Advertisement

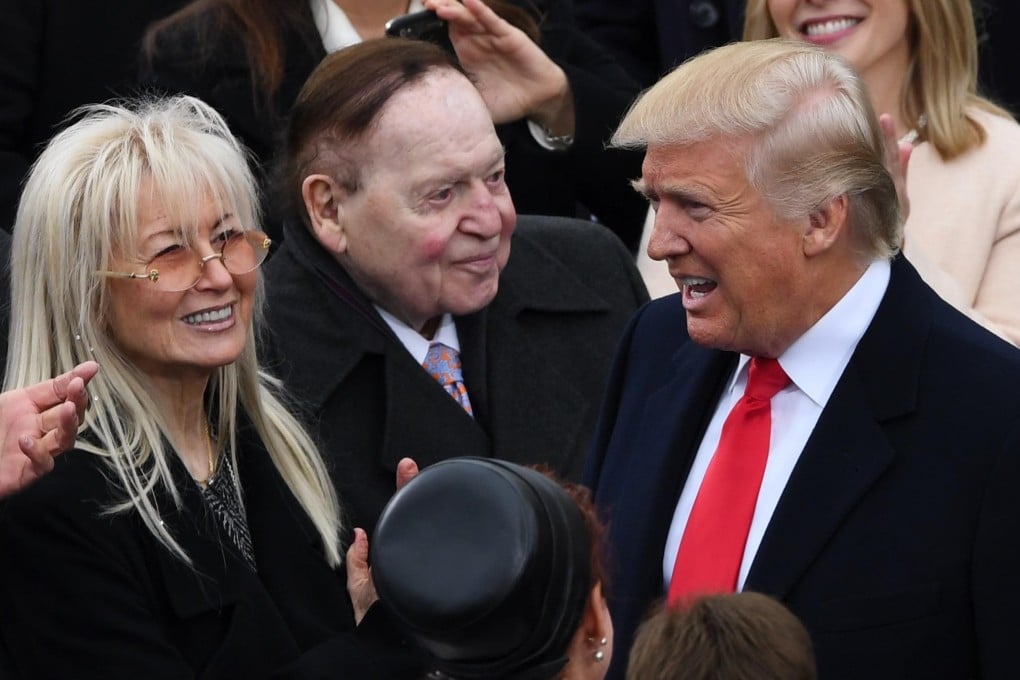

China Briefing | Will Macau casinos be targeted in US-China trade war? The odds are shortening for Sheldon Adelson, Trump’s ‘Patron-in-Chief’

- American casino licences may be brought into play as trade tensions worsen

- Even if they are not revoked, there are other ways Beijing can squeeze them

Reading Time:4 minutes

Why you can trust SCMP

That thought has kept gnawing away at the back of the minds of investors and analysts ever since trade tensions started a little more than a year ago.

Initially, they did not appear overly worried as the majority view was that the trade war would not go on much longer and American casino operators played an important role in Macau’s thriving development.

Advertisement

Since last month, such upbeat assessments have started to sour. The odds are getting shorter that American casino licences will be brought into play, not least because one of the owners is the biggest political donor to US President Donald Trump and reportedly carries extraordinary influence with him.

Advertisement

Last month, Trump sharply escalated tensions by accusing China of reneging on earlier promises in trade talks, igniting fresh tit-for-tat tariffs. In particular, his administration has blacklisted Huawei, China’s largest telecom equipment maker, effectively denying it access to US products and services, and has threatened to bar several more Chinese tech companies in the name of national security.

Advertisement

Select Voice

Select Speed

1.00x