Is China railroading Kenya into debt?

A controversial Chinese-funded railway that will cut through the Nairobi National Park has become a new line of attack for those who oppose borrowing from Beijing

Last week a spanking new 750km railway built by Chinese companies connected the Ethiopian capital of Addis Ababa with Djibouti, dramatically cutting short a multi-day trek and winning accolades for opening up new opportunities for the two economies. But in neighbouring Kenya, the ride is getting a lot bumpier for another Chinese-made railway and Chinese projects in general, which are being blamed for the country’s debt pile-up.

Kenya last month approved the second phase of the standard gauge railway (SGR) line between Nairobi and Mombasa, overriding public outcry over the proposed route that cuts through the Nairobi National Park, the only national park in the world that sits within a city. President Uhuru Kenyatta signed a US$1.5 billion contract for the second phase of the SGR, funded by the People’s Republic of China and contracted to state-owned China Road and Bridge Corporation (CRBC), which critics say the government is railroading through without an environmental impact assessment.

China Railway Group sees One Belt, One Road boosting overseas revenue

“We are wondering if the Kenyan government has been coerced by China to carry on with the project regardless of the damage it may cause,” Kenya Coalition for Wildlife Conservation and Management chairman Sidney Quantai told This Week in Asia.

The latest SGR controversy adds to the long-running saga of a railway line that critics of the government say is overpriced and serves only to raise Kenya’s external debt, like several other projects in which the rapacious Chinese contractors are alleged to have been indulged in return for the lure of easy Chinese loans.

Alfred Keter, a member of parliament and fierce critic of the multi-party Jubilee government, alleges CRBC inflated the cost of the project threefold. He contrasts SGR’s costing of US$5.38 million per km with a railway line built by a Chinese consortium led by China Railway Materials in Tanzania that is costing US$3.18 million per km. “I wonder where this disparity is coming from, if not corruption,” Keter told members of the Public Investment Committee.

Obama aims to shore up ties with Kenya in face of Chinese competition

Opposition leader Raila Odinga says Kenyatta’s government has been borrowing at almost five times the rate of the former Grand Coalition government, in which he was the prime minister from 2008 to 2012. “But there is nothing to show for the big loans. We used to spend four per cent of our export revenue on servicing foreign debts. Now we spend 10 per cent,” Raila told the local Star newspaper.

Leaders like Raila have blamed soft loans from Beijing for the rapid rise in Kenya’s debt. With a US$600 million loan from China in June to meet its budget goals, Kenya’s external debt now amounts to seven times its annual budget, with China accounting for nearly 60 per cent of those loans. Loans from China have grown by 54 per cent between 2010 and 2014, according to the World Bank. Meanwhile, loans from Japan, which used to be the largest creditor, have fallen.

China Railway Construction wins pair of contracts in Africa

Debt owed to bilateral lenders almost doubled from US$2.85 billion in 2011 to US$4.7 billion in 2015, mainly due to Chinese lending. Loans from China increased by 657.33 per cent to US$2.73 billion over the period, dislodging Japan, Germany and France as the biggest lenders.

It was not until in 2008 that Kenyans got the first taste of Chinese largesse, with the Export-Import Bank of China agreeing to lend US$84.07 million to former president Mwai Kibaki’s government to finance two bypasses in capital Nairobi. CRBC executed the contract.

Thais to fund first phase of US$15b Thailand-China railway project

Within three years, the Kenyan government announced it had secured another US$156.06 million, again from Exim Bank of China, to finance a southern bypass to ease the traffic into the capital from the port city of Mombasa.

Economists say the wave of infrastructure financing deals secured from Beijing between 2008 and 2011 marked the beginning of Kenya’s economic transformation.

According to World Bank lead economist for Kenya, Apurva Sanghi, Beijing suddenly became a valuable bilateral partner for Kenya since it was not interested in local politics and was more than willing to offer critical financing in the sectors that traditional investors and donors had overlooked for decades. One such project that donors had been unwilling to finance was the US$3.23 billion SGR. In 2014, Exim Bank agreed to finance 90 per cent of it.

China rail project cannot happen overnight: Jakarta

“China’s loans compete with loans from traditional donors that attach conditions of good governance and transparency,” Sanghi said in a research paper titled ‘Deal or No deal: Strictly Business for China in Kenya’.

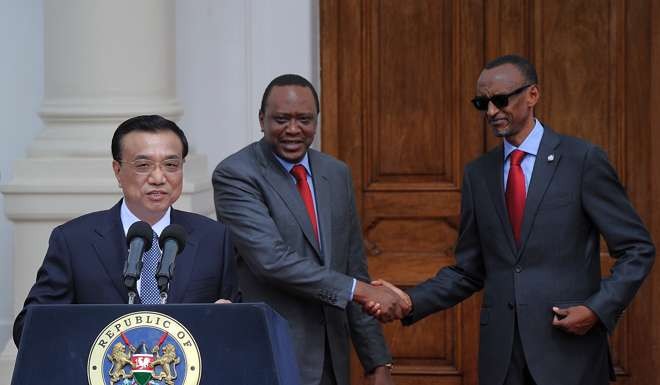

The depth of the Kenya-China ties was showcased in May 2014 when Premier Li Keqiang ( 李克強 ) landed in Nairobi for a three-day visit. Kenya secured another loan to build the SGR line, along with 16 more loans worth billions of dollars. A high point in China-Kenya relations, ironically this was the first time fingers began to be pointed at Chinese loans, with critics saying Kenya was now over-borrowing from China.

CRBC had by then executed its projects in record time. The quality and speed of delivery stunned ordinary Kenyans accustomed to potholed roads made by local contractors. But it was then that critics also began to allege that CRBC was inflating the bills and that the government was turning a blind eye to its overpriced projects, which were contributing to the country’s growing loan burden.

Richard Mungai is a Kenya-based journalist