UAE and Saudi Arabia invest in Central Asia renewable energy deals, with Russia’s blessing

- Oil-rich nations signing huge green energy deals with the likes of Azerbaijan, Kazakhstan in a China Belt and Road region that Moscow politically dominates

- State-owned firms can make such investments as their governments have decided not to abandon their Russia investments or curtail relations over Ukraine, says analyst

Oil and gas giants the United Arab Emirates and Saudi Arabia are fast emerging as influential players in Central Asia amid an unfolding series of multibillion-dollar investments in renewable energy projects.

Deals sealed since July with Azerbaijan, Kazakhstan, Kyrgyzstan and Uzbekistan will build substantially on efforts to expand east-west energy corridors across a region that has long been politically dominated by Russia, and over the last decade become heavily indebted to China over Belt and Road Initiative projects, analysts said.

“For Gulf governments and investors, there seems to be a natural gravitational pull towards Central Asia, given the region’s position between Europe and East Asia,” said Robert Mogielnicki, a senior resident at the Arab Gulf States Institute in Washington.

The geopolitical significance of these Gulf investments has grown because the “strategic nature of Central Asia’s position has come even more into focus in the aftermath of the Russian invasion of Ukraine”, he said.

“This is a region that folks in Washington now understand they need to be following much more closely,” Mogielnicki added.

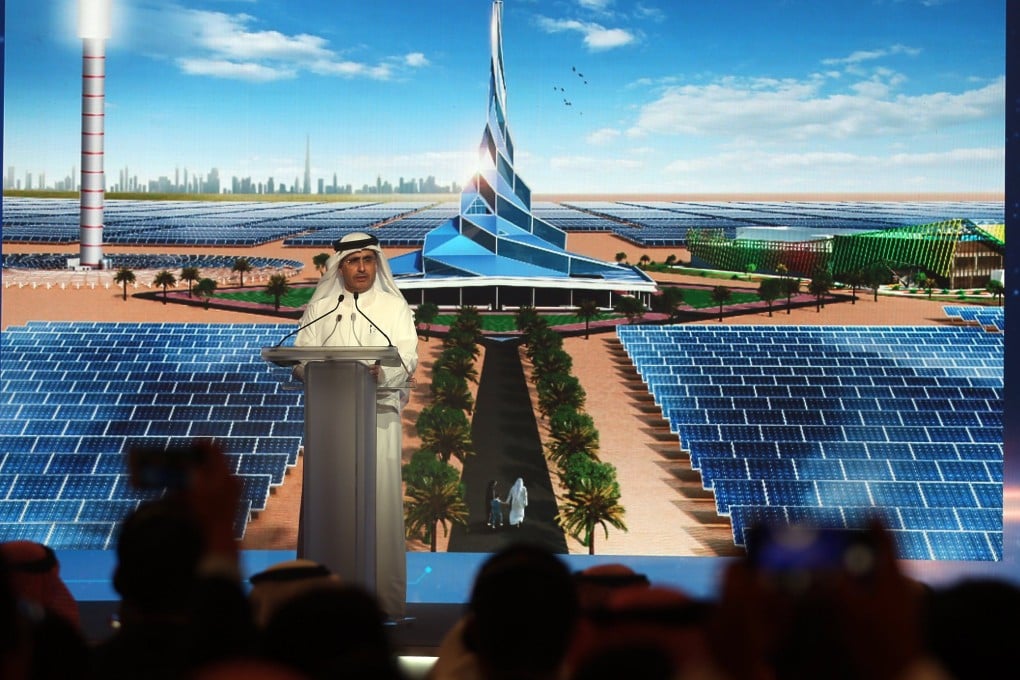

Last week, the UAE’s state-owned firm Masdar, a major global renewable power operator, unveiled deals to develop 5 gigawatts (GW) of solar and wind power projects in Azerbaijan and Kazakhstan. Each gigawatt is about 1 billion watts.