1MDB scandal: Jho Low not off the hook despite US$1 billion settlement

- The US Justice Department says the fugitive Malaysian financier still faces criminal charges in the US, and it will not tolerate its financial system being used for ill gotten gains

- Low says he is ‘very pleased’ with the comprehensive settlement, which does not constitute an admission of guilt or liability from him

The development marks a major milestone in a colourful saga that stretches back to 2015, and currently involves investigations in multiple jurisdictions over plunder at the 1 Malaysia Development Berhad fund amounting to over US$4.5 billion.

The saga became a global talking point after prosecutors in Malaysia and the US revealed that funds allegedly illicitly moved from 1MDB to Najib and Low were used to buy luxurious jewels, a super yacht, a private jet – and even fund the Hollywood movie Wolf of Wall Street.

In a statement, the DOJ confirmed earlier reports that it had reached a settlement with the businessman that does not include an admission of guilt or wrongdoing, and is separate from criminal proceedings that are pending against him.

Jho Low nears US$1 billion settlement with US over 1MDB scandal

“This agreement does not release any entity or individual from filed or potential criminal charges,” the DOJ said.

With the latest conclusion and other prior forfeiture cases brought against Low, the US has “recovered or assisted in the recovery” of more than US$1 billion in assets, the DOJ said.

The DOJ said the assets in the forfeiture action include “high-end real estate in Beverly Hills, New York and London; a luxury boutique hotel in Beverly Hills; and tens of millions of dollars in business investments that Low allegedly made with funds traceable to misappropriated 1MDB monies”.

The businessman’s legal team includes Chris Christie, the former governor of New Jersey, and lawyers from Kobre and Kim, a law firm that specialises in disputes and investigations involving international fraud.

The DOJ said as part of the settlement agreement US$15 million of the assets seized would be released to Low’s counsel for legal fees and costs.

The Wall Street Journal last year reported that the DOJ had initiated a probe into whether Christie and others in Low’s legal team had been paid with embezzled funds.

Jho Low may have paid Chris Christie and a Trump lawyer with laundered funds

Low, in a statement through his US-based spokesman, said he was “very pleased” with the “landmark comprehensive, global settlement”.

“Importantly, the agreement does not constitute an admission of guilt, liability or any form of wrongdoing by me or the asset owners. We believe all parties consider this resolution, which is subject to final court approval, to be a successful and satisfactory result,” Low said.

Mahathir’s victory in last year’s general election came on the back of his coalition campaigning to bring Najib and others involved in the 1MDB scandal to justice.

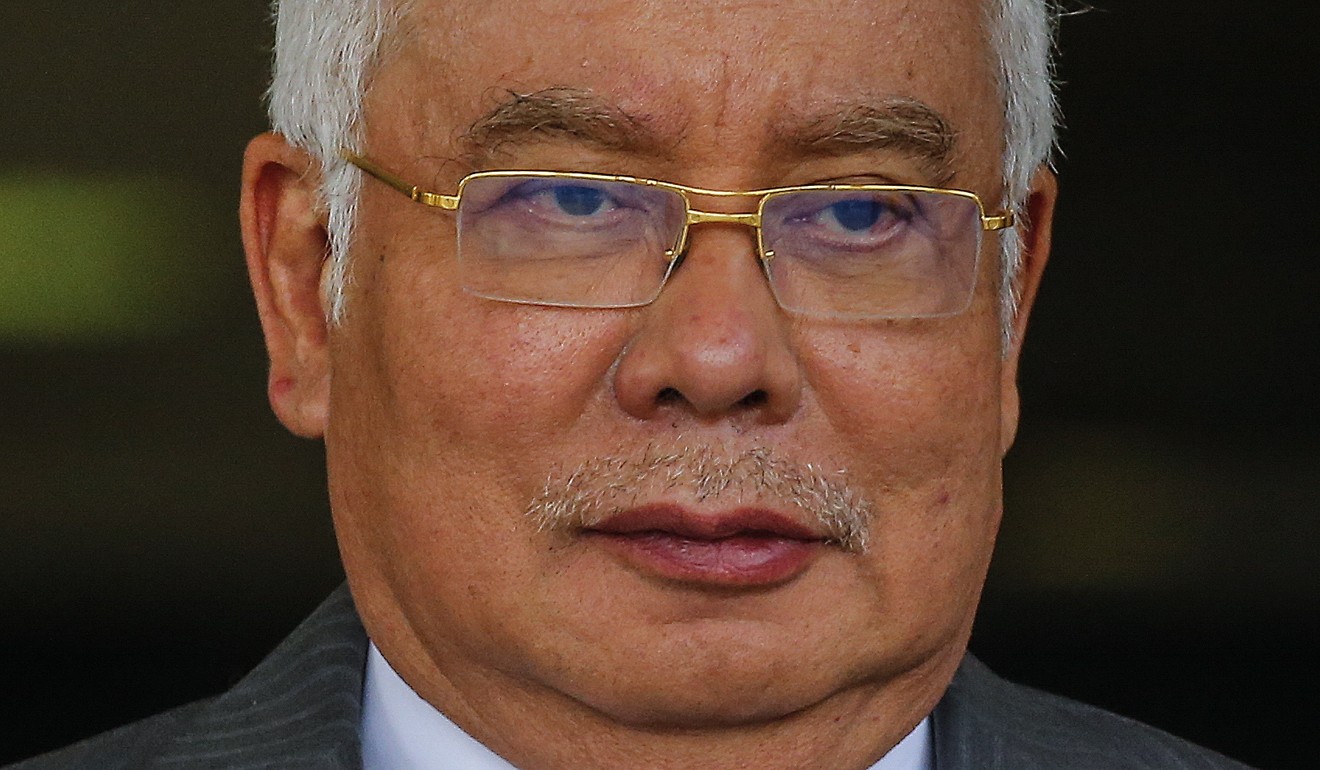

Najib is among a string of individuals currently facing criminal trials for their roles in the saga.

In court, the former premier’s lawyers have sought to suggest that Low was the brains behind the scandal, with Najib duped into thinking that US$681 million of the 1MDB funds found in his personal bank accounts were political donations from Saudi monarchs.

Malaysia mulls slashing Goldman Sachs’ 1MDB fine to just US$2 billion

The Mahathir government is separately seeking a US$3.3 billion payout from Goldman Sachs for its role in the saga. Seventeen current and former executives of the bank face criminal action for their alleged role in the plunder, but the bank has maintained it acted in good faith and committed no wrongdoing.

Malaysian attorney general Tommy Thomas suggested in an interview earlier this month that the government believes Low stole up to US$10 billion worth of state funds, far higher than the DOJ’s US$4.5 billion figure.

At the height of 1MDB’s financial woes in 2015 and 2016 its debts amounted to some US$13 billion. Part of its cash crunch was solved after Chinese state-linked firms swooped in to buy a number of its key assets.