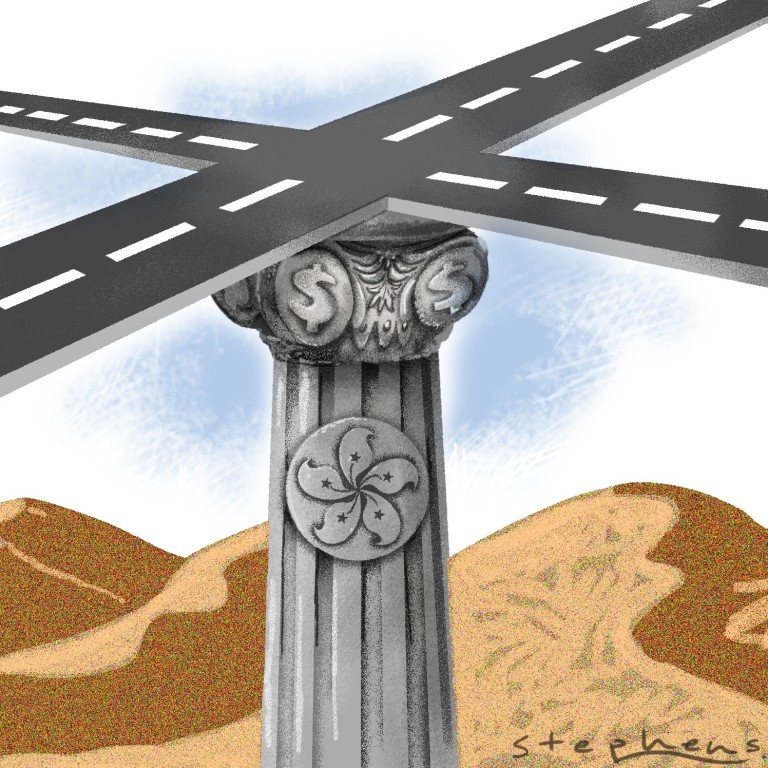

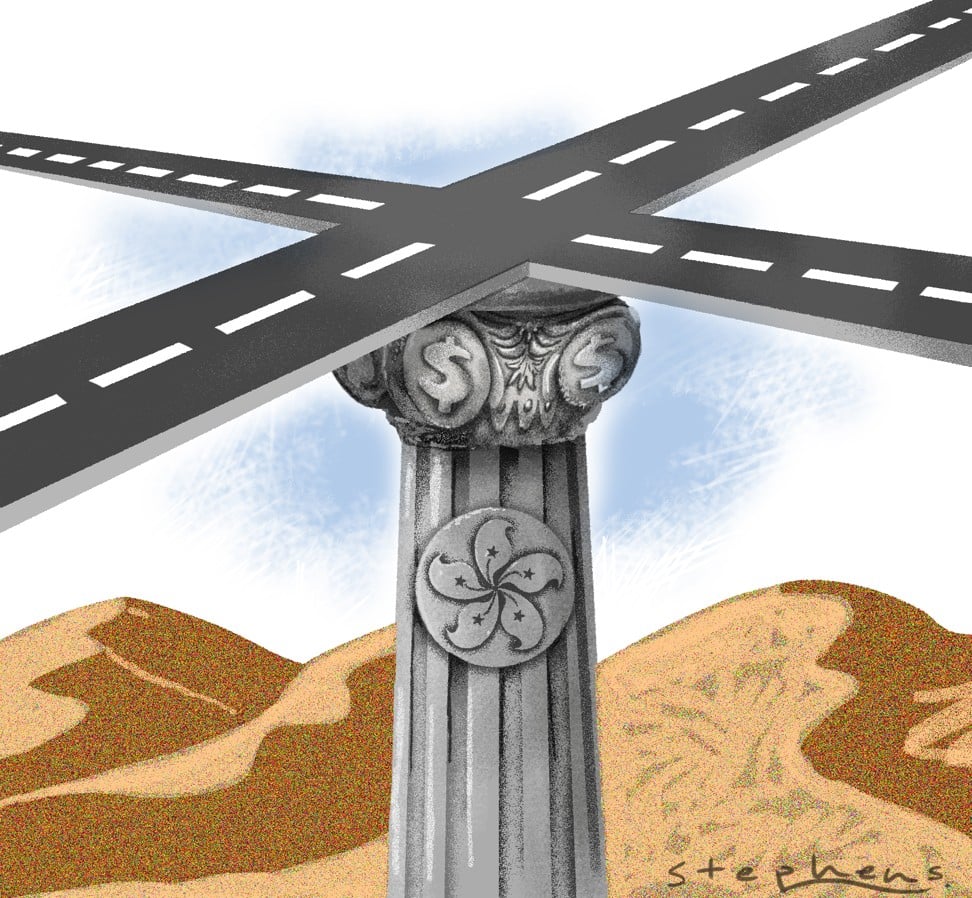

How Hong Kong can be a key pillar for belt and road infrastructure

Lawrence J. Lau says Hong Kong, with its financial expertise and sophisticated legal system, is uniquely placed to contribute to and gain from the belt and road plan, especially with relation to infrastructure projects

It seeks to stimulate and create sustainable trade and investment exchanges where none existed, through enhanced connectivity, thus benefiting – and accelerating economic development for – each country along the belt and road.

It can give new momentum to the world economy, which has seen growth stalled since 2008 due to insufficient aggregate demand. And economic development will in turn foster peace, security and harmony among the belt and road nations.

What role can Hong Kong play in this wide-ranging plan? The initiative will include Asean, where Hong Kong traditionally has strong ties. One terminus of the belt and road is Europe, and Hong Kong – with its long history of close economic relations with the continent – can also help to involve European businesses in the initiative.

Under “one country, two systems”, Hong Kong has the advantages of not only complete capital mobility, full currency convertibility, a stable exchange rate and low taxes, but also ready access to the huge market, the excess savings pool, and the support of the governmental institutions, in mainland China. Thus, Hong Kong is ideal as a centre for financing belt and road infrastructure projects.

Infrastructure building is the indispensable first step. China’s own economic development experience confirms that both infrastructure and openness are vital for success. The Asian Development Bank expects emerging Asian economies to need infrastructure investment totalling US$1.7 trillion a year to maintain economic growth, but only about half that would be available. Finding ways to finance infrastructure needs is the first priority.

Belt and Road Initiative could bring Hong Kong practical benefits

But without additional private participation, there will not be sufficient resources. Attracting private investment requires organising the financing in a diversified and structured way – with a combination of public and private equity and debt, loans from commercial and government banks and multilateral development finance institutions, government and multilateral aid grants, guarantees and political risk insurance.

Hong Kong, with its expertise and sophistication, is an ideal place for assembling such financing packages.

Permanent long-term financing for infrastructure projects, typically for 30 years or more after completion, cannot be provided by commercial banks, as they do not have the long-term deposits to fund the loans. Often, long-term financing comes from a loan from a government development bank or project bonds, and occasionally supplemented by a loan or grant from a multilateral development finance institution or a foreign development bank. Once a pre-agreed plan is in place, commercial banks will be willing to provide the loan during the construction phase. Long-term lenders and bond investors don’t have the expertise to make or monitor construction loans and do not want to assume the construction risk (including cost overruns), so their funding will kick in only upon completion and start of operation, replacing the construction lenders.

To serve the needs of belt and road infrastructure bonds, Hong Kong must develop a more active bond market

Moreover, to prevent moral hazard, the owner/operator of the project is required to have some equity in it; if the project is completely debt-financed, there may be no incentive to see it successfully completed and in operation. The equity can frequently be a grant from the host government.

One factor discouraging private interest in long-term infrastructure bonds is the lack of liquidity – the lack of a secondary market for individual project bonds. Hong Kong needs to develop a secondary market for the belt and road debt securities to ensure some liquidity, which will increase their attractiveness to private investors.

Hong Kong must also continue to expand its double taxation agreement network. Such agreements facilitate trade and investment, infrastructure financing in particular. The city can also provide various types of insurance and reinsurance for the infrastructure projects.

Capital raising for belt and road projects will create significant new demand for accounting and legal services in Hong Kong. Because of its long tradition of the rule of law, its efficient and fair judicial system, and abundance of seasoned professional legal manpower, Hong Kong can also serve as a centre for international legal arbitration, dispute settlement and mediation services for belt and road projects.

Hong Kong should make sure it is always the first choice of entrepreneurs and enterprises of the developing belt and road nations

However, infrastructure building is only the first step. Infrastructure and openness make possible new continuing trade and investment flows among belt and road countries, which means even more opportunities for Hong Kong.

As the belt and road economies grow and prosper, they will demand more goods and services from the rest of the world and supply them as well. They will need to raise more equity and debt capital, as well as more international accounting and legal services.

Hong Kong should make sure it is always the first choice of entrepreneurs and enterprises of the developing belt and road nations.

Indeed, the initiative opens up significant new and continuing economic opportunities. It is up to Hong Kong to step up to the plate and do its part – now.

Lawrence J. Lau is the Ralph and Claire Landau Professor of Economics at the Lau Chor Tak Institute of Global Economics and Finance, the Chinese University of Hong Kong