Advertisement

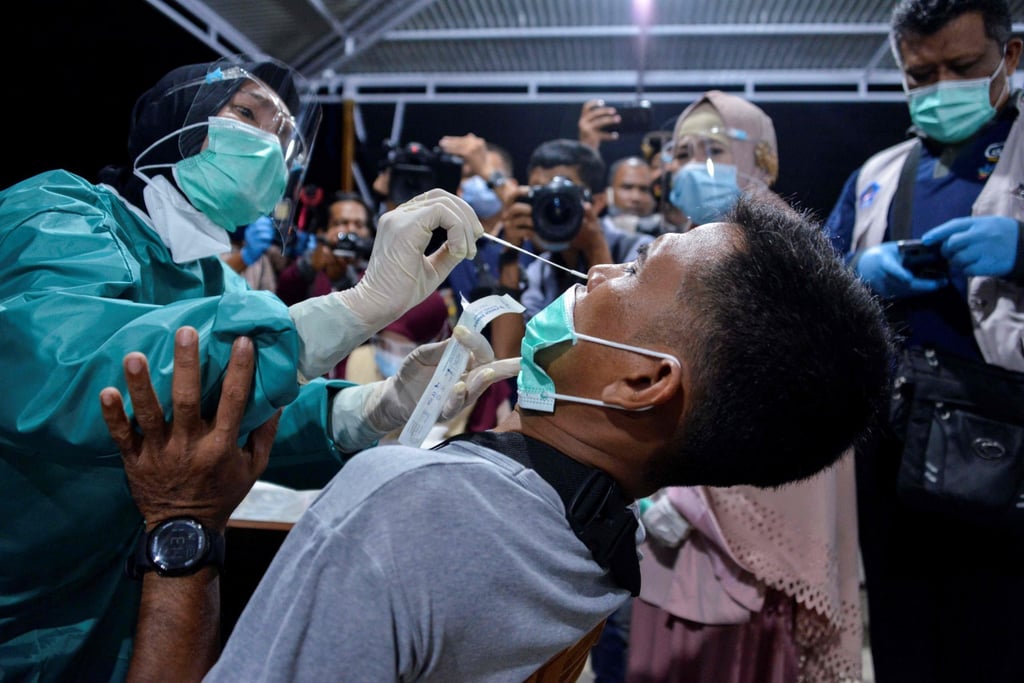

Indonesia targets its crazy rich Asians with 35 per cent income tax in bid to heal coronavirus-hit economy

- Those earning more than US$350,000 a year face the new rate as part of proposed overhaul that will also add VAT to foodstuffs, education and health care and target major carbon emitters

- Taxing the rich could prove lucrative for Southeast Asia’s largest economy, where ultra-high-net-worth individuals are proliferating at an even greater rate than in China

Reading Time:5 minutes

Why you can trust SCMP

8

In a bid to boost government coffers decimated by the coronavirus pandemic, Indonesia is considering a sweeping tax overhaul that would add VAT to foodstuffs, education and health care, hike rates for high-net-worth individuals and put major carbon emitters in the firing line.

Indonesian President Joko Widodo asked parliament recently to discuss proposals to amend the 1983 law on general tax provisions and procedures. A leaked draft of the government’s proposals showed it was seeking a new tax rate for the highest earners; a new carbon tax; and to widen the scope of VAT to include staple foods, education, health-care and social services, public transport, manpower, postal money orders and even coin-operated public telephones.

Indonesia’s need to collect more revenue comes after its budget deficit reached 6.09 per cent of GDP last year. Jakarta has allowed the deficit to grow as a response to the pandemic but has said it would return the deficit to within the legal limit of 3 per cent of GDP by 2023. The government hopes that if the tax reforms go ahead next year as planned it will not need to seek further foreign debt, which had reached US$418 billion as of April.

Advertisement

Key to its plan is raising the income tax rate for high-earners, defined as those with an annual income of at least five billion rupiah (US$347,540). Indonesian taxpayers are currently grouped into four tax brackets, ranging from 5 per cent to 30 per cent rates.

In comparison, Singapore also implements progressive income tax rates, ranging from 0 per cent to 22 per cent, while Malaysia’s rates are between 0 per cent and 30 per cent, and Hong Kong’s range from 2 per cent to 17 per cent.

Advertisement

Under the proposed amendment, the highest earners will be taxed at 35 per cent, five per cent more than at present.

Advertisement

Select Voice

Select Speed

1.00x