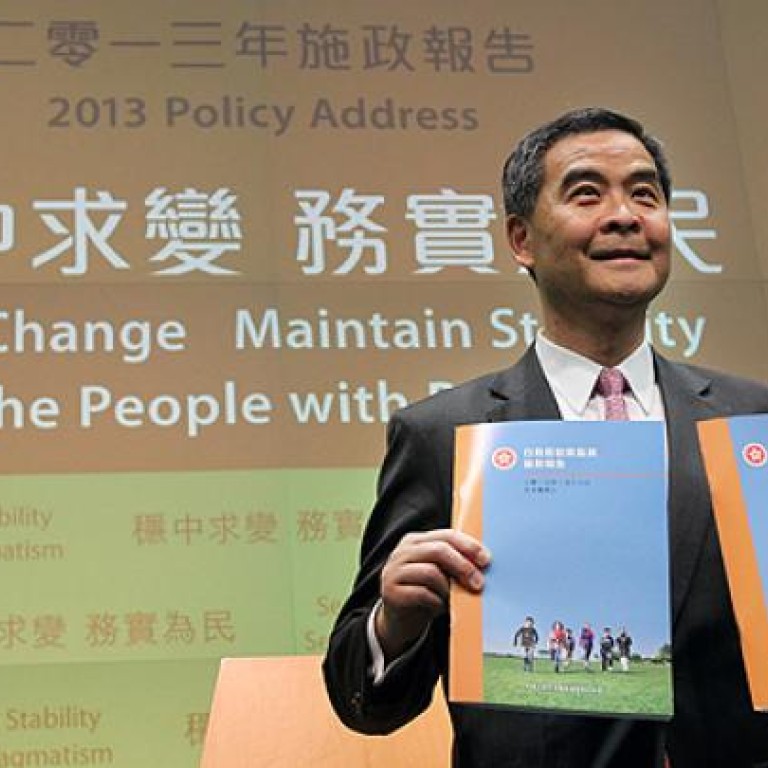

Extra-flats policy won't cause repeat of 1997 crash, says CY Leung

Leung Chun-ying has vowed to keep a close watch on global markets to ensure history does not repeat itself in a property crash as his extra-flats policy takes hold.

The Chief Executive was responding to a RTHK radio interviewer who asked whether his blueprint for building more homes could cause a crash if the US raises its rock-bottom interest rates in 2015 as some economists are predicting.

“We are mindful of the economic situation in the States and in Europe, the economy slowing down on the mainland, and so on and so forth, and any possibility of an interest rate hike might bring market adjustments, so we are being very cautious.”

Leung also rejected a suggestion that his housing targets could lead to oversupply and repeat the failure of former chief executive Tung Chee-hwa’s infamous “85,000-flats-a year” policy immediately after the handover.

“The 1997-1998 crash of the market wasn’t really due to over-supply,” Leung said. “I remember very clearly that the Asian financial crisis hit Thailand on the second day of July, 1997, and it hit Hong Kong, and not just Hong Kong, but also other Asian markets, including the property markets.”

Tung’s policy of building 85,000 subsidised flats a year was intended to cool the red-hot property market as many people complained of not being able to buy a home – a similar situation to the one that has prompted Leung to increase supply.

But shortly after its introduction, the public mood changed as the Asian financial crisis sent prices spiralling and pushed many property owners to the brink of bankruptcy. Leung was said to have been the brains behind it.