Opinion | How Indonesia’s EV plans will shape its relations with the US and China

- The market for electric vehicles is projected to explode over the next decade, making lithium-ion batteries an increasingly important geostrategic resource

- Indonesia – with the world’s largest nickel reserves – is likely to be caught up in the intensifying technological rivalry between Beijing and Washington

With lithium-ion batteries constituting about 40 per cent of EV manufacturing costs, they will be an increasingly important geostrategic resource. According to a 2018 McKinsey report, annual battery demand will grow 10 times between 2020 and 2030, with EVs accounting for 80 per cent of battery demand.

More importantly, the EV revolution will be increasingly refracted through the lens of great power competition. Today, China is the world leader in the production of EVs and lithium-ion batteries. While there were 93 battery megafactories in China in 2020, there were only four in the US.

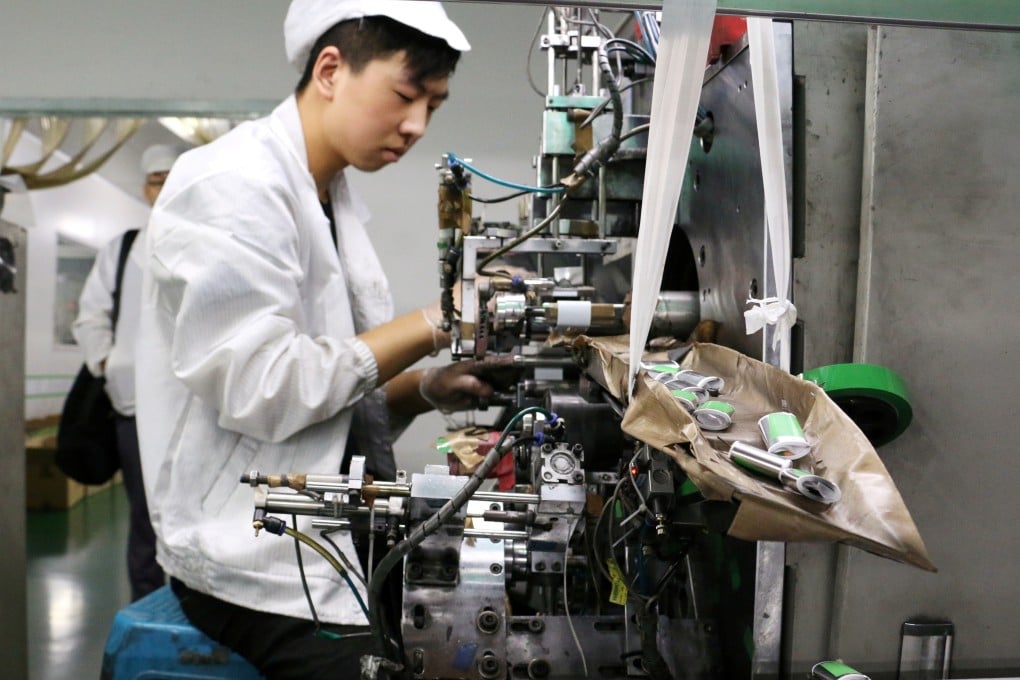

Furthermore, China has secured stable supplies of critical raw materials such as lithium, nickel, and cobalt. It produces the bulk of midstream products such as the chemicals, cathodes, and anodes needed to assemble battery cells. In contrast, the US is almost entirely dependent on imports and has been slow to develop a raw material supply chain.

This will include mining and refining, producing battery-grade nickel chemicals, battery parts, battery cells, and EVs. By 2030, Indonesia aims to build 140 gigawatt hours (GWh) of battery production capacity, equivalent to five of Tesla’s battery gigafactories in Nevada, with plans to export about 50 GWh.

.jpg?itok=OVTyzlEa)