South Korea moves Japan to trade ‘white list’ as President Yoon Suk-yeol consolidates upswing in ties

- South Korean President Yoon Suk-yeol makes ‘first move’ to remove trade obstacles with Japan, says Tokyo will ‘follow’ if Seoul takes initiative

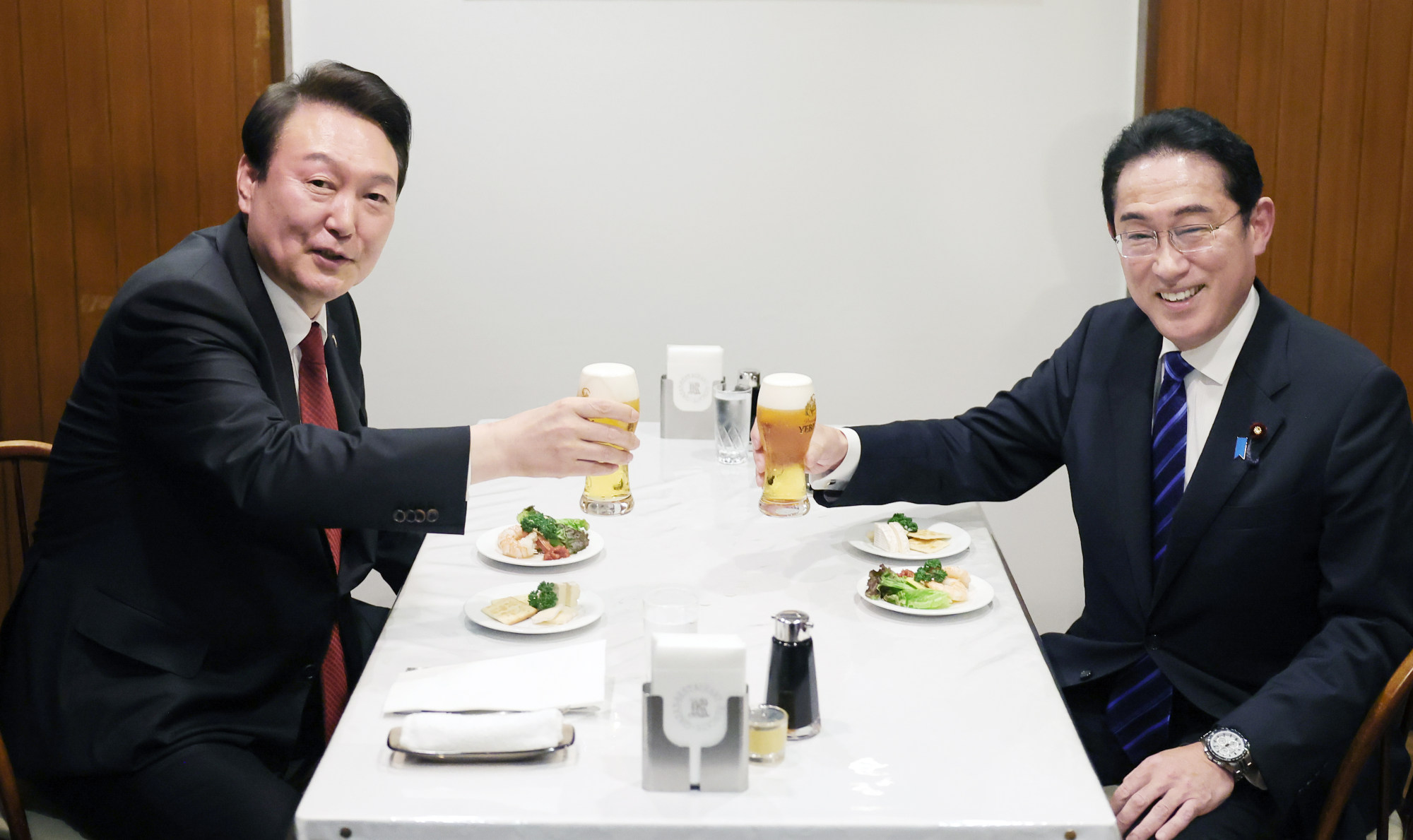

- Following summit with Japan’s PM Kishida, move aims to improve strained bilateral ties and combine semiconductor expertise, helping global supply chains

“I am making the first move to put Japan back on our white list and ordering today the trade ministry to embark on legal steps to do so,” said Yoon, according to his presidential office.

“If we first take the initiative in removing obstacles [that hinder the improvement of bilateral ties], Japan will certainly follow up with its own measures,” he said.

In so doing, Washington dangled a share of the US$50 billion already approved to revitalise the US chip industry.

The inaugural meeting of the Economic Security Dialogue took place in Hawaii, with the initiative aiming to address issues related to critical and emerging technologies, the supply chain resilience of semiconductors, batteries and critical minerals, plus data transparency amid the US-China tech war.

South Korea is seeking to attract investments worth 300 trillion won (US$230 billion) in a cluster of semiconductor-related enterprises expected to be set up in Gyeonggi province, surrounding Seoul, by 2042.

It is envisaged that the site will harbour five advanced chip fabrication facilities and around 150 materials, parts and “fabless” companies – where a firm designs and sells hardware and chips, but does not make the chips.

Yoon’s remarks on Tuesday came even as he saw his approval ratings sink amid criticism following Seoul’s controversial announcement that it would pay compensation to its own citizens who were forced to work in Japanese factories during World War II.

His government justified the decision as a realistic solution to resolve a colonial grievance that has long hindered relations between the two countries, but victims and critics have said the proposal does not hold Japan accountable.

Japan had hit South Korea with export restrictions in an apparent tit-for-tat against a 2018 South Korean court ruling calling for compensation for Koreans forced by Japan to work during World War II, prompting Seoul to appeal to the WTO.

How better South Korea-Japan ties could weaken a China-centric supply chain

The two countries agreed last week to return each other to their respective “white lists” of most trusted trading partners, promising to continue close consultations for the restoration of this status as soon as possible.

Seoul on Tuesday also said it had informed Tokyo of its decision to fully restore a military intelligence-sharing deal with Japan.

Signed in 2016, the General Security of Military Information Agreement (GSOMIA) was seen as a rare symbol of security cooperation between the two countries before former South Korean President Moon Jae-in’s government decided to terminate it in 2019 amid Tokyo’s export restrictions.

A senior trade ministry official said on Monday it would take at least two months for South Korea to go through the necessary administrative steps to restore Japan to its white list of trusted trade partners.

Japan, South Korea to resume mutual visits amid thaw in ties

Lee Won-deog, a political science professor at Kookmin University and an expert on Japanese affairs, said South Korea had adapted well to Tokyo’s export restrictions by importing goods from elsewhere or sourcing materials locally.

Therefore, he said, the two countries being back on each other’s white list and the removal of export restrictions “won’t bring about any significant increases in bilateral trade. These measures are rather highly symbolic measures, loaded with heavy political undertones”.