Advertisement

Japan lures TSMC with US$1.8 billion plan to revive domestic chip industry

- Tokyo is pulling out the stops to safeguard its access to semiconductors as a hedge against US-China tensions by attracting foreign manufacturers and marrying them with domestic firms

- At the heart of its plan is a US$337.2 million research and development project in Tsukuba that will involve the Taiwanese chip giant and more than 20 Japanese firms

Reading Time:4 minutes

Why you can trust SCMP

3

The Japanese government has placed semiconductors at the heart of its future economic growth strategy, announcing this week a research and development fund designed to attract foreign chip manufacturers and marry them with domestic firms.

The plans, outlined in a draft paper unveiled on Wednesday, indicate that Japan intends to do everything in its power to safeguard supplies of components that are critical to domestic companies but have been severely disrupted as a result of the trade dispute that is still simmering between the United States and China.

Tokyo is also concerned that its cutting-edge industries could be held to ransom by nations that produce a large number of the world’s semiconductors – such as China and South Korea – in the event of geopolitical differences of opinion.

Advertisement

Given those fears, the government’s strategy is to convince some of the biggest chip manufacturers in the world to set up research and fabrication facilities in Japan, which will also help to keep domestic firms on the cutting edge of semiconductor development.

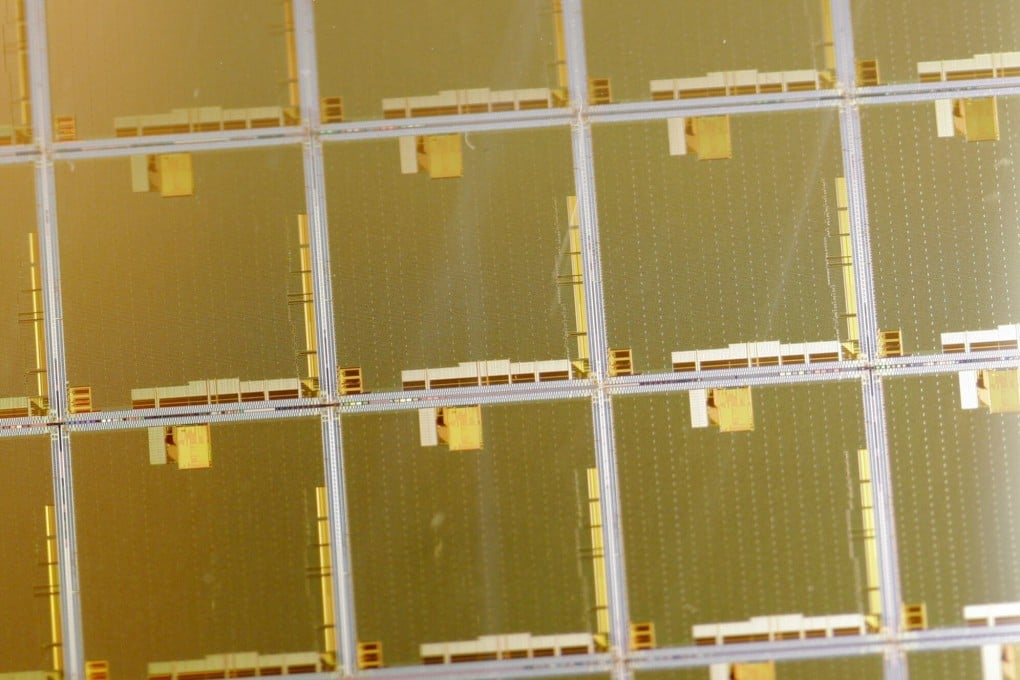

Taiwan Semiconductor Manufacturing Company (TSMC) is at the heart of the plan and Tokyo will have been delighted that the world’s largest chip manufacturer has agreed to open a research and development facility in Tsukuba, north of Tokyo, to work on next-generation semiconductors.

Advertisement

“The pandemic and trade rivalries in the last few years have made it quite clear that future industries will be squeezed and, to avoid that, traditional supply chains will need to change to become both more resilient and more flexible,” said Martin Schulz, chief policy economist for Fujitsu’s Global Market Intelligence Unit.

Advertisement

Select Voice

Select Speed

1.00x