US, Chinese unicorns may lead, but South Korea shows it’s not a two-horse race

- South Korean banks remain reluctant to invest in start-ups, an aversion to risk that is a legacy of the 1997 financial crisis

- The government has pledged to invest US$5.9 billion in the field by 2022, but there is a long way to go – especially as the huge chaebol are still favoured

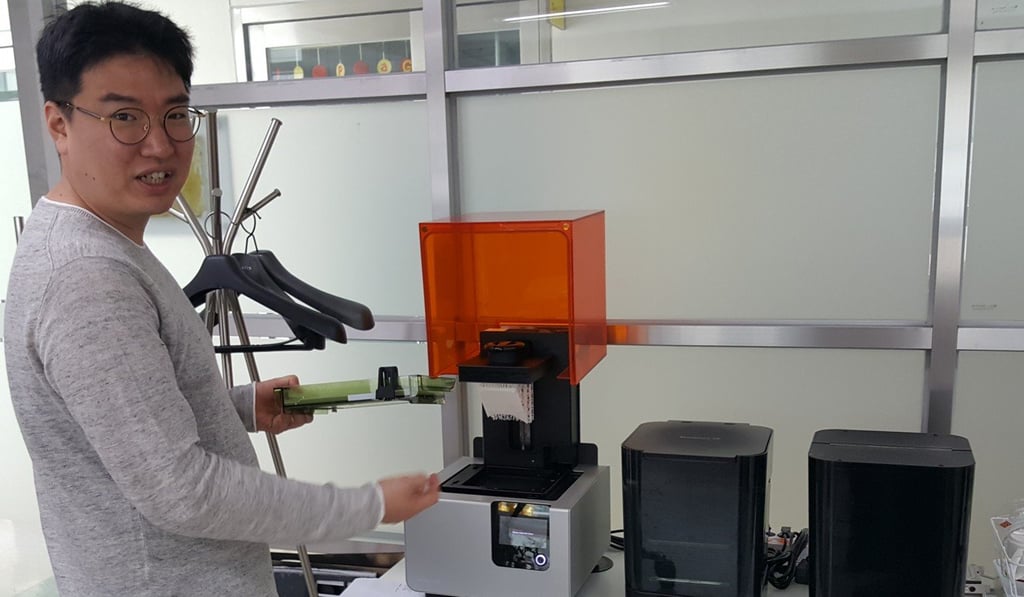

Park Jae-hyun is the 33-year-old chief executive of The Ant Institute, which fosters creative hobbies for people interested in arts and crafts. “Easy-to-do art education” being its motto, the start-up creates instructional videos such as making paper animals and painting watercolours of flowers.

With a target audience of adults and children alike, the company’s YouTube channel has so far logged 4,000 viewing hours and amassed 1,000 subscribers, allowing it to monetise its videos. However, The Ant Institute also makes commercial advertisements for private clients on the side to keep the business afloat.

“Not many start-ups make it through the ‘death valley’, or the first three years, because of the small window of opportunity for Korean start-ups,” he says. “Our country doesn’t have a big capital market like the United States or the European Union, where start-ups with solid ideas attract investments from all around.”

Someone who comes from nothing like Steve Jobs is ostracised in South Korea

But there has been a significant shift in the South Korean government’s attitude towards start-ups. The country’s Financial Services Commission recently pledged 7 trillion Korean won (US$5.9 billion) for start-up investments by 2022. This follows an investment of 8 trillion won allocated between 2018 and 2020 from a pooled investment fund run by the Korea Development Bank, a state-run policy lender, and K-Growth, an independent fund management company.

According to the Korea International Trade Association, South Korea’s annual investments into start-ups grew 106 per cent last year to US$4.5 billion, while the US and China grew 21 per cent and 94 per cent respectively.

This transformation has been driven in part by the success of South Korean “unicorns” – the term given to a start-up valued at US$1 billion or more. Such Korean companies include e-commerce website Coupang, valued at US$9 billion, and the video game developer Bluehole, valued at US$5 billion, according to tech trend forecaster CB Insights.