Advertisement

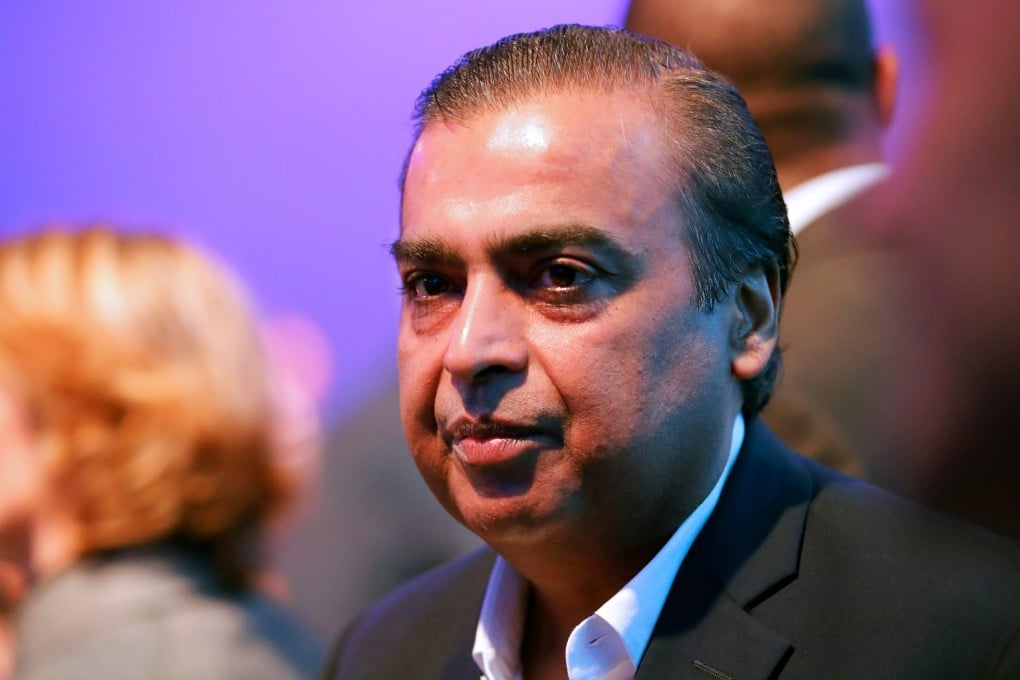

In India, a Facebook-led investment spree for Mukesh Ambani’s Jio Platforms

- In less than eight weeks, the digital arm of oil-to-retail giant Reliance Industries has attracted more than US$13 billion in investment

- Market dominance and its potential to grow are some of the biggest lures, though analysts say it’s also a bet on the acumen of India’s richest man

3-MIN READ3-MIN

Jio Platforms has only been around in its current form since November, yet the digital arm of oil-to-retail giant Reliance Industries – whose chairman Mukesh Ambani is India’s richest man – has attracted almost US$13.5 billion in investment in the past eight weeks alone.

As a wholly owned subsidiary, it was created to comprise Reliance’s telecoms division Jio Infocomm – the third largest mobile network operator in the world – as well as its music and video streaming apps.

Facebook was one of the first heavy hitters to take a stake, as part of a US$5.7 billion deal signed in April, closely followed by a slew of private equity funds including US-based TPG and L Catterton with US$598 million and US$249 million investments, respectively. In all, nearly 22 per cent of Jio Platforms has been snapped up so far, giving the unit an enterprise value of US$67.87 billion, according to Reliance.

Advertisement

Hemang Jani, an equity strategist at Mumbai-based Motilal Oswal Finance Services, said the development of Jio Platforms would be interesting to watch “because of the ecosystem Reliance is going to build”.

Advertisement

“From what we sense, total market size could be more than US$5 billion, realigning sectors like digital payments, retail, commerce, content and advertising,” he said.

Advertisement

Select Voice

Select Speed

1.00x