Topic

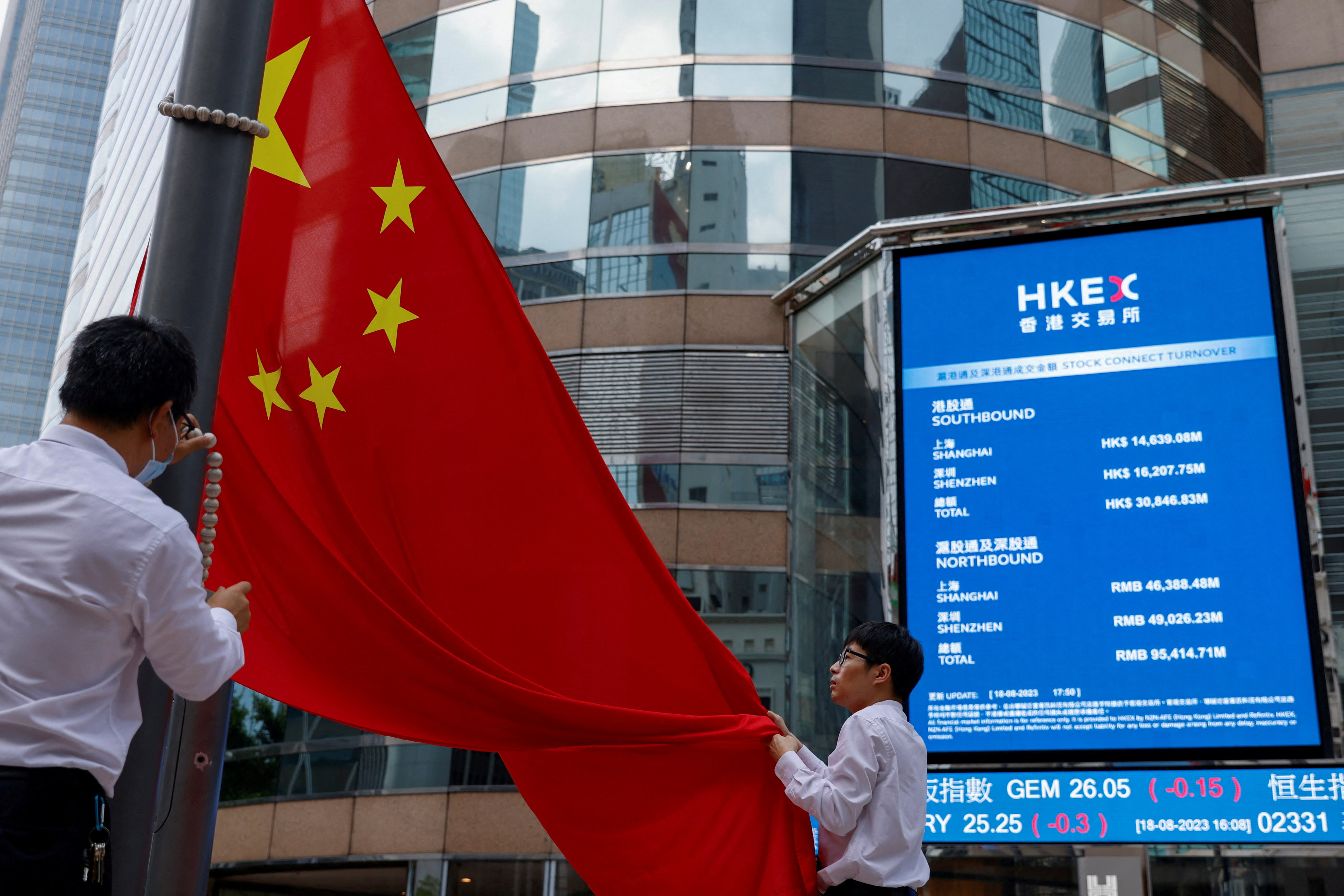

The mechanism by which international investors can trade via the Hong Kong stock exchange to directly access stocks listed in mainland China. The scheme, launched in November 2014, adds more than 800 companies with market capitalisations equivalent to US$1 billion or more to the universe of stocks available to global investors. It marks a significant reform and liberalisation of China’s capital markets.

Team set up by Hong Kong financial secretary will not only consider business and finance, but also geopolitics and US-China tensions.

As Beijing halves stamp duty on share deals to lift investor confidence, Hong Kong is seeking greater liquidity to strengthen its position.

Liquidity begets liquidity; and Hong Kong’s financial policy that is closely coordinated with mainland China has shown to be a winning formula.

Trades in local dollar or yuan in city stock market will offer greater choice to those investors seeking to diversify not only in shares but also currencies.

- Some mainland companies with strong fundraising needs may opt to transition their listing plans to Hong Kong, according to Deloitte’s Edward Au

- Central government is asking mainland’s leading companies to prioritise Hong Kong as their overseas listing venue, UBS banker says

China Securities Regulatory Commission on Friday announce five measures to further enhance connectivity between mainland and Hong Kong capital markets.

China’s capital market regulators have announced a package of measures to boost liquidity, attract international investors and enhance competitiveness between the mainland and Hong Kong.

Hong Kong stocks fell on Friday as investors were rattled by reports of Israeli missiles hitting Iran, with the heightened Middle East tensions triggering a scramble for safe haven assets.

The erratic performance of Chinese stocks is not giving investors the confidence to commit their funds for the long haul, so some are betting on proxies outside the country, according to top wealth managers.

Hong Kong stocks struck five week lows as consensus-beating GDP data reduced expectations of a rate cut in China, while weak retail, industrial and property data weighed on sentiment.

Hong Kong stocks declined to three week-lows as rising geopolitical tensions dealt a further setback to investor sentiment, already jittery ahead of a batch of economic data due to be released during the week.

Stocks pare gains in week as traders continue to dial back bets on a rate cut in June amid concerns about sticky US inflation data. Trading shrinks as markets in mainland China are closed for a holiday.

Hong Kong stocks retreated after expectations of rate cuts by the US Federal Reserve were dealt a setback by strong jobs and factory orders data in the world’s biggest economy.

Hong Kong stocks jumped by the most in three weeks, with investor sentiment lifted by a manufacturing rebound in the world’s second biggest economy and as Chinese smartphone and gadget maker Xiaomi reported solid orders on its debut in the world’s biggest electric vehicles (EV) market.

Chinese stocks took the limelight in the region as a rebound in manufacturing fanned optimism about the nation’s economic recovery. Foreign funds have snapped up more than US$11 billion of them over the past two months.

Global fund managers have increased their exposure to Chinese yuan-traded stocks for a second month in March, indicating that foreign appetite for these shares is recovering.

Chinese stocks advanced on the back of an earnings-fuelled rally in state-owned banks which reported steady financial results and gold stocks after bullion hit a fresh peak.

Has China’s long march to recouping stock market losses begun, after a US$1.75 trillion bounce in value from January lows? Many sentiment indicators have reached inflection points, backstopped by state intervention. Or do market bears still hold sway?

Samsonite is exploring a dual listing plan for its shares, a surprise move that tempered market speculation about a potential offer to take the luggage maker private.

Hong Kong stocks made a firm start after the US Federal Reserve’s dovish outlook brightened the prospects of lower funding costs in the months ahead.

The Hong Kong stock market posted gains driven by corporate earnings announcements but investors were cautious awaiting central bank monetary policy moves after benchmark rates were held steady

WuXi AppTech, WuXi Biologics and Xpeng weighed on the market as fourth-quarter earnings of Chinese companies trail those of peers in the rest of Asia, according to Goldman Sachs.

Hong Kong stocks recovered from a weak start after China’s economic data triggers hopes of more policy easing in the world’s second-largest economy.

Hong Kong stocks eased amid caution about corporate earnings although property sector shares advanced amid hopes of state support.

South Korea plans to review the sale of potentially high-risk investments after a probe found that banks mis-sold China-linked structured products, exposing retail investors to more than US$4 billion in losses.

The minimum asset requirement for investing in Hong Kong equities via the Stock Connect scheme should be cut to 100,000 yuan (US$13,900) from 500,000 yuan, SFC chairman Tim Lui says.

Hong Kong stocks rose, amid expectations global central banks will ease monetary conditions this year following dovish comments from heads of the US Federal Reserve and the ECB.

Hong Kong stock markets weakened, led by big losses in Wuxi Biologics and Wuxi AppTec, after a US bill proposed restricting business with Chinese biotech companies on national security grounds.

Tech stocks lead Hong Kong stock markets higher ahead of e-commerce giant JD.com’s results as focus returned to corporate earnings after mood was dampened by the lack of stimulus at China’s ongoing annual parliamentary meeting

Hong Kong stocks slumped amid worries the targets set by Beijing was a signal by authorities about the economic headwinds in China.

Hong Kong stocks ended unchanged but the mood was cautiously optimistic as investors awaited details from a meeting of lawmakers in Beijing, where it is widely expected that steps to support the market and the economy will be unveiled.

The government’s recent adjustments are ‘steps in the right direction’, but further relaxations are needed to revitalise the industry, according to the Asian Securities & Financial Markets Association.

Foreign investors bought a net 60.7 billion yuan (US$8.4 billion) of onshore shares in February through the Stock Connect programme, ending an unprecedented six months of selling.

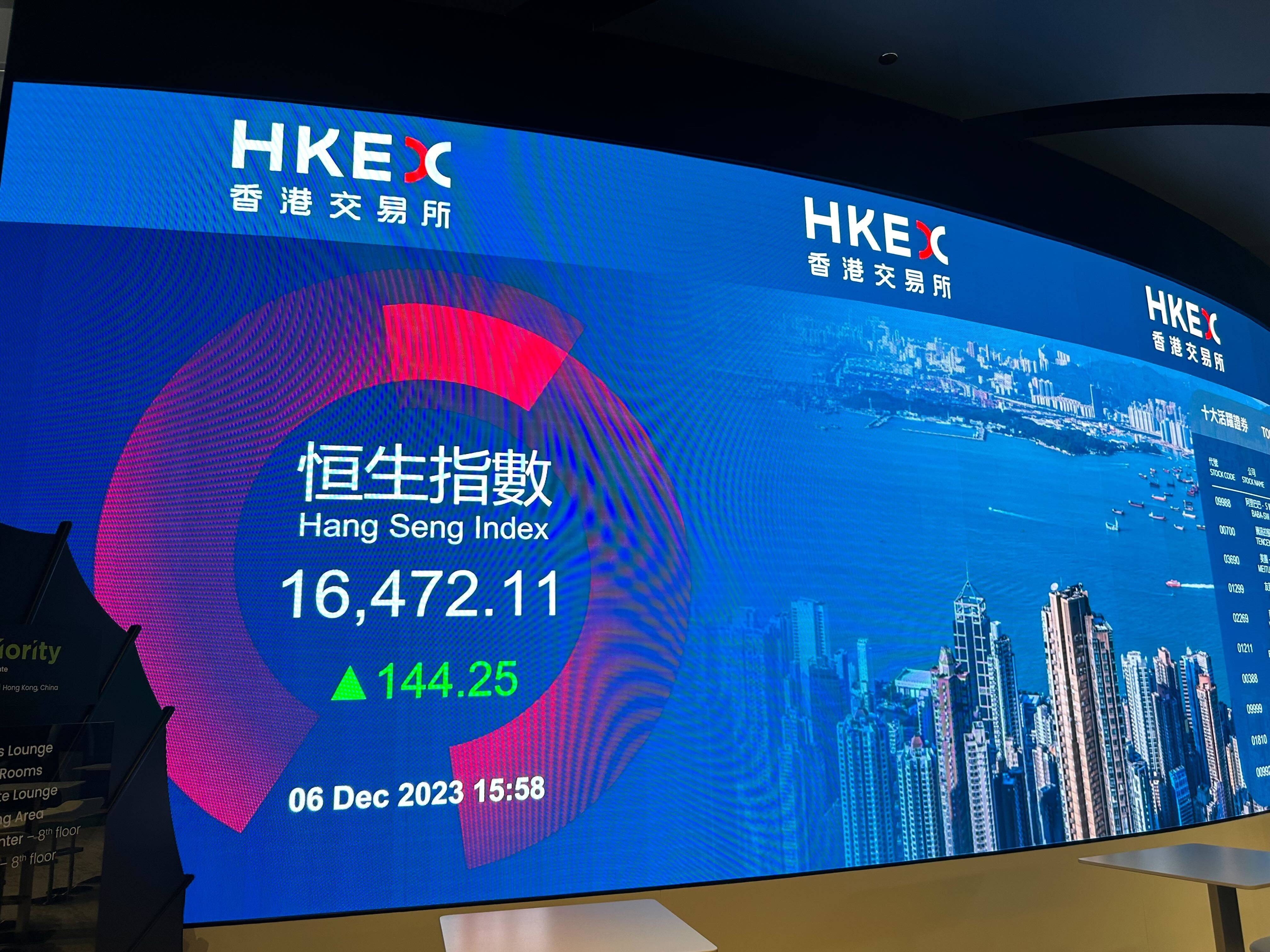

The Hang Seng Index capped a third week of gains despite a choppy trading on Friday as traders banked on more China policies to lift stock prices. New home prices fell in fewer mainland cities last month.