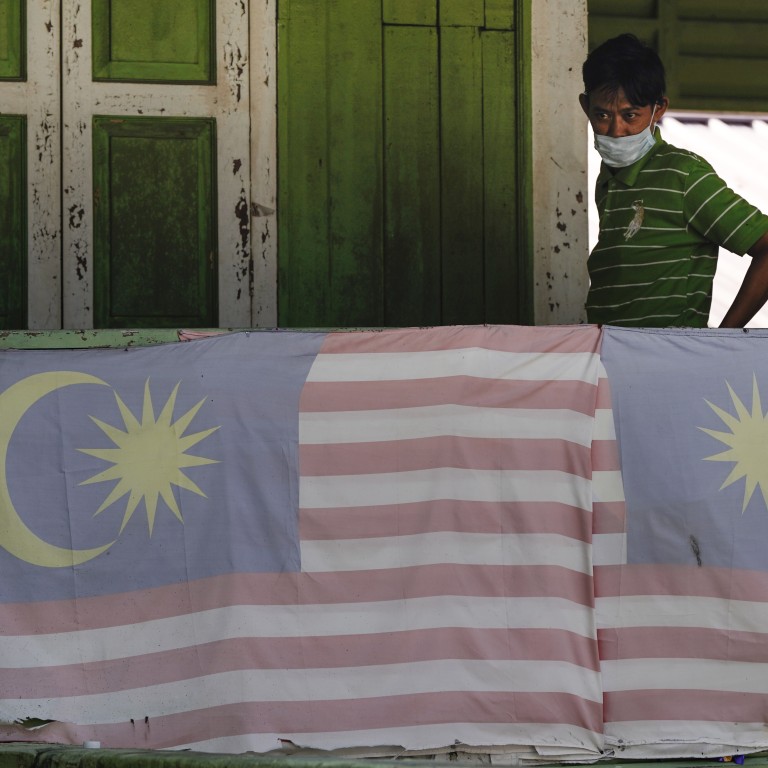

Coronavirus: for Malaysia’s economy to survive and recover, its stimulus package needs more firepower

- The country’s wage subsidy programme has been criticised for its inadequacy in helping businesses retain employees

- This is likely to hit SMEs – which make up nearly half of the economy, and employ more than 60 per cent of Malaysia’s workers – particularly hard

If Makcik (Auntie) Kiah existed, she would be one lucky lady.

‘Stop nagging, speak like Doraemon’: Malaysia sorry after coronavirus tips spark sexism row

The package provides additional one-off cash transfers not just for B40 (the bottom 40 per cent, in terms of income) households and individuals, but those in the M40 (middle 40 per cent) as well, in addition to more soft loans for small and medium-sized enterprises (SMEs) and a six-month loan moratorium announced earlier by the central bank.

Beyond the rhetoric and one-off cash disbursements, however, questions arise as to whether the package is sufficient to ensure the economy’s survival and subsequent recovery once the pandemic threat has passed.

In particular, Malaysia’s wage subsidy programme has been criticised for its inadequacy as an employment retention scheme. Under the programme, the government will subsidise wages of 600 ringgit per month per employee for three months for workers earning less than 4,000 ringgit, and employed by businesses that have faced a reduction in income of more than 50 per cent since January 2020.

SMEs – which make up nearly half the nation’s economy and employ more than 60 per cent of its workers – have been particularly vocal about declaiming the inadequacy of the government’s stimulus measures in supporting the sector.

Even before the MCO was imposed, SMEs were already hit hard by the effects of the Covid-19 pandemic. This is especially true of those linked to the tourism, hospitality, food and beverage, and events-management sectors – all of them labour-intensive.

While the wage subsidy programme purportedly covers 3.3 million workers, SMEs themselves employ an estimated 9-10 million workers. Signing up to the programme prevents employers from resorting to other labour-cost-saving measures such as imposing wage cuts or unpaid leave on wage-subsidised employees.

Coronavirus: Malaysia’s food delivery workers help nation stay connected amid lockdown

This might lead employers to impose such measures on their other employees who earn higher pay. Worse, a large percentage of these businesses might find that, despite recourse to a loan moratorium and soft loans, it would be impossible to sustain themselves for the remainder of the year, during which economic conditions are expected to remain muted.

Microbusinesses, which have sales turnovers of less than 300,000 ringgit and comprise more than 75 per cent of SMEs, will probably be the first casualties. A closure rate of even 25 per cent of SMEs might double the unemployment rate, or worse.

Lack of resources might be a potential reason behind Malaysia’s relatively weak employment retention measures. The country has consistently run fiscal deficits since the 1997/98 Asian financial crisis. This failure to build up reserves is now exacerbated by the crash in oil prices. Hence, only an estimated 10 per cent of the 250 billion ringgit Prihatin package is being financed by direct government funds.

By contrast, the Singaporean government was able to draw up to S$17 billion (US$11.9 billion) from its reserves for its economic stimulus package. Even so, perhaps a shift in allocations emphasising job security rather than one-off transfers was in order. While Singapore’s enhanced jobs support scheme and wage credit scheme made up more than 30 per cent of its stimulus package, the wage subsidy programme under the Prihatin package comprised about 2 per cent of the total amount.

Coronavirus: hundreds arrested in Malaysia for violating restrictions, as deaths rise

Another option would be to seek more funds. In this regard, the Malaysian government has several options. For instance, the central bank, which recently loosened statutory reserve requirements, has room to release more liquidity into the system. In addition, the Central Bank Act allows for loans to the government under special circumstances.

Additional funding would mean a more substantive employment retention programme. One option is to subsidise 50 per cent of wages for all employees, up to a cap of 2,400 ringgit (the median monthly salary), for a period of six months. Employers should also be allowed to resort to other labour-cost-saving measures, save for retrenchments, and provided employer-worker relations are preserved.

More direct help in the form of revenue subsidies could also be provided to the self-employed who have been forced to halt their business during the MCO. This need will be more urgent should the MCO be extended beyond April 14.

Coronavirus: for Malaysia’s new leader Muhyiddin, a deadly litmus test

These options, however, require the tabling of a supplementary budget at parliament, which is not due to sit until May 18. Moreover, in recent media appearances, the finance minister has reiterated that the government remains committed to fiscal discipline. This commitment should perhaps be reconsidered, given the extraordinary circumstances that not just Malaysia, but the world, now finds itself in. In fact, the International Monetary Fund, in announcing a global recession this year, has advised countries to “go big” on spending.

Muhyiddin, in his speech on Friday, stated that Malaysia is “a nation at war with invisible forces”. Presuming that one of those foes is an economic crisis, one hopes that the government is ready to devote more firepower to the battle.

Nadia Jalil is an economist, most recently with the Malaysian Aviation Commission. She will be heading a Malaysian research institute in May 2020