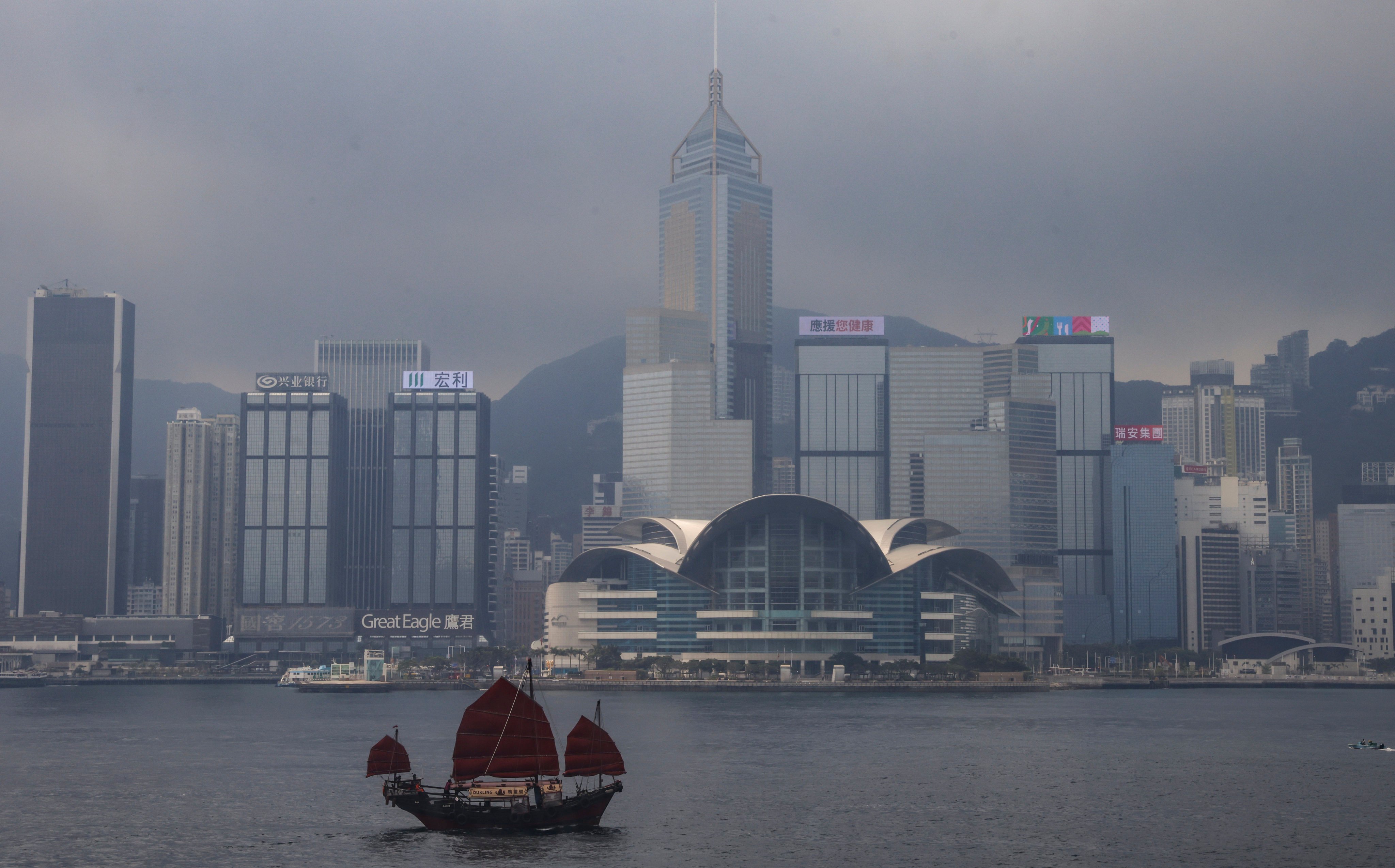

The Securities and Futures Commission (SFC) is an independent statutory body set up in 1989 to regulate the city’s securities and futures markets. It works to ensure orderly securities and futures market operations, to protect investors and help promote Hong Kong as an international financial centre and a key financial market in China.

The departure of Ashley Alder as chief executive of the Securities and Futures Commission is the latest loss from the management ranks of the regulator.

Nicolas Aguzin’s appointment as the first non-Chinese to run HKEX raised some eyebrows, given the continuing importance of attracting Chinese companies. While his experience guiding JPMorgan’s expansion into China would have weighed with the board, the question facing him now is, what next?

Hong Kong’s securities watchdog has bared its teeth in many cases of malpractice and should spare no effort to safeguard city’s reputation as a global financial hub.

A global search is under way to find a replacement for Ashley Alder, the outgoing CEO of the Securities and Futures Commission, and local candidate Julia Leung fits the bill

- The Asian finance hub’s upcoming spot cryptocurrency ETFs could attract regional investors who do not want to bother with US accounts and tax forms, experts say

- Hong Kong is the first major financial market to offer spot ether ETFs, but some were dismissive, noting the city’s small ETF market relative to the US

Bosera Asset Management, HashKey Capital, Harvest International and ChinaAMC are all working on spot crypto ETFs after the SFC’s first conditional approvals.

Tokenisation has proved to be cheaper, more efficient and better than ‘the old-fashioned way of trading’, Noel Quinn says, but HSBC will stay ‘away from crypto’.

Laura Cha worked hard to elevate Hong Kong’s prominence on the international stage since she became the first and only female chairman of HKEX in 2018. As her tenure draws to a close, she believes that aim is no less important today.

All financial institutions licensed by the SFC should be required to submit ESG reports for the development of a comprehensive ecosystem of sustainability disclosures, City University of Hong Kong says.

Crypto industry executives were touting the benefits of bitcoin at the four-day Web3 Festival amid anticipation for the approval of spot ETFs this month.

The numbers do not lie, Hong Kong’s financial regulators told the HSBC Global Investment Summit on Tuesday. The city’s market has shown resilience and competence through several years of economic headwinds.

HKVAEX is advising users to withdraw funds this month ahead of its May 1 shutdown, just three months after it submitted an application for a crypto licence.

HSBC Gold Token, which will be available on the lender’s online banking and mobile app, is the first such retail product to be issued by a bank, according to HSBC, as the government pushes for more digital assets to be rolled out for public use.

The Securities and Futures Commission has warned investors about trading on Bybit, which is under scrutiny for offering suspicious virtual-asset products in Hong Kong.

The SFC saw a jump in last-minute applications, but the number of applicants so far falls far short of the 70 that Singapore saw after a similar regulation.

Regulators from Hong Kong, Japan and Singapore welcome the trend of tokenisation as a means to promote efficiency, disintermediation, liquidity and financial inclusion in markets.

The Securities and Futures Commission (SFC) said it had started proceedings in the Court of First Instance against Sui and 20 other employees for allegedly manipulating Ding Yi Feng’s shares between March and September of 2018.

The world’s fifth-largest crypto exchange is hoping to win customers in Hong Kong after exiting the mainland market.

The government will submit a bill on licensing rules for stablecoin issuers and OTC trading services to the legislature ‘as soon as practicable’, says the city’s financial affairs chief.

HKUST and a cross-agency green finance body led by the city’s financial watchdogs have launched two new greenhouse gas emissions calculation and estimation tools to help firms with their sustainability reporting.

DAB says more stock exchange listings from mainland would boost city’s standing as major financial centre and increase global profile of Chinese companies

The SFC warned it may delist two companies formerly headed by Alvin Chau because of concerns about a US$116 million sale of assets in Russia.

The SFC issued a notice on Monday reminding investors that a number of new licence applicants are not yet approved and pose risks.

The Securities and Futures Commission aims to enhance cross-border trading schemes and ties with the Middle East, the rest of Asia and around the world.

Hong Kong is set to develop a more flexible regime for cryptocurrency exchange-traded funds, even though the US leads in both approval speed and market size, according to industry experts.

Trading platforms Aramex and DIFX alleged to have used social media and messaging apps to lure victims into investing cash.

The successful US launch of spot bitcoin exchange-traded funds is expected to help move Hong Kong regulators closer to authorising similar cryptocurrency funds to operate in the city.

In 2023, 17 jurisdictions including Hong Kong, the EU, South Korea, Singapore, and the US, tightened cryptocurrency regulations, according to a report by TRM Labs.

This initiative shows Hong Kong policymakers’ determination to rebuild investor confidence in virtual assets, following a number of major financial scandals involving cryptocurrencies.

Hong Kong attracts a wave of financial services providers eyeing opportunities in the wealth management and family offices space even as dozens of home-grown brokerages pull down shutters.

Readers discuss the importance of seeing both sides for conflict resolution, striking a balance between development and wildlife protection, investors’ expectations, and the optimal temperature in MTR train cabins.

City leader John Lee says regulator powers may be bolstered, after watchdog explains it cannot close Hounax platform at centre of alleged HK$148 million scam.

Some victims of Hounax scam say watchdog issued warning over investment platform too late, as lawmakers call for shake-up to end ‘unregulated vacuum’.

The futures are expected to support greater international participation in China’s equities and fixed-income markets, and further broaden investment and risk-management opportunities in Hong Kong, HKEX said.