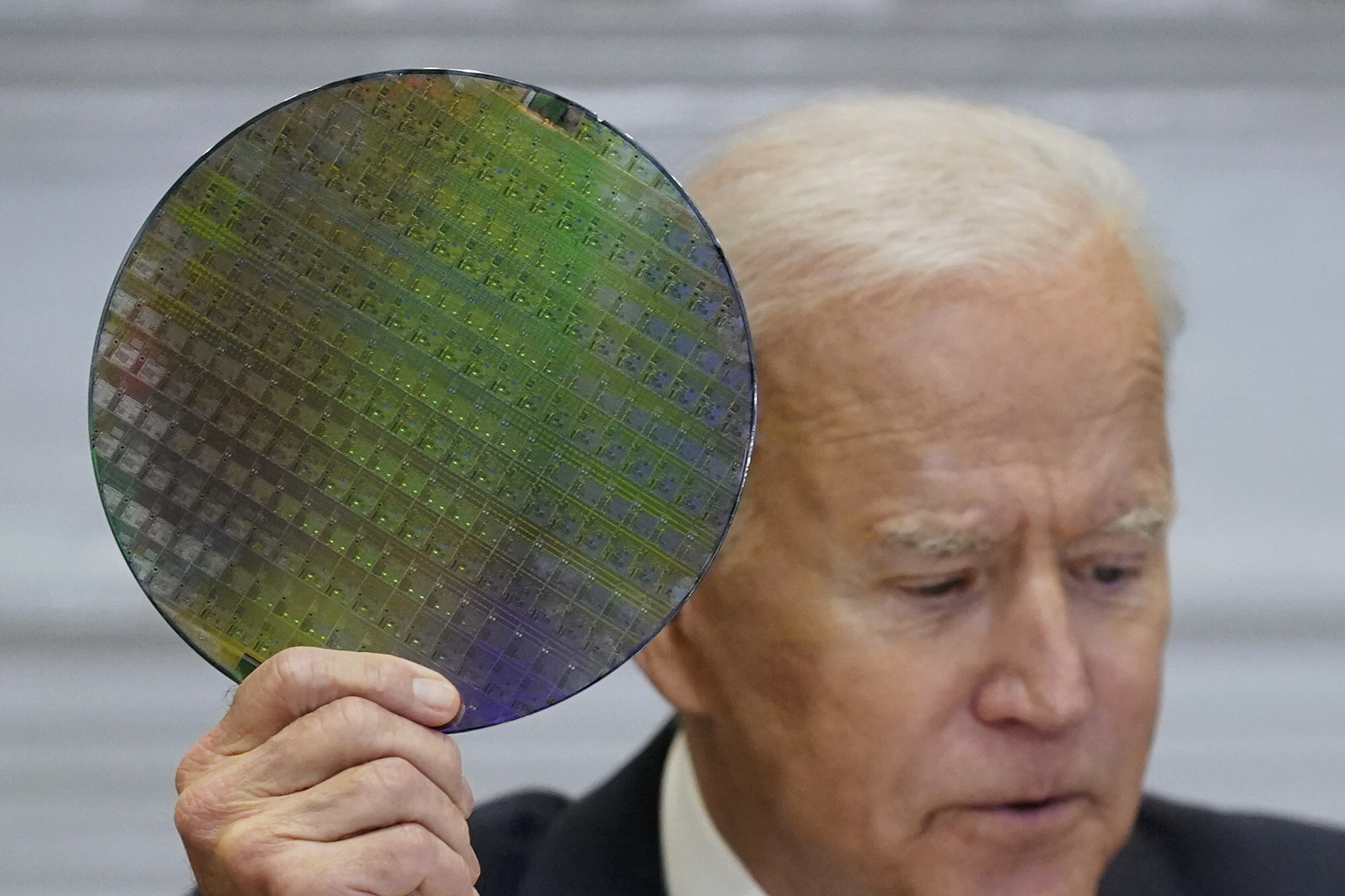

Biden’s US$50 billion for US chip industry puts South Korea on the spot with China

- US president’s move to boost domestic production is aimed at addressing a global shortage and matching Chinese investments into the supply chain

- It leaves the chip-making powerhouses of South Korea with a dilemma: how can they serve China, their biggest market, while keeping the country holding the patents happy?

Kim Yang-paeng, senior researcher at the Korea Institute for Industrial Economics and Trade, said Korean chip makers would be concerned about Washington’s move to increase chip production in the US.

“The US will be able to increase production in a few years’ time as it has the technology but this would certainly result in a global supply glut and prices taking a downward spiral,” Kim said.

“This possibility gives semiconductor chip manufacturers a great headache,” he added.

This possibility gives semiconductor chip manufacturers a great headache

Kim said South Korea would increasingly face a “dilemma” of how to cater to China, its dominant market for exports, while keeping the US, its security ally and the country holding the patent for manufacturing semiconductors, happy.

TSMC and Samsung were among the companies invited to a White House discussion on Monday when Biden described his proposal, and this was widely seen by observers as an implicit message they should build more plants in the US.

Samsung is reportedly considering ploughing US$17 billion into a new chip plant in Austin, Texas, in addition to its foundry factory there.

China has also been calling for South Korean companies such as Samsung – which has a NAND Flash memory plant in Xian and semiconductor packaging plant in Suzhou – to expand cooperation in technology including semiconductors, a request made by Foreign Minister Wang Yi when he met his South Korean counterpart Chung Eui-yong in Xiamen, Fujian province, this month.

Kim, the researcher, said despite the pressure from the US and China, he did not think political considerations would have a big influence on the chip makers’ long-term investment plans, worth tens of billions of dollars. But even if South Korean companies wanted to work more closely with China, there would be challenges due to US restrictions on its technology and the feared global supply glut.

Chips are down for Taiwan. ‘Where the bloody hell’ is Australia?

Semiconductor imports by China surged to an all-time high in March, with the country buying 58.9 billion semiconductor units worth US$35.9 billion, a new monthly high for the category, according to data released by the General Administration of Customs.

Sun Luyuan, CEO of Huawei Korea, expressed hope at the press conference that Huawei could work more closely with Korean companies to overcome US sanctions, pointing out that Huawei had been a “big partner” to chip makers Samsung Electronics and SK Hynix.

“For the past five years, Huawei’s accumulated purchases from Korean firms amounted to US$37 billion. We also created various job positions and helped local partners speed up R&D activities,” Sun said.

“Huawei is highly complementary to such a drive and we are actively seeking to support Korea’s digital economic development,” Sun said.