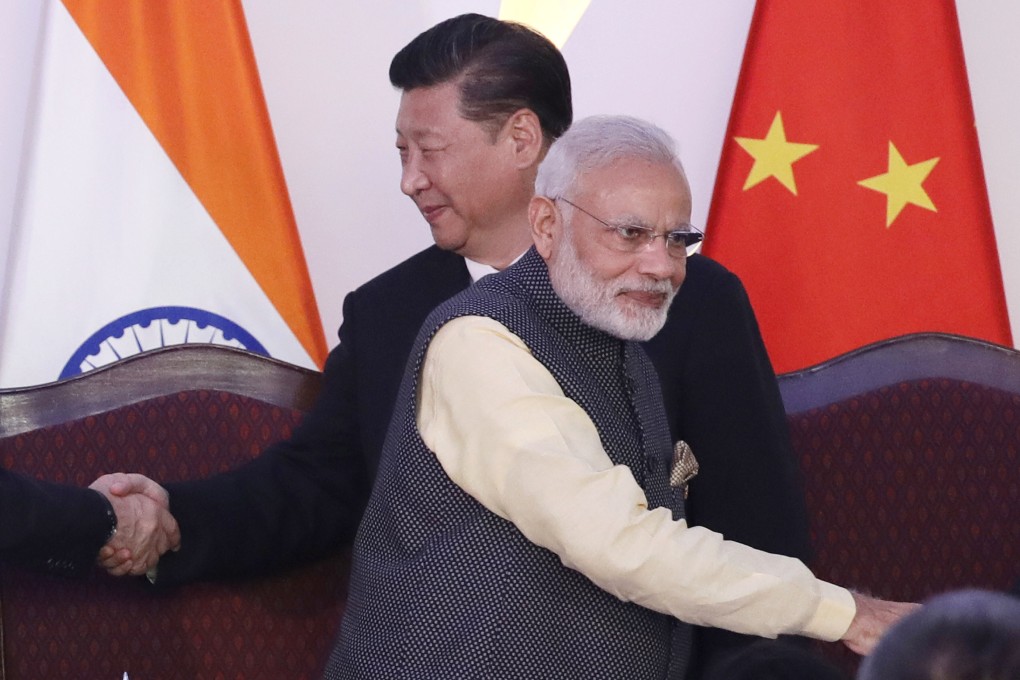

India can’t go ‘cold turkey’ on Chinese goods so trade keeps flourishing despite deep freeze in ties

- Indian Prime Minister Narendra Modi wants to promote self-reliance and reduce dependence on China for raw materials and components

- But it’s going to take time, as India’s factories rely heavily on Chinese inputs to make finished products and medicines

According to the latest official figures, the value of India’s imports from China leapt more than 66 per cent year-on-year to US$27.66 billion between April and July. Part of the import spike was driven by pandemic-related medical purchases, but Ajay Sahai, director general of the Federation of Indian Export Organisations (FIEO), expects bilateral trade to stay strong.

“Our trade with China is happening,” Sahai said. “It’s business as usual. I’m not seeing any impact on the dynamics of business demand.”

The value of India’s exports to China, meanwhile, jumped almost 22 per cent to US$8.89 billion in the April-July period. Last year, China supplanted the US and regained its place as India’s top trading partner with bilateral trade worth US$77.7 billion.

However, Sahai said India’s goal was never to go “cold turkey” on buying Chinese goods in its push for self-reliance but to gradually reduce dependency on Chinese imports for key sectors such as electronics, drug ingredients and telecoms equipment.