Advertisement

Malaysia’s billion-dollar question: where did 1MDB money go? New Finance Minister Lim Guan Eng says money trail will reveal all

There are few clues left behind regarding the US$4.5 billion missing from the state fund, but that doesn’t mean it can’t be traced

Reading Time:3 minutes

Why you can trust SCMP

The major culprits in Malaysia’s epic 1MDB financial scandal may already have destroyed much of the evidence against them but newly minted Finance Minister Lim Guan Eng is confident a global money trail will reveal the truth.

He also hopes that will allow the government to recover some of the estimated US$4.5 billion worth of assets that disappeared from the books of the state investment fund.

Advertisement

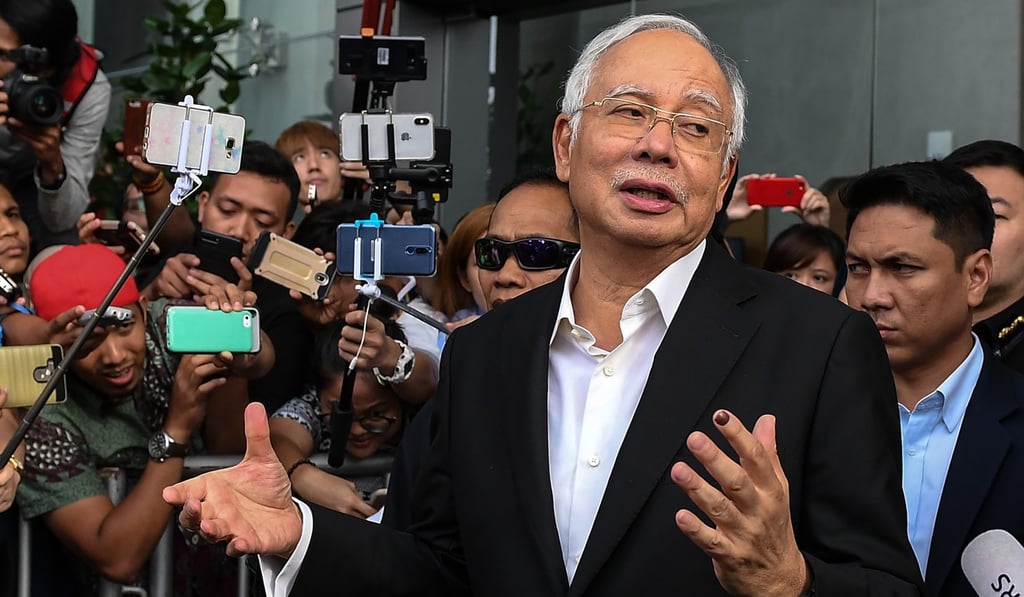

Among those facing possible indictment on suspicion of graft at the fund is the former prime minister, Najib Razak, who has strenuously denied the allegations.

Lim, in an exclusive interview with This Week in Asia, said that whether losses from the 1MDB scandal could be recovered by the newly elected government was “a billion-dollar question”.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x