Topic

Stock market action from around the world, with a focus on Hong Kong, China and the rest of Asia.

Both Beijing and the West will cherry-pick and distort the numbers as their rivalry escalates, so we all need to remain mindful and alert.

- Winding-up petition against debt-laden developer Times China Holdings relates to US$266 million debt

- Times China is seeking to restructure US$11.7 billion worth of offshore debt in its latest efforts to avoid liquidation

Hong Kong stocks struck five week lows as consensus-beating GDP data reduced expectations of a rate cut in China, while weak retail, industrial and property data weighed on sentiment.

More divestments to come, analyst says, as conglomerate aims to cut debts by US$1.38 billion annually in the next two to three years.

Hong Kong stocks declined to three week-lows as rising geopolitical tensions dealt a further setback to investor sentiment, already jittery ahead of a batch of economic data due to be released during the week.

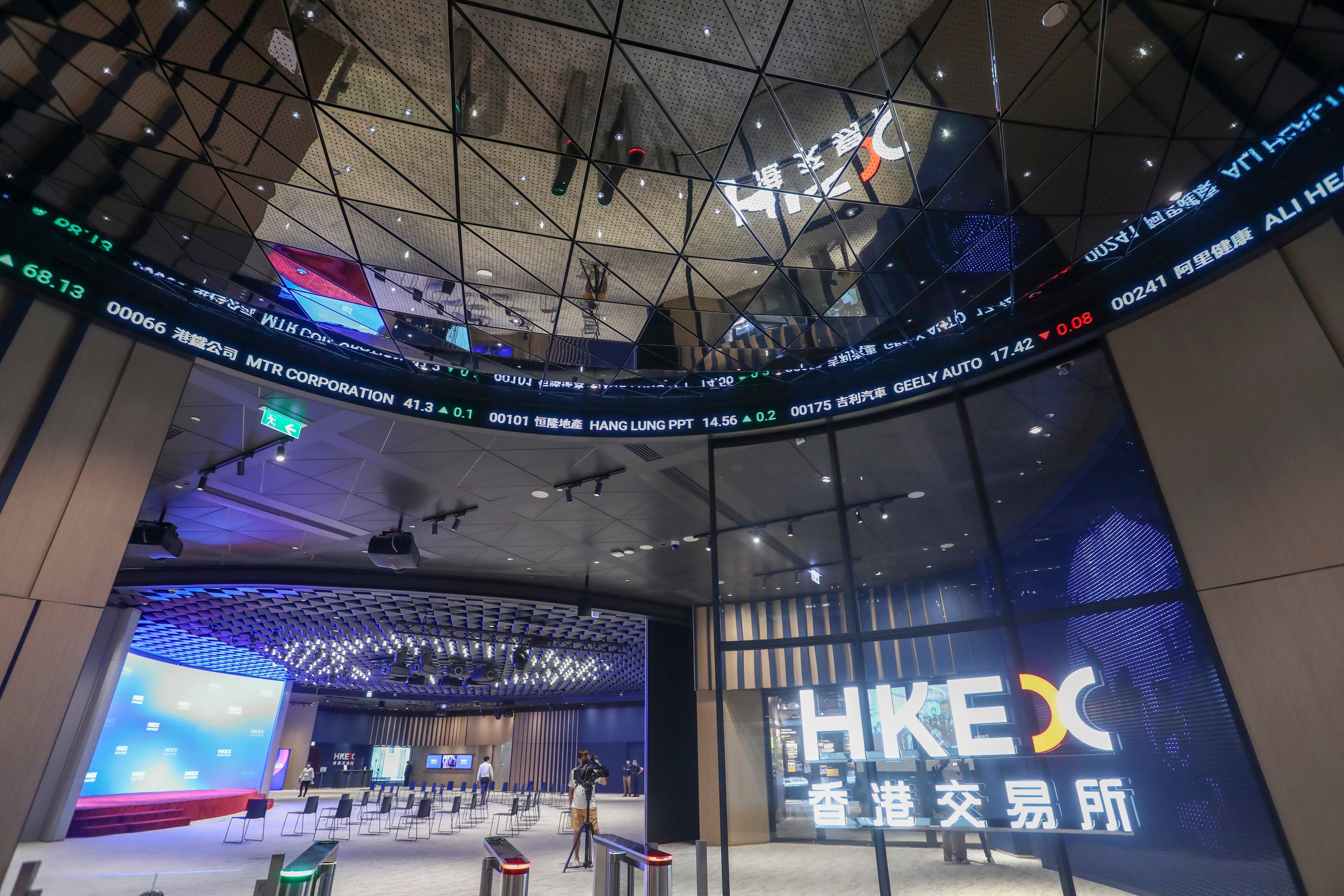

Laura Cha worked hard to elevate Hong Kong’s prominence on the international stage since she became the first and only female chairman of HKEX in 2018. As her tenure draws to a close, she believes that aim is no less important today.

Readers discuss suggestions that stringent checks on investors might scare them away, the need to widen pavements near beaches, and making payment on public transport more convenient for visitors.

A document published by the nation’s cabinet on Friday promises to promote the ‘high-quality’ development of China’s capital market by strengthening supervision and guarding against risks.

Hong Kong stocks eased, pressured by the weak Chinese yuan currency and following trade data that showed a contraction in exports from the world’s second-largest economy.

Truong My Lan, 67, was found guilty of embezzlement, bribery, and banking regulation violations for orchestrating a massive fraud using hundreds of ghost companies.

Hong Kong stocks tumble after data suggested China’s consumption demand remains weak and as investors lowered their bets on the US Federal Reserve cutting rates in June.

Hong Kong stocks rose as a growing number of corporate buy-backs triggered bets that the market is nearing a bottom.

China’s stockbrokers took another pay cut in 2023 as the double whammy of a slumping equities market and a government crackdown on corporate extravagance eroded the incomes of financial workers. Things don’t look much better this year, one fund manager says.

Sentiment has been recovering after a visit to China by US Treasury Secretary Janet Yellen, as traders await March economic data due later this week.

Companies in Saudi Arabis and Indonesia have shown a genuine interest in Hong Kong’s IPO market, Bonnie Chan Yiting, CEO of Hong Kong Exchanges and Clearing, says at a Legislative Council meeting on Monday.

Yield-hungry Chinese investors are flocking to pockets of strength as property woes, volatile stocks and falling deposit rates reduce their options.

Hong Kong stocks ended steady but the mood was cautious as ahead of economic data releases that will drive sentiment later in the week.

Stocks pare gains in week as traders continue to dial back bets on a rate cut in June amid concerns about sticky US inflation data. Trading shrinks as markets in mainland China are closed for a holiday.

China’s state-directed buying binge has swollen the size of exchange-traded funds (ETFs) tracking the underlying benchmark CSI 300 Index, helping them outperform the market while boosting their asset-size ranking.

Global fund managers have become more positive about Chinese stocks after the securities regulator took a flurry of forceful measures to halt a three-year decline, according to a joint-venture brokerage of HSBC Holdings.

Alibaba Group spent US$4.8 billion to repurchase its own shares in Hong Kong and New York last quarter, the most since late 2021, to boost returns to shareholders.

Hong Kong stocks retreated after expectations of rate cuts by the US Federal Reserve were dealt a setback by strong jobs and factory orders data in the world’s biggest economy.

Bond funds, driven by rate cut hopes, outperformed their stock market peers, which helped them gain a dominant share of issuance in the first quarter

‘The time to buy is when everyone hates the market and it’s cheap, which is now the case in Chinese equities,’ especially as there are signs that the country’s economic leaders are preparing stimulus measures, the hedge fund billionaire said in his LinkedIn blog.

Lack of interest has more to do with lacklustre IPO activity than the reform per se, which will draw more interest when listings pick up, analysts say.

Hong Kong stocks jumped by the most in three weeks, with investor sentiment lifted by a manufacturing rebound in the world’s second biggest economy and as Chinese smartphone and gadget maker Xiaomi reported solid orders on its debut in the world’s biggest electric vehicles (EV) market.

Investors should exercise more caution when it comes to the valuations of Chinese stocks, as corporate earnings growth is set to slow because of Beijing’s pursuit of high-quality economic growth, according to China’s biggest money manager.

Chinese state intervention has tentatively put a floor under stocks, but corporate earnings show little sign of providing upwards momentum as pressure is building for investors to pocket profits from the decent gains the market has made.