First the ‘guns’, then the ‘knives’ ... now Xi goes after the ‘money bags’ in China’s financial industry

Observers question whether heavy-handed crackdown is the best way to address nation’s financial risks

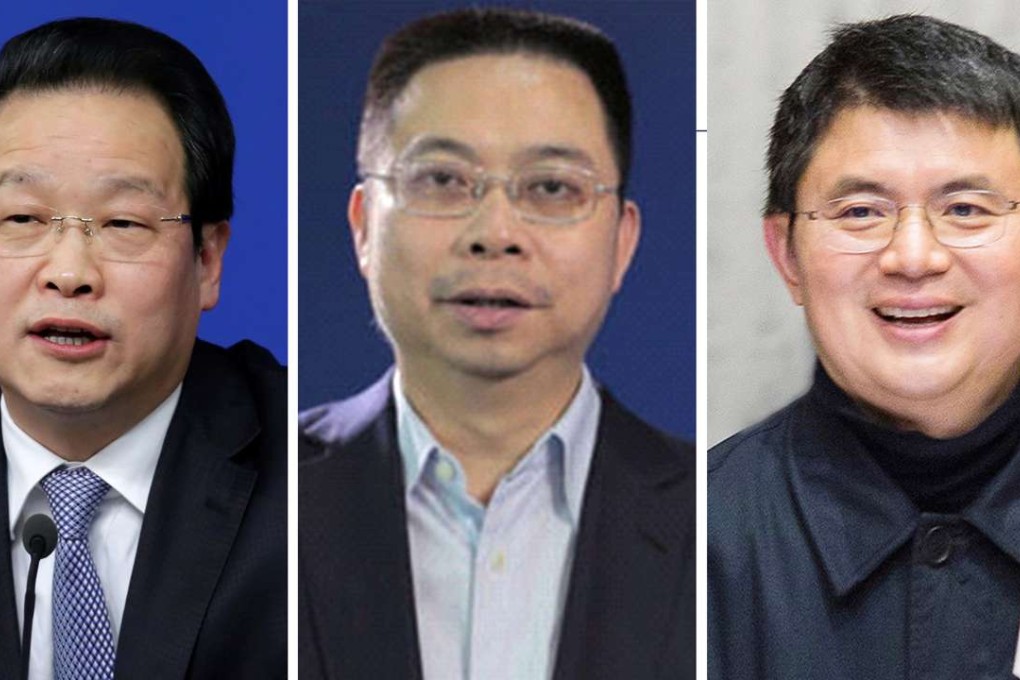

A storm is brewing in China’s financial industry as President Xi Jinping seeks to stem collusion among senior regulators, ruling elite family members and private tycoons ahead of a key Communist Party meeting later this year.

Alarmed by a stock market rout in 2015, Xi is loudly beating the anti-graft drum in the financial world, where shady money-for-power deals have been rampant. Xi is also alert to financial risks that have the potential to roil markets, hurt growth and endanger state security.

However, some observers question whether Beijing can effectively address financial risks through arrests and seizures.

The latest casualty is Xiang Junbo, the former China Insurance Regulatory Commission chief who brought chaos to a sleepy sector in just a few years. The downfall of Xiang, who had extensive ties to banking and insurance businesses, could herald a new stage in the financial clean-up, with a social media account run by party mouthpiece People’s Daily saying “a more exciting show” would follow.

While Xiang’s wrongdoings were not made public, there are some clues in a speech Premier Li Keqiang gave in late March but was not made public until the same day Xiang was taken away. In it, Li said the authorities were punishing those who “stole what they had been entrusted to guard” or who had “collaborated with financial big crocodiles”, a term for tycoons.

Zhuang Deshui, from Peking University’s Clean Government Centre, said the financial industry was “a stronghold of China’s interest groups” and Xi was determined to break that hold.