Topic

Daily analysis of the major talking points in the worlds of business and investing with a focus on implications for doing both in mainland China and its key financing hub - Hong Kong.

- The speed of India’s rise in consumerism is outpacing China’s as the gap between the two countries’ markets continues to narrow

- If it wants to maintain its lead as the world’s top market, China must broaden its focus to include rural areas and cater to often-overlooked consumer bases

While Asia’s property markets have no shortage of stories, some of the most consequential are also among the most overlooked by investors. The strength of Seoul’s office market, more affordable luxury residential property and Japanese investment in Australian property all merit greater attention.

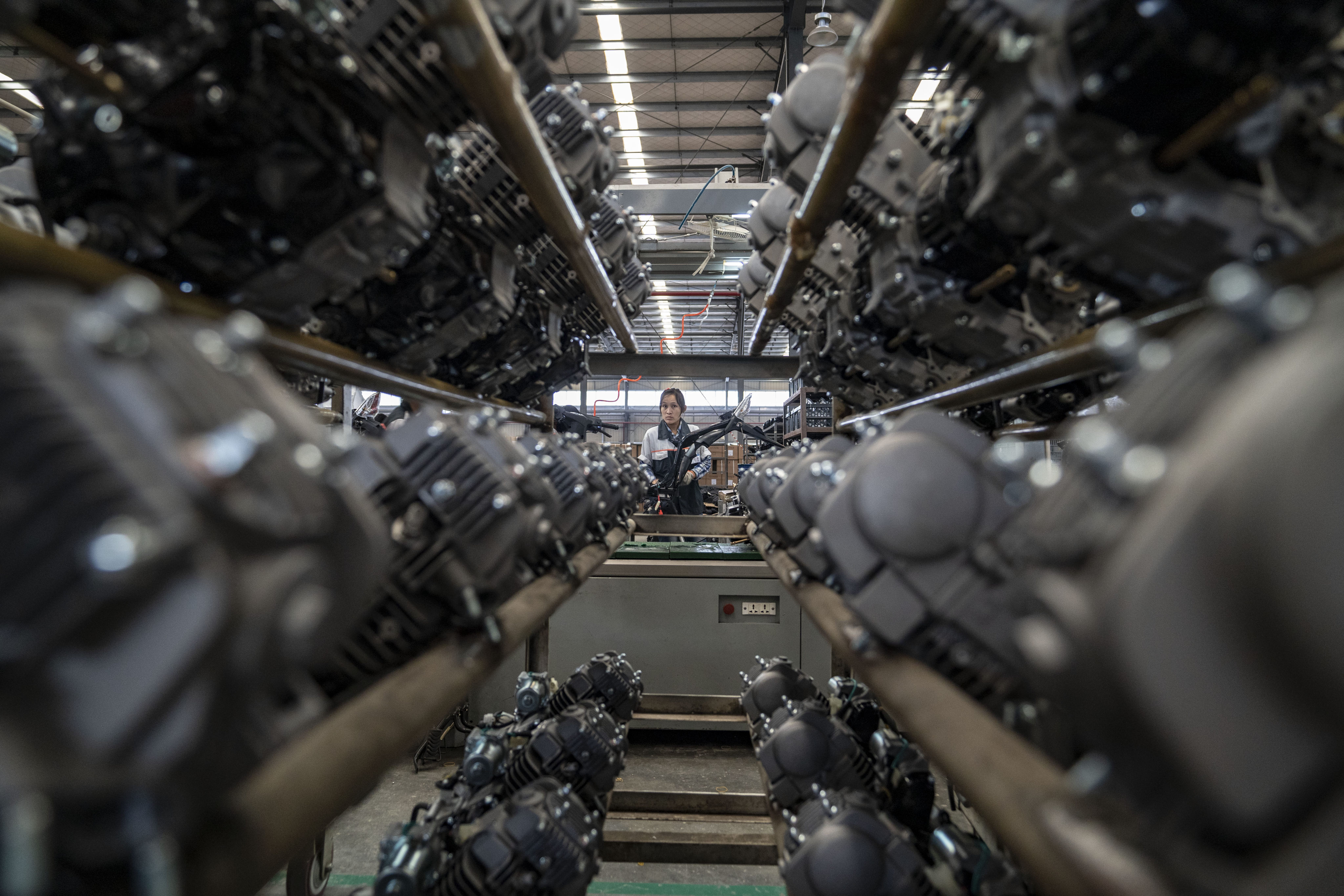

As global supply chains are reshaped, countries such as Vietnam and Mexico are becoming attractive manufacturing hubs. Chinese-backed factories in the US might face resistance, but the job growth and knowledge transfer they bring will benefit the American economy.

As Asia looks to the future, the continued growth of green jobs in the energy transition will be a cornerstone for building a more prosperous, resilient and sustainable regional economy which outpaces the progress seen in developed countries.

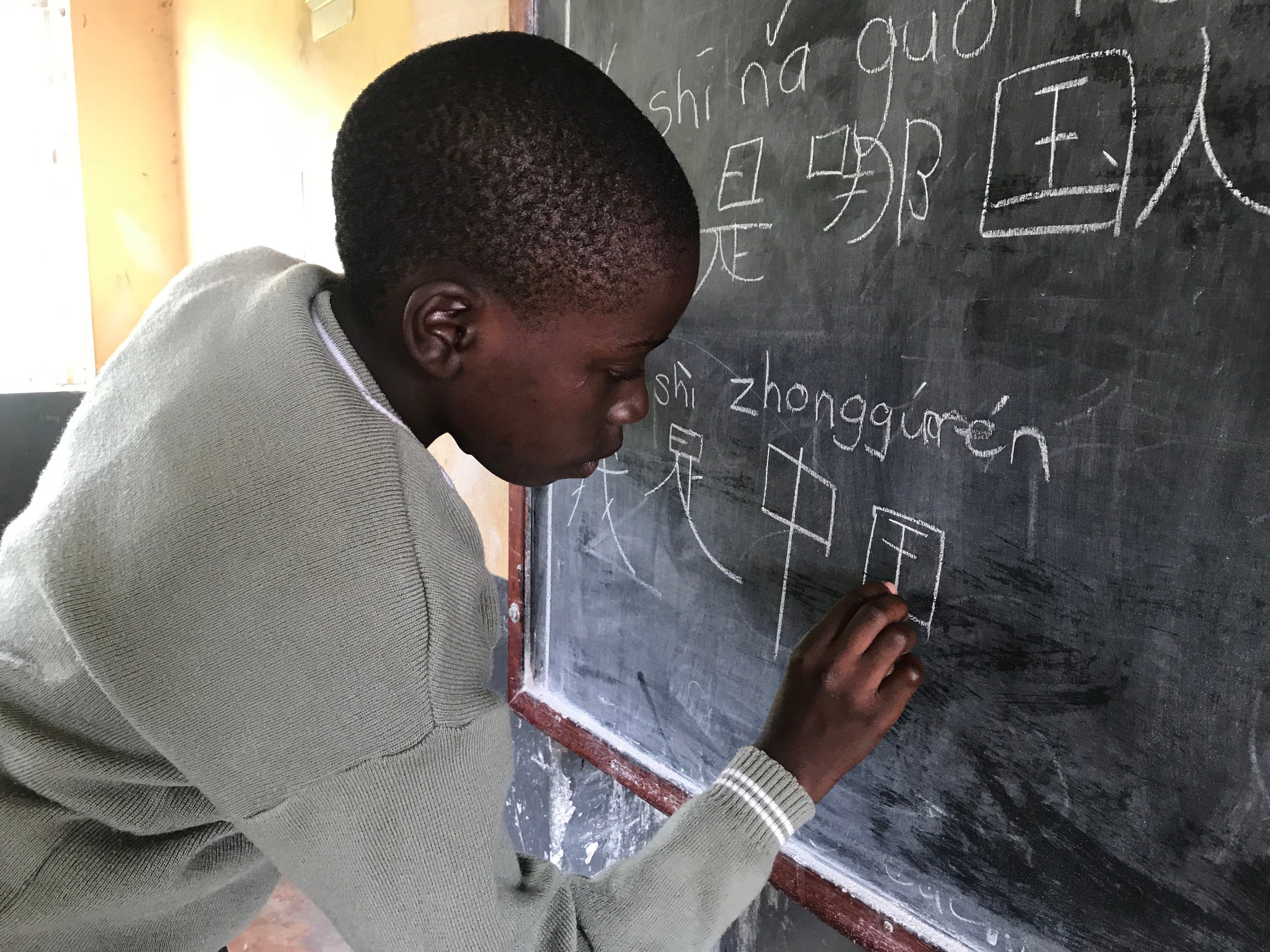

As major investors displacing the traditional Western powers, China and the GCC are precipitating a reconfiguration away from the North-South flow of development resources.

Hong Kong’s move to scrap long-standing cooling measures in February was a breath of fresh air at a time when other markets are turning inward. The city deserves credit for adopting a contentious policy while Canada, Singapore, Australia and others are making life harder for foreign homebuyers.

The US, Europe and Japan will not gladly sacrifice their IMF quotas to give China and others more voting rights. But a failure to reform the organisation will worsen rifts and weaken its ability to deal with looming global crises.

Just as the Sevens rugby tournament, with its changed format, draws crowds, so Hong Kong is drawing investors again with a more mainland-led economy.

While the US is mired in infrastructural challenges and market inertia, China offers a supportive EV ecosystem and a multimodal transport system in which EVs can thrive.

Planning restrictions are constraining supply in all sectors of Australia’s residential property market, driving up prices and rents, but the lack of a clear way forward on student housing threatens to hold back the potential of a sector that is increasingly important to the Australian economy.

Office markets in Asia are performing well and the shift to hybrid working has had less of an impact, yet investment in the sector has fallen sharply. Asia’s office markets need a stronger narrative, one that differentiates the sector more clearly from its counterparts in the US and Europe.

Beijing has shown no urgency at its NPC meeting to reboot or stimulate its economy in a way that would support its target, dashing the hopes of its neighbours worried about the drag from an economic giant fighting decline.

The end of more than a decade of cooling measures for Hong Kong’s property market is welcome and has sparked a surge in new home sales. These changes must be put in proper context, though, as several other factors will be more consequential in setting the property sector’s course.

Efforts to keep Chinese electric vehicles out of the US will only hurt American consumers and manufacturers in the long run. Instead, the Biden administration should welcome Chinese carmakers into the US to improve innovation and competitiveness.

The surge in Japan’s stock market looks out of place and unsustainable in an economy with a shrinking population and falling real wages. Chinese investors shifting money to Japan in the hope of catching the wave should be wary of being left behind when this bubble pops – possibly this year.

Deteriorating affordability has left many Australians struggling in the housing market, but foreign buyers’ interest remains strong. Record migration, China’s housing crisis, Australia’s stability and Asian private wealth’s influence are driving the surge.

To better understand the current conditions driving record stock prices across the globe, investors would do well to learn the lessons of history and look back at the situation in Germany after the fall of the Berlin Wall.

Hong Kong has made a modest contribution to the global climate fight by developing two simple tools SMEs can use to track their carbon emissions. The city has the potential to be a leader in the new corporate governance system in the climate change era.

Given the bleak domestic and external backdrop, the strong performance of China’s commercial real estate investment market is remarkable. It shows that a solid domestic investor base, a sharper repricing of property values and policy support for key sectors can make a difference.

The middle class has long been seen as the core of China’s future prosperity, but a depressed stock market and home values are sapping their confidence. The nation is at a critical juncture when effective reforms are needed to channel the energy of the middle class into driving economic recovery.

The Japanese economy is a study in contrasts, with a roaring stock market and record corporate profits set against stagnant wages and shrinking GDP. Decades of prioritising a weak yen over structural reform have deadened Japan’s animal spirits and hurt its attractiveness as an investment destination.

Compared to markets in the US and Europe, both prices and rental yields have been slow to adjust. As a result, affordability has taken a hit and investors are thinking twice. Yet Asia’s strong underlying fundamentals are undoubtedly an asset.

Donald Trump’s pledge of expanded, ‘eye for an eye’ tariffs if he wins the presidency threatens a return to an era of depressed trade and growth. US firms, importers and allies should prepare for the effects of Trump’s possible re-election.

From pensions to medical care, China’s rural-urban divide must be urgently addressed. Or just about everyone outside the rich middle class will be left out of the silver economy.

Given high borrowing costs, cooling measures and a surge in private home completions, it would be astonishing if Singapore did not see a slowdown. While the property sector is losing momentum, it is the kind of slowdown landlords and investors in most other markets would envy.

As a developing country, China does not have to give directly to UN climate funds, such as the loss and damage fund. This has fuelled a debate over outdated categories.

Shares on the Hong Kong bourse offer excellent value and the market will receive unstinting support from Beijing. While the US and European markets are outperforming Hong Kong’s now, their ability to keep inflation down relies on the weakness of China’s post-Covid economy.

Domestic developments such as rising wages and stricter environmental regulations in addition to geopolitical factors have pushed Chinese companies to shift their operations either within the country or overseas. This ability to adapt quickly to changing conditions will help Chinese firms to survive a challenging environment.

India’s growing middle class, the right government support and a favourable external environment have given the property sector wings to escape the headwinds buffeting markets elsewhere.

Lessons from the G20’s failed attempts at restructuring sovereign debt must be learned. Why not explore debt-for-development swaps, where loans are in effect turned into investments, and market-based alternatives such as packaging the debt into securities?