Dubai to Hong Kong, follow the money (laundering)

Glittering skyscrapers, runaway real estate markets and back stories as sleepy fishing villages turned international finance centres aren’t the only things linking the two cities

To the believers, the glittering towers and man-made islands that characterise the Dubai real estate market are proof of an economic miracle.

A reminder of how a small fishing port on the edge of the desert took just decades to transform itself into a global investment hub. Yet for all the admirers, there are many doubters. Those who see its shimmering skyline as a facade, its reputation for secrecy an invitation for money laundering and who question whether an emirate once synonymous with gold smuggling has ever truly shaken its appeal to those with something to hide.

Those doubts gained traction with the recent publication of a report by the Washington-based Centre for Advanced Defence Studies, which found that the emirate’s real estate sector had been used by terror financiers, drug lords and war profiteers to launder money. It said individuals subject to sanctions by the United States and in some cases the European Union owned 44 properties – worth about US$28 million – in the emirate, while their expanded networks held an additional 37 properties, worth almost US$80 million.

How Macau became North Korea’s window to the world

The report, titled Sandcastles, did not merely confirm the long-held suspicions of many regarding Dubai. It cast its net farther, outlining links between sanctioned individuals and jurisdictions including Hong Kong, Syria, Romania, Mexico and the US. Not only that, but Hong Kong’s real estate sector was identified as being among a group (including Dubai, New York, Los Angeles and London) that saw “large amounts of illicit money flowing through their systems, constituting a global security threat.”

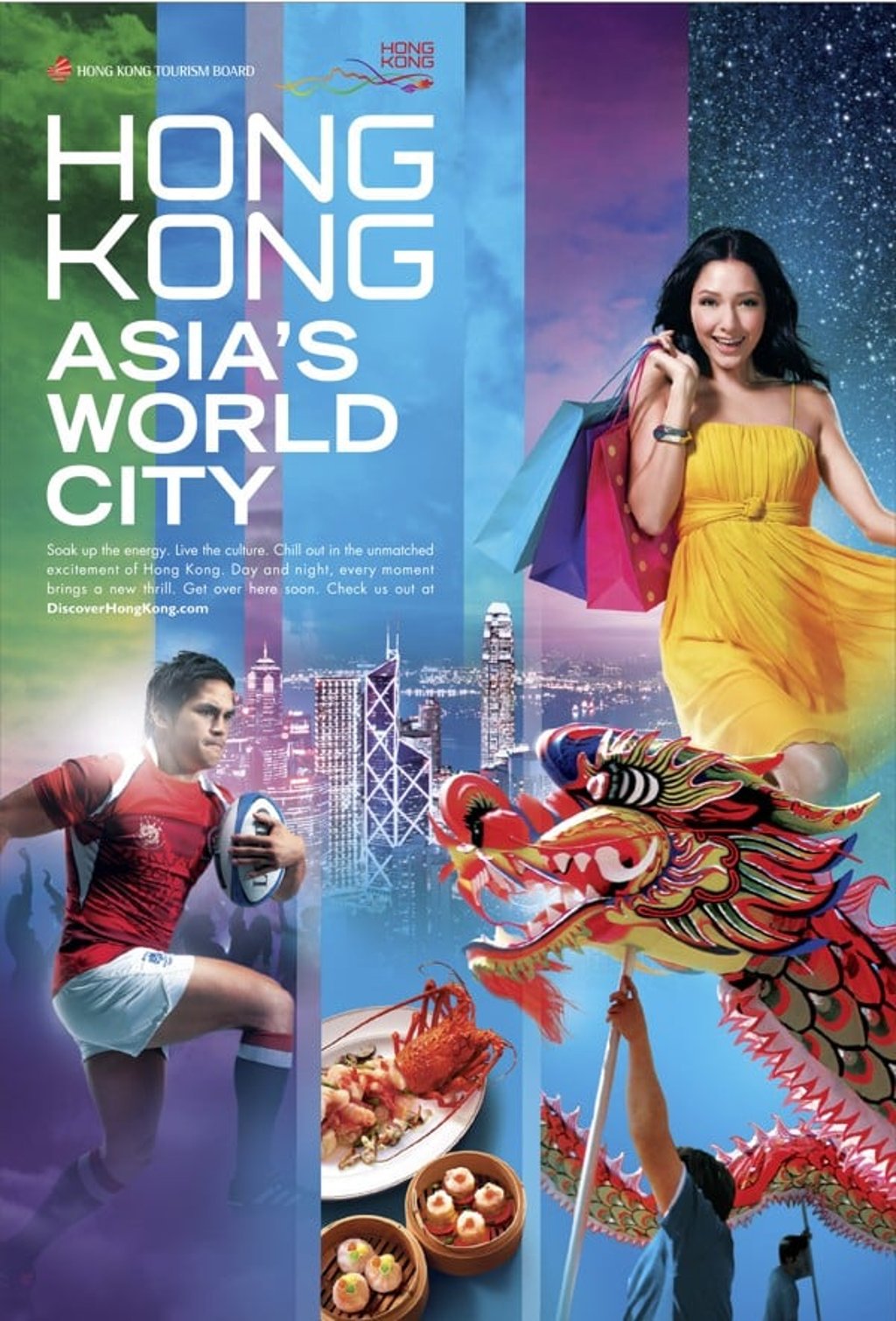

Some 6,000km from Dubai, the glistening skyscrapers of Hong Kong are far from the only thing the two jurisdictions have in common. Dubai’s rise mirrors that of the Chinese territory, also a once sleepy fishing village turned international trading centre that now lays claim to be “Asia’s World City” and was last year the world’s third-biggest recipient of foreign direct investment.

With its free port and attractive tax system, Hong Kong is seen by many as the gateway to the Chinese market and is famed for its luxury property market. It is also grappling with increasing reports of fraud, money laundering and terrorist financing.

The Sandcastles report was based on leaked data from real estate professionals regarding 54,000 addresses with 129,000 owners from 181 countries. It examined seven individuals and organisations - three of those who were suspected of money laundering and offshoring their assets in Dubai were sanctioned individuals with links to China. Their networks are thought to have links to North Korea, Iran’s missile programme and the Tehran-backed Lebanese militant group Hezbollah.