Topic

Latest news and features on wealth management, with a particular focus on Hong Kong, mainland China and Asia.

From wealth management to bonds and banking services, mainland China has shown further support for city as a financial hub

As Hong Kong continues to emerge from its post-Covid slump, proposed confidence-building measures in line with safety nets at a global level can only help.

The likely impact of the US lender’s collapse is that China’s tech elite will look to banks in Hong Kong, Singapore and even Europe.

When looking for a friendly, experienced jurisdiction to help protect their wealth and legacies, the world’s richest need look no further than Hong Kong.

Lockdown fatigue and fear of a mostly non-lethal virus has left China’s entrepreneurial class discouraged, hurting the people needed to achieve national goals.

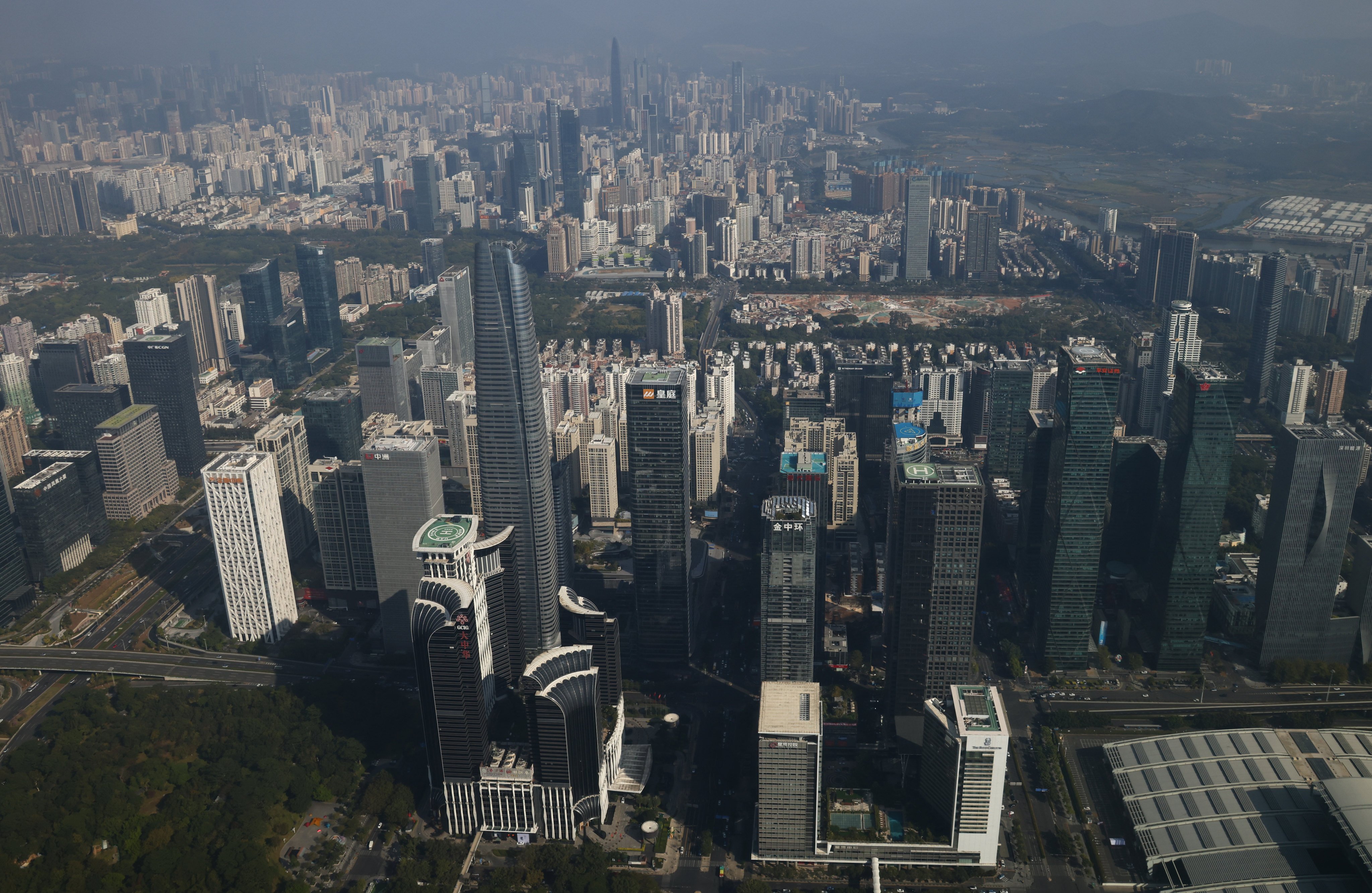

- Hong Kong offers wealth management and stock market opportunities despite headwinds and uncertain economic outlook in China, top business leaders say

- Some 200 business leaders from across the region are in Hong Kong for a four-day summit of the Apec Business Advisory Council

BNP Paribas marks its re-entry into China’s market with hires, at a time when Morgan Stanley, Goldman Sachs and JPMorgan have all made rounds of job cuts in Hong Kong and China

Germany’s Allianz Global Investors looks forward to tapping mainland China’s ‘vast potential and steady growth’ after getting the green light to operate an onshore fund management company there, says regional head.

Frederic Genta, a high-ranking official from the principality, holds a flurry of meetings with government officials and investors in Macau and Hong Kong. ‘We can be a small door to Europe,’ he says.

AI is likely to make dramatic improvements to workers’ quality of life, but as with every new technology, some jobs will also be lost, Dimon says.

More than 40 of the 50 jobs the Wall Street firm plans to cut will be from Hong Kong and mainland China. Morgan Stanley joins a host of banks that have laid off bankers this year.

Wealth management is transforming into ‘a new virtual format in addition to the traditional finance space’, asset manager says.

The domain address of Sheikh Ali Al Maktoum’s private office leads to a webpage that says it ‘isn’t connected to a website yet’.

InvestHK says it has had 1,600 inquiries since March 1 launch, with 70 per cent of interest from professional services providers.

Financial Services and the Treasury Bureau says recent ‘talk of the town’ shows there is a general lack of understanding about family offices.

Readers discuss the opening of a family office by a prince from Dubai, how Cathay Pacific can give back to the city, portable toilets at outdoor events, and steps public libraries could take to promote the culture of reading.

Switzerland’s biggest lender expects Asia to be its future growth engine after the acquisition of rival Credit Suisse last year expanded its footprint and client assets in the region, says CEO.

Investors should exercise more caution when it comes to the valuations of Chinese stocks, as corporate earnings growth is set to slow because of Beijing’s pursuit of high-quality economic growth, according to China’s biggest money manager.

Gold purchases have soared in China in recent years, with investors seeking safe-haven assets amid the weak stock market and ongoing property crisis, but a number of scams have been reported.

LGT Group, the world’s largest royal family-owned private banking and asset management group, sees private equity continuing to be attractive to high-net-worth clients, especially in China.

Family office advisers see higher demand for art advisory services, including impartial expertise, collection governance and legacy planning from Chinese family offices.

Hong Kong’s revamped investment-migration scheme is paying off for insurers such as Prudential Hong Kong, which is planning to expand its product line to appeal to wealthy would-be Hongkongers.

Government official says no such protocol for routine courtesy meetings unless Chief Executive’s Office raised questions.

China’s finance sector was once freewheeling, but new regulations and mandates from officials suggest banks’ new role looks beyond simple profit-seeking.

The death of Zong Qinghou, formerly China’s richest man, is thrusting his only child into the spotlight. Her family fortune has dwindled as rivals outsell Hangzhou Wahaha Group by latching onto new trends and younger consumers.

‘Impact Link’, or iLink, underscores Hong Kong’s determination to harness its strengths and resources to drive positive change and to assist family offices in using ‘wealth for good’, Financial Secretary Paul Chan says.

Hong Kong’s ambitions as a wealth management and family office hub for Asia, offers significant private banking opportunities, top executives at Citigroup say.

Organised by the Financial Services and the Treasury Bureau and InvestHK, the summit will centre around four key topics: luxury and legacy, green technology, philanthropy and wealth legacy.

A product which allows residents of mainland China to make deposits in Hong Kong has underwhelmed as a route for investment, leaving potential users wishing for more expansive options.

The number of rich families in China declined for the second time in 15 years as the world’s second-largest economy tackles a slew of economic challenges.

The cuts are part of a broader cost-reduction programme launched globally this month, which is expected to save US$125 million and make 9 per cent of its workforce redundant.

The number of family offices in Hong Kong may have exceeded those established in major financial centres in the region as efforts in the past year to lure foreign capital started to show results.

Sheikh Ali Al Maktoum, the nephew of Dubai ruler, is opening a family office in Hong Kong, one of the first high-profile global investors to respond to the city’s campaign to lure the ultra-rich.

Analysts consider India a promising growth story, with significant economic expansion and an influx of capital into equities and fixed income.