For Asia, low-carbon energy is both a priority and one of the greatest regional challenges

- Asia will make up two-thirds of global energy demand growth by 2025, meaning private capital needs to flow into low-carbon projects

- A survey by The Economic Research Institute for Asean and East Asia (ERIA) revealed a lack of information on finance and gaps in de-risking investment opportunities in this sector

To avoid these environmental and health hazards across Asia in the coming decades, meeting energy needs through low-carbon means is a priority, but it is also one of the greatest regional challenges.

A low-carbon energy transition, involving low-carbon energy generation and energy efficiency improvements, will require the mobilisation and establishment of capital flows to the respective technologies. In order to encourage such investment, private sector involvement is necessary but currently faces extensive barriers and risks to entering the market due to regulations, licensing processes, taxation, and fuel subsidisation programmes.

Having a clear understanding of both government and private sector roles in the low-carbon energy transition is important to stimulating necessary investments.

In an effort to understand how to enhance the flow of private capital into low-carbon projects, The Economic Research Institute for Asean and East Asia (ERIA) conducted a market research survey to analyse the primary policies, regulations, risks, and perceptions that have consistently slowed and limited the development of projects that incorporate the usage of low-carbon technologies.

The identified barriers were considered in three categories of the barriers and risks for those providing and seeking financing: market, institutional and policy oriented. These categories were applied to two categories of survey respondents, those that provide capital – lenders (banks/credit agencies and non-bank financial institutions such as private equity and venture capital and others) and those that borrow capital – borrowers (renewable energy business owners, project developers, and others).

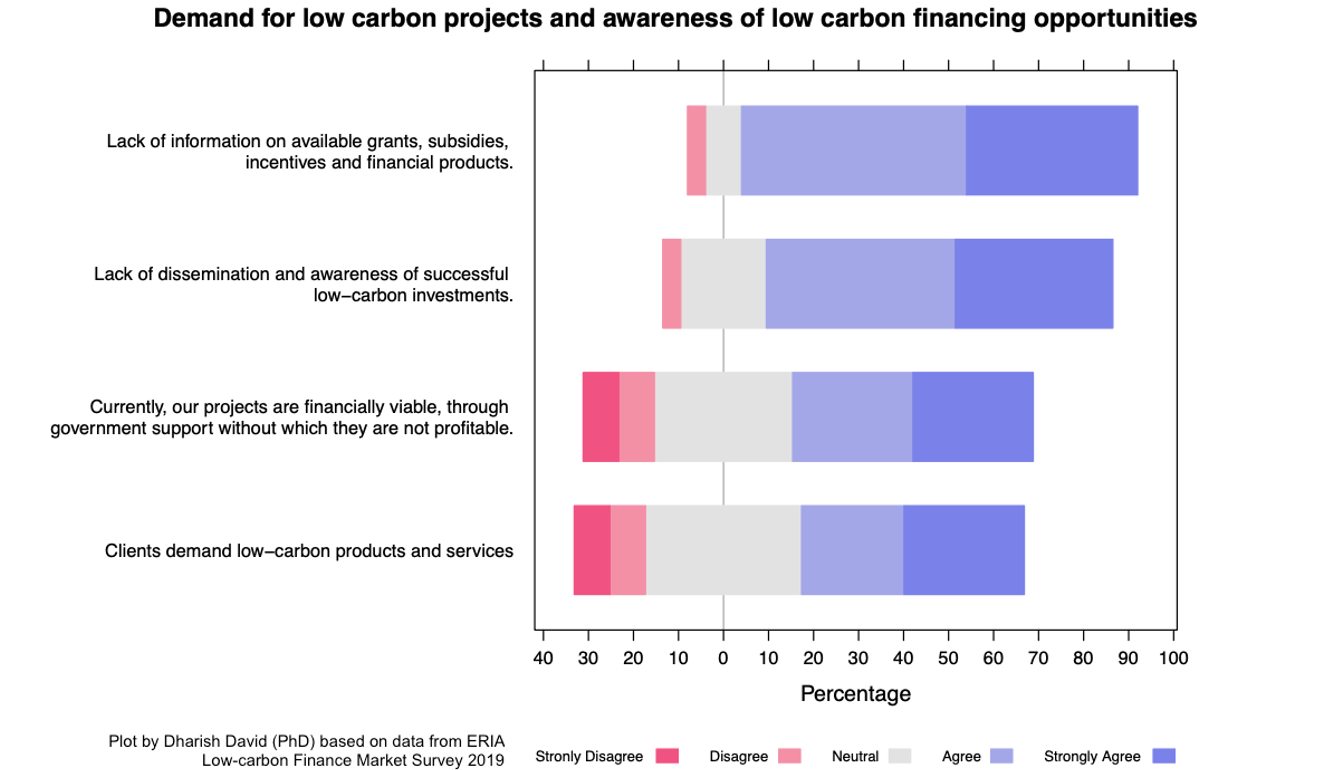

A lack of information was a concern strongly expressed by both groups. With regards to demand and awareness for low-carbon finance, an overwhelming response from business owners and project developers was that there was a lack of information on grants, subsidies, incentives, and other financial products. This was supported by responses on awareness, with considerable agreement that most did not know of any successful low-carbon investments or how to approach such opportunities.

While government support seemed important to both lenders and borrowers, the survey results also indicated that firms are currently not very reliant on this type of support. It is also worth noting that lenders on their part have not fully developed the capacity to assess low-carbon risks, and it is apparent that the market only partially has the manpower skills, tools and best practices to evaluate the low-carbon investments risks, which require more due diligence when compared with projects that are not low-carbon.

World’s next clean energy battle isn’t in China or India. It’s in Indonesia

The survey findings suggest that in terms of access to finance, borrowers face obstacles to low-carbon investments, and more firms would be ready to make such deals if there were de-risking mechanisms. For this they require more support through government guarantees, bonds and international finance, which surprisingly rank much higher than tax breaks, subsidies, bonds, owner contributions and securitisation.

The top five obstacles for low-carbon investments by borrowers were high initial investment costs; high collateral requirements; changing policies; longer recovery periods; and insufficient profits. It goes without saying that the prime movers in making low-carbon finance accessible – bank or lenders and governments – were considered the most important, while institutional investors and international assistance were rated next, and social enterprises were rated last. Even though these may be important to raise policy awareness, they might be lacking in providing finance.

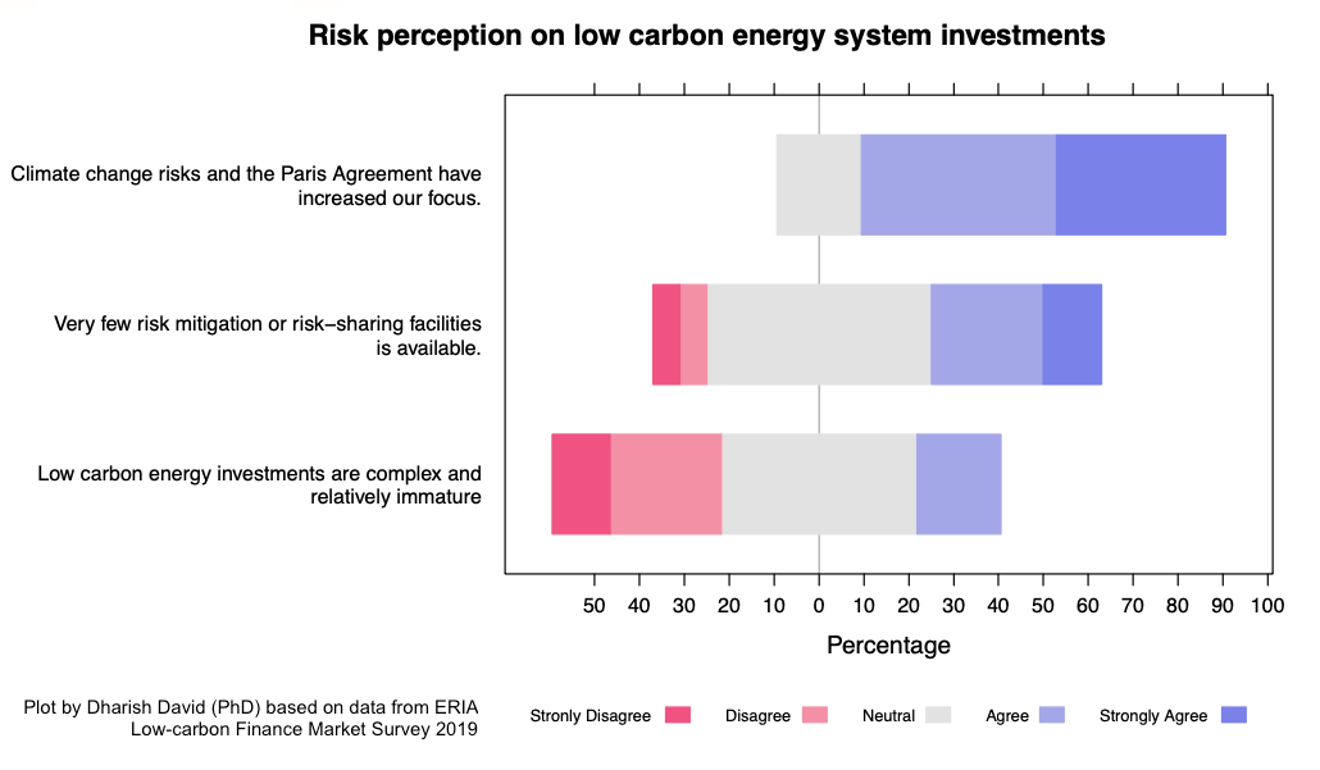

For respondents who represented lenders, the Paris Agreement has raised the focus among investors on low-carbon investments. It seems clear that the mindset of these organisations to integrate low-carbon business principles into their business plans is gaining pace, even though only half of them are making significant investments in low-carbon energy projects.

While these investments are no longer perceived as complex or immature, it was clear that governments were the only ones that could share risks on such projects, with banks, insurance companies and multilateral development banks all ranked much lower. The main opportunities to mitigating financial risks were power purchase agreements while others included government guarantees, long-term government policies, and the removal of fossil-fuel subsidies, while risk participation was not very significant.

China’s role ‘critical’ if world is to meet climate change targets

Subsidies for conventional energy, unstable energy prices and the absence of carbon pricing are all obstacles for capital providers, making it difficult for low-carbon projects to be more profitable and garner more investments.

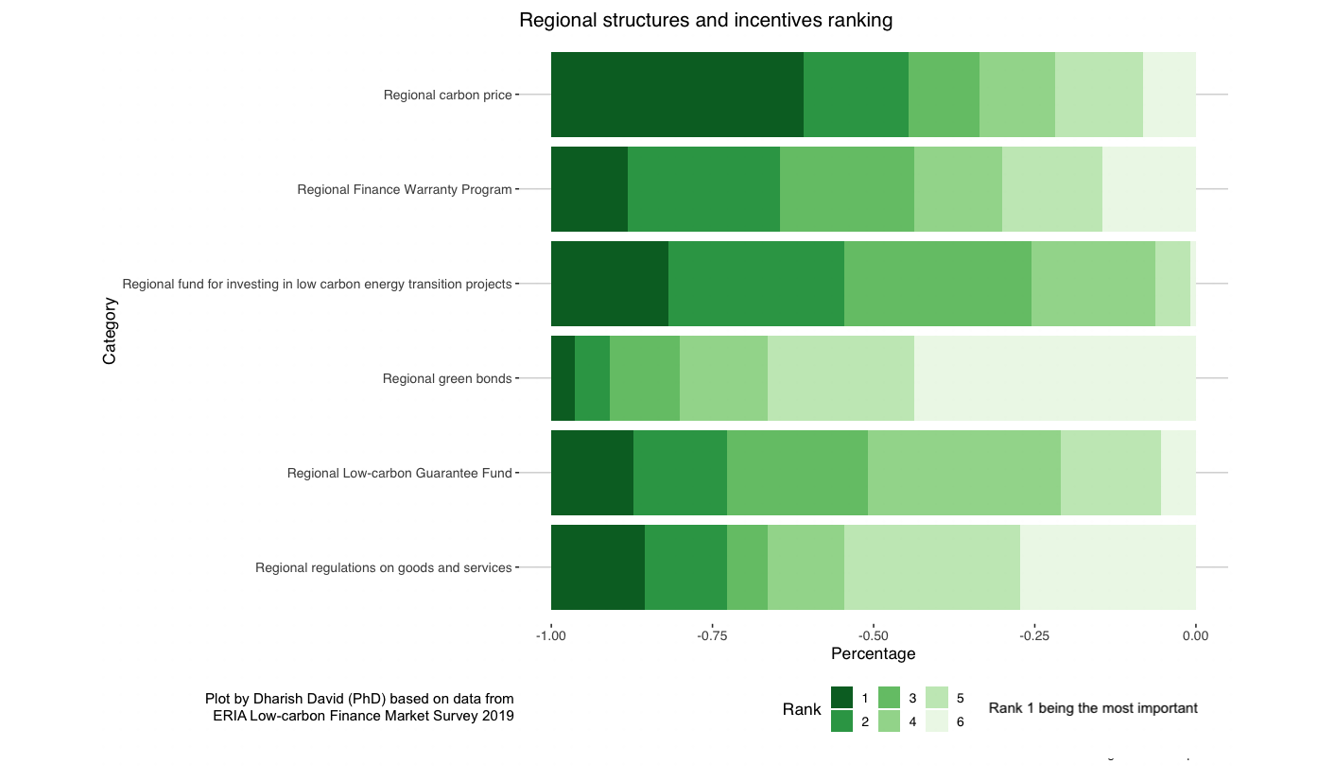

The report goes on to look at other challenges that low-carbon financers and projects face, by going into detailed aspects of technology, economic and financial barriers, but there are also regional implications. An overwhelming percentage of the respondents strongly agreed that increased regional coordination on energy policies, regulations and funding mechanisms will promote low-carbon investment, with hardly anyone disagreeing.

Regional carbon price was ranked the number one incentive that would enhance the investment environment. This was followed by regional funds for investing in low-carbon projects and a regional finance warranty programme. Respondents did not consider a regional low-carbon guarantee fund and regulations on low-carbon products and services, or green bonds, as that effective.

Dharish David is an associate faculty at the Singapore Institute of Management – Global Education (SIM-GE) teaching courses relating to political economy.

Matthew LoCastro is a Luce Scholar with the Economic Research Institute for Asean and East Asia.